How Pfizer Uses AM/FM Radio To Elevate The Media Plan And Generate Significant Incremental Reach That Lifts Brand Equity

Click here to view a 14-minute video of the key findings.

Click here to download a PDF of the slides.

Last week Pfizer, the pharmaceutical giant, named Publicis Groupe as their new media agency and awarded Interpublic Group as their lead creative partner.

One surprising aspect to Pfizer’s recent success has been its use of AM/FM radio as a key element of its media plan.

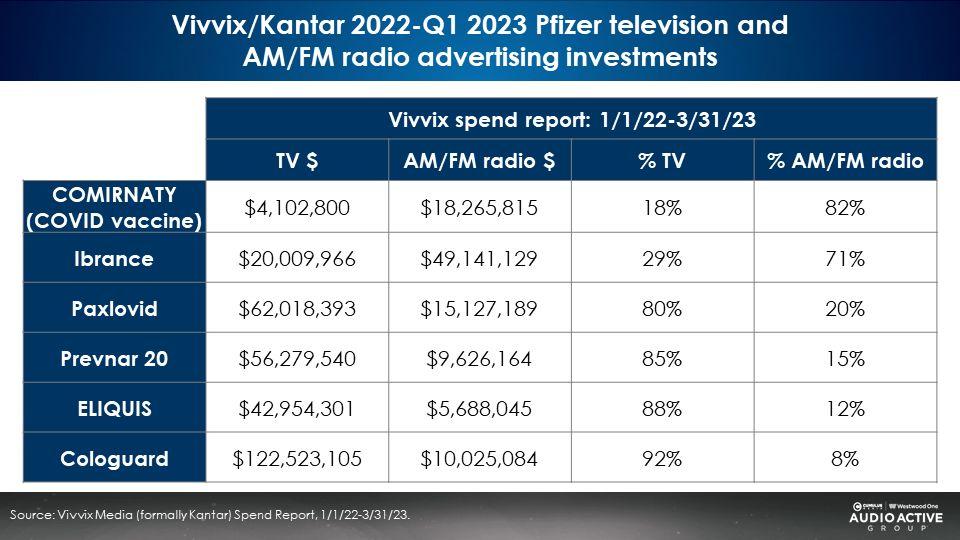

For some Pfizer brands, AM/FM radio is the primary media platform

As a proportion of AM/FM radio/TV spend, Vivvix/Kantar reports AM/FM radio represents the majority of investments for brands such as COMIRNATY (the COVID vaccine) and Ibrance.

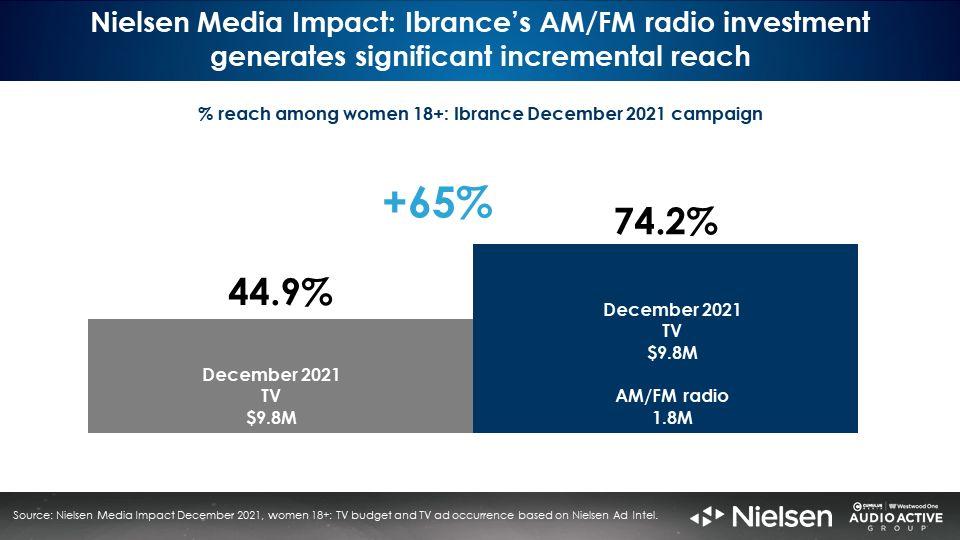

AM/FM radio generates +65% lift in incremental reach for Ibrance

Just a modest allocation of network radio can have an outsized impact on campaign reach. Nielsen Media Impact, the media planning and optimization platform, examined Ibrance’s December 2021 campaign.

In that month, Ibrance spent $9.8M on linear television and $1.8M on network radio. Among women 18+, the linear TV campaign generated a 45% reach. The addition of network radio lifts women 18+ reach from 45% to 74%, a massive +65% increase.

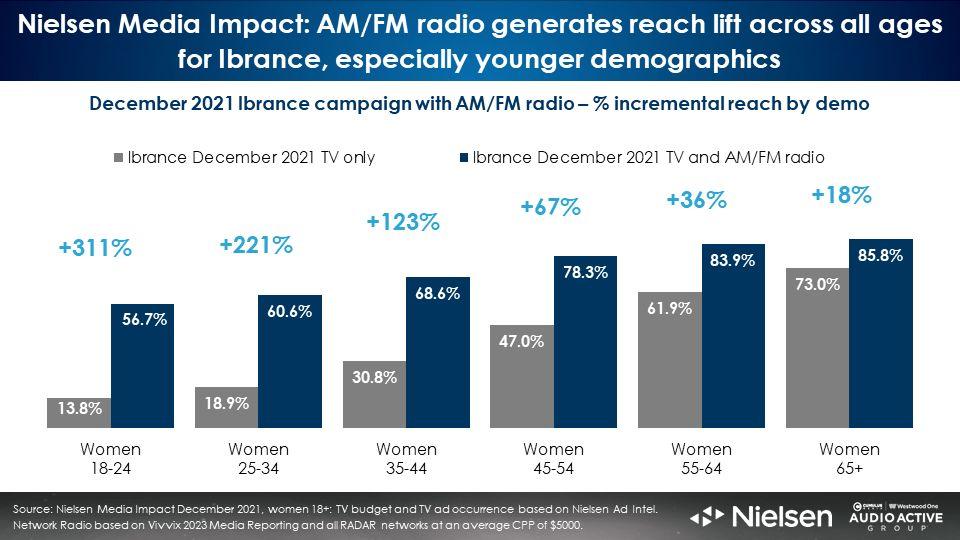

AM/FM radio generates reach lift across all ages, especially younger demographics

The younger the demographic, the greater the reach lift. Ibrance’s network radio overlay generates a +67% increase in women 45-54 reach and a +123%% lift in women 35-44 reach.

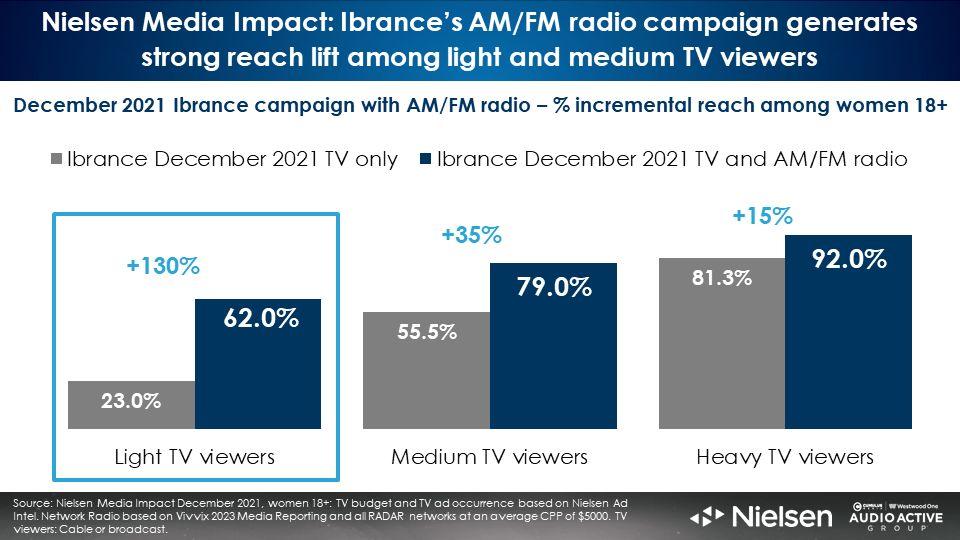

AM/FM radio makes Ibrance’s TV better with a massive 2.7X reach increase among light TV viewers

A wise media planner once said, “You cannot solve the light TV viewer problem by buying more TV.” AM/FM radio’s superpower is the ability to generate outsized reach among light TV viewers. The network radio campaign for Ibrance generated a 2.7X increase in Ibrance’s reach (23% to 62%) among light TV viewers. Among medium TV viewers, network radio lifts reach by +35%.

How did Pfizer’s AM/FM radio campaign impact brand equity versus linear TV?

We turn to the Harris Poll Brand Tracker, a leading brand measurement firm, to quantify brand awareness, familiarity, trial, usage, and recommendation in the market overall and among AM/FM radio and TV audiences. The best way to understand the impact of TV and AM/FM radio ads is to examine awareness, familiarity, trial, usage, and recommendation among heavy TV viewers and heavy AM/FM radio listeners.

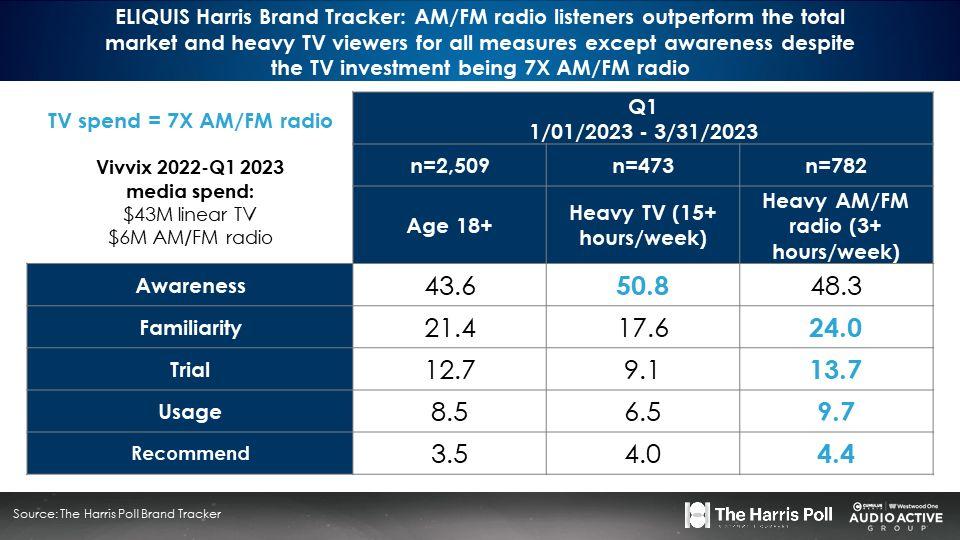

While TV spend for ELIQUIS was seven times greater than AM/FM radio, the Harris Poll Brand Tracker reports familiarity, trial, usage, and recommendation are stronger among AM/FM radio listeners than among TV viewers

The Harris Poll Brand Tracker surveyed 2,509 Americans about ELIQUIS in Q1 2023 and found TV had a two-point advantage in awareness over AM/FM radio. This is unsurprising given that ELIQUIS spent $43M on linear TV in 2022 and Q1 2023, seven times the AM/FM radio investment ($6M).

Among AM/FM radio listeners, ELIQUIS’ familiarity, trial, usage, and recommendation outperforms the general market and the TV audience.

Why does ELIQUIS perform so much better among AM/FM radio listeners? Are AM/FM radio ads so much more effective than TV ads? Or are AM/FM radio listeners more likely to have the symptoms and health issues that ELIQUIS can address?

Regardless, this is strong evidence and support for AM/FM radio’s inclusion in the ELIQUIS media plan.

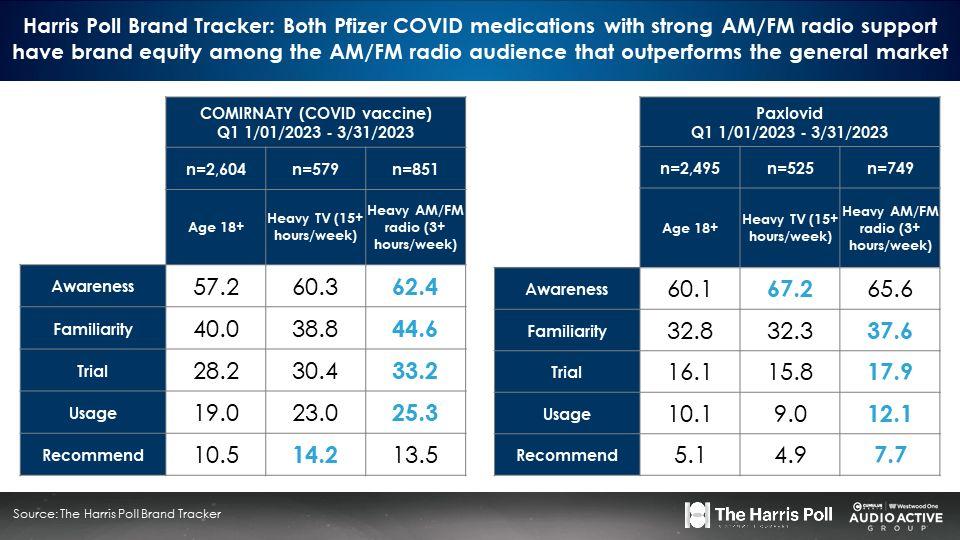

Pfizer’s COVID medications that strongly utilized AM/FM radio advertising outperformed the general market in most brand equity measures

Harris Poll Brand Tracker surveyed 2,500 consumers in Q1 2023 and found brand equity among heavy AM/FM radio listeners was stronger than the general market and stronger than TV viewers for Paxlovid and COMIRNATY (the COVID vaccine).

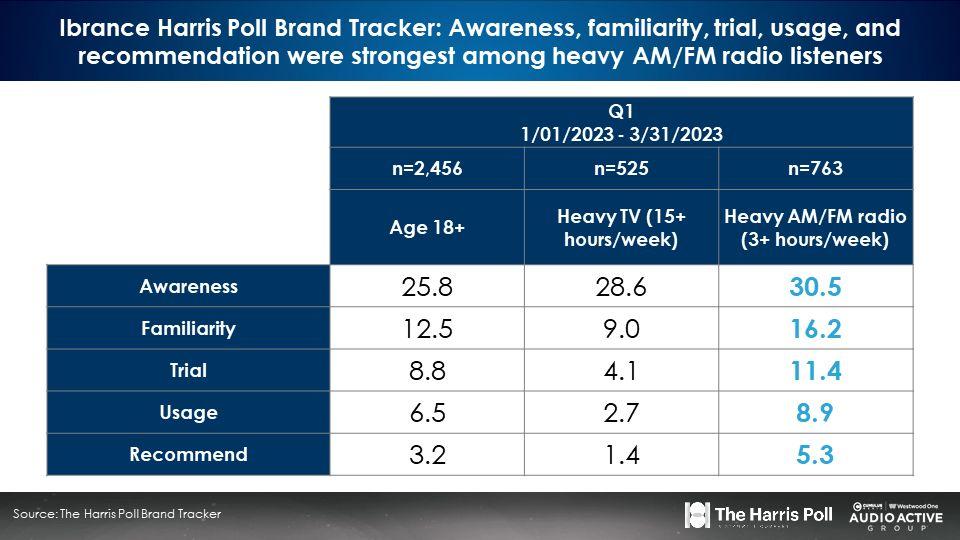

Ibrance’s usage of AM/FM radio resulted in strong brand equity that outperformed the general market

Vivvix/Kantar reports that AM/FM radio represented 71% of Ibrance’s 2022 and Q1 2023 AM/FM radio/TV investment. From the top to the bottom of the purchase funnel, Harris Poll Brand Tracker’s survey of 2,456 persons in Q1 2023 found Ibrance had stronger performance among AM/FM radio listeners versus the market overall.

The evidence of AM/FM radio’s marketing effectiveness for the pharmaceutical category is quickly accumulating

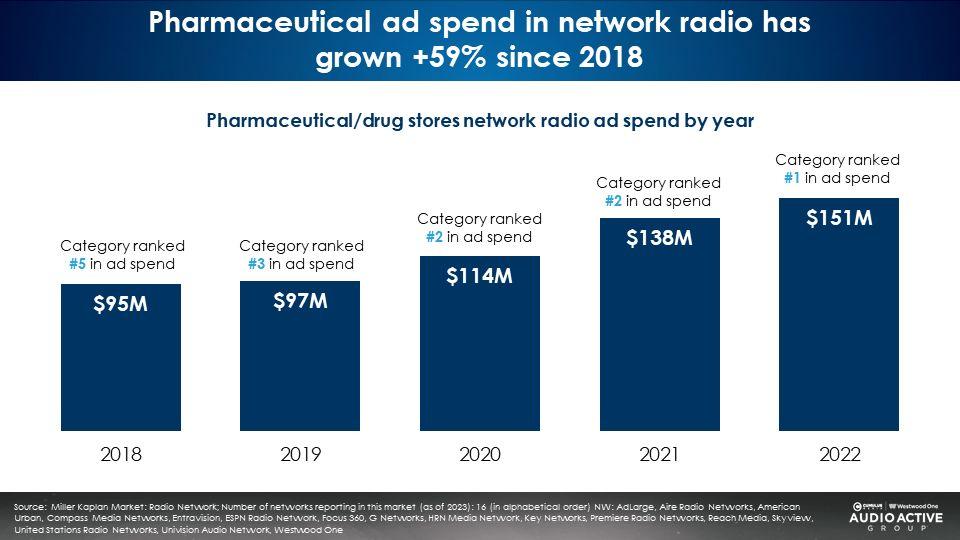

Pharmaceutical is now the number one advertising category on network radio

Since 2018, pharmaceutical and drug store spend on network radio has soared +59%, according to Vivvix/Kantar. AbbVie, Pfizer, Johnson and Johnson, and P&G are running AM/FM radio campaigns for multiple brands.

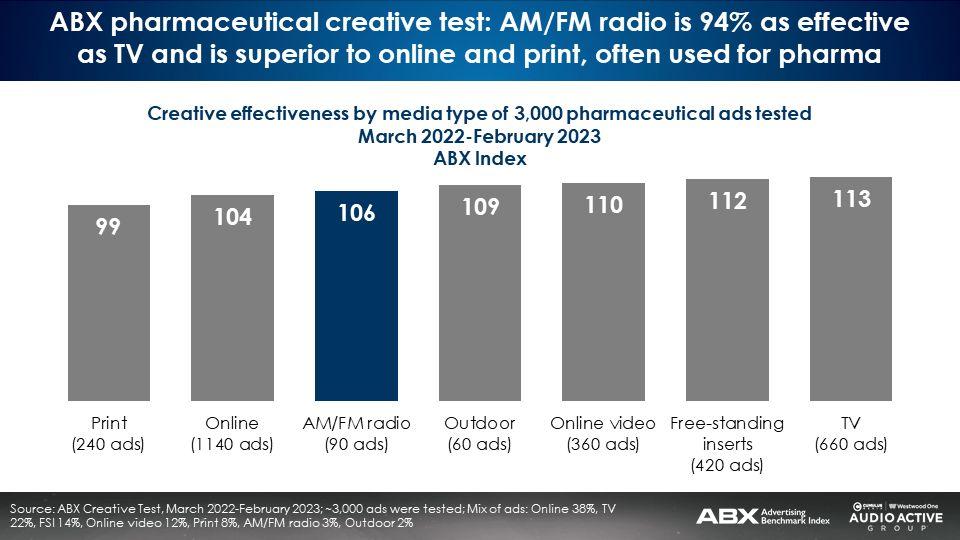

Brand new ABX creative effectiveness study of nearly 3,000 pharmaceutical ads: AM/FM radio is 94% as effective as TV at one-fourth the CPM

A just released study from ABX, a leading creative effectiveness measurement firm, examined 2,970 pharmaceutical ads that ran from March 2022 to February 2023 across TV, print, digital, outdoor, online video, free standing print inserts, and AM/FM radio.

The average creative effectiveness score for the 90 AM/FM pharmaceutical AM/FM radio ads tested (106) was 94% of the average score of 660 pharmaceutical TV ads (113).

“Sight, sound, and motion” superiority over audio ads is a myth

Pharmaceutical AM/FM radio ads performed nearly as well as TV at a fraction of the CPM. AM/FM radio pharmaceutical creative effectiveness scores beat online and print, both highly visual media.

Gary Getto, President of ABX, says, “Moving some TV funds to AM/FM radio produces significantly higher reach. Often the excuse for not doing this is the need for sight, sound, and motion that TV provides and, in many cases, the lack of confidence in AM/FM radio creative’s ability to move the needle. But extensive ABX data shows that AM/FM radio can be nearly as effective as television when best practices in audio creative are followed.”

Key findings:

- Pharmaceutical brands that utilize network radio generate extraordinary reach lifts, according to Nielsen Media Impact

- AM/FM radio enhances pharmaceutical brand TV campaigns via reach growth among younger and middle-aged demographics and light TV viewers

- Across a number of Pfizer brands, Harris Poll Brand Tracker studies reveal the strongest brand equity occurs among AM/FM radio listeners

- Pharmaceutical is now the number one advertising category on network radio

- Brand new ABX creative study of nearly 3,000 pharmaceutical ads reveals AM/FM radio is 94% as effective as TV at one-fourth the CPM

- “Sight, sound, and motion” superiority of pharmaceutical TV ads versus audio ads is a myth

Click here to view a 14-minute video of the key findings.

Download a PDF of the slides:

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.