New Nielsen Consumer Study: Workplace Commuting Increases Sharply, Time Spent In The Car Soars, And Audio Listeners Are More Likely To Make Major Purchases As AM/FM Radio Is The Soundtrack Of The American Economic Recovery

Click here to view a 12-minute video of the key findings.

Nielsen recently released the results of a national consumer study of 1,000 adult 18+ respondents conducted March 2022. It was the eighth in a series of studies released since April 2020 measuring the pandemic’s impact on consumer movement, spending, attitudes, and media usage.

Here are the key findings:

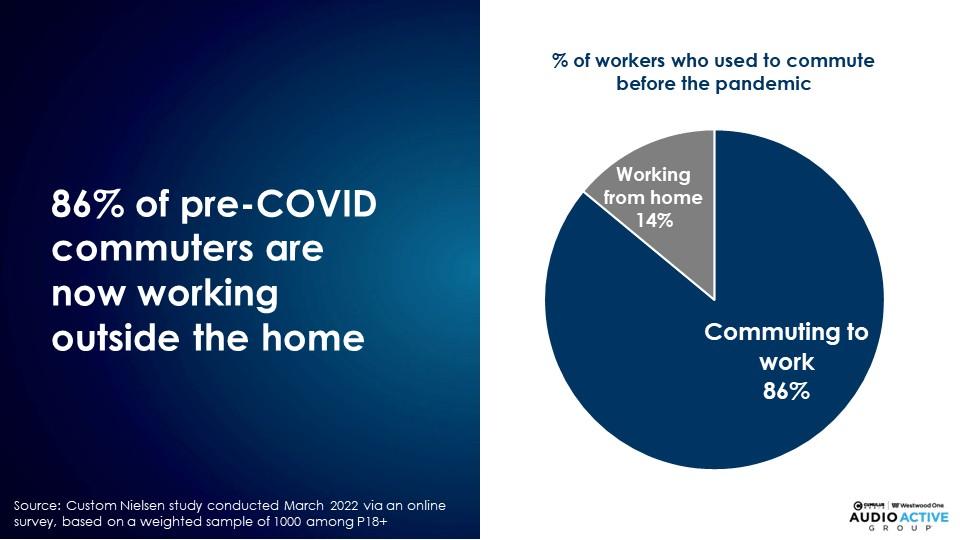

86% of pre-COVID commuters are now working outside the home

Among workers who commuted prior to the pandemic, Nielsen reports 86% are now working out of the home. This return to work is reflected in AM/FM radio’s audience recovery.

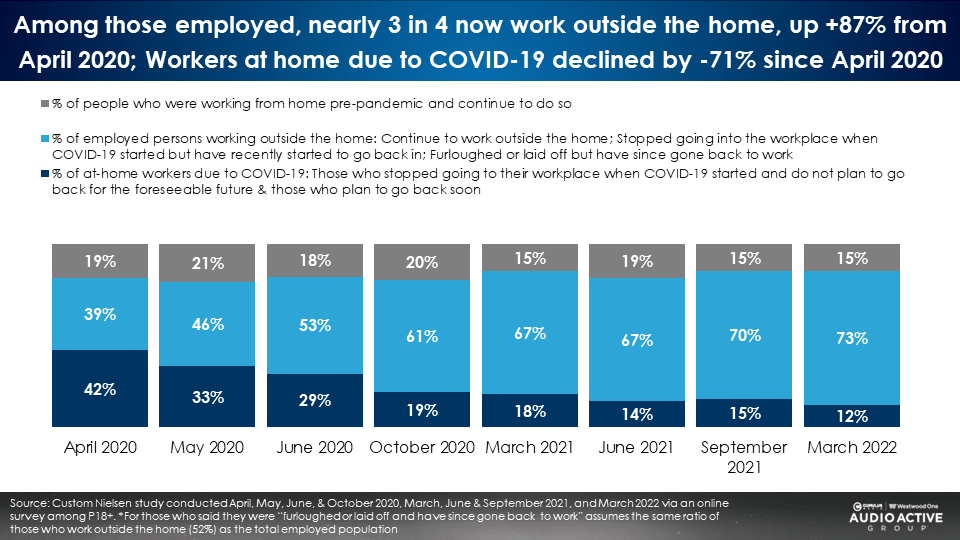

Since April 2020, employed persons working from home due to COVID have dropped from 42% to 12%. The proportion of workers commuting outside of the home has increased from 39% to 73%.

Apple Maps: Driving search soars +66% over pre-COVID levels as Apple ends their post-pandemic reporting

At the onset of pandemic in April 2020, Apple started a Mobility Trend Report that compared daily driving search volumes to the pre-COVID date of January 13, 2020. While traffic volumes dipped in Spring 2020, by Summer 2020 Americans were back on the road and Apple Maps driving search volumes surged.

A year ago in March 2021, Apple Maps revealed driving search was 23% greater than pre-COVID. March 2022 driving search volumes are 66% greater than before the pandemic.

Given that traffic volumes have long since recovered, Apple recently stopped reporting post-COVID driving search volumes. Their last report confirms data from many other sources, showing Americans have been back on the road and in their cars for two years.

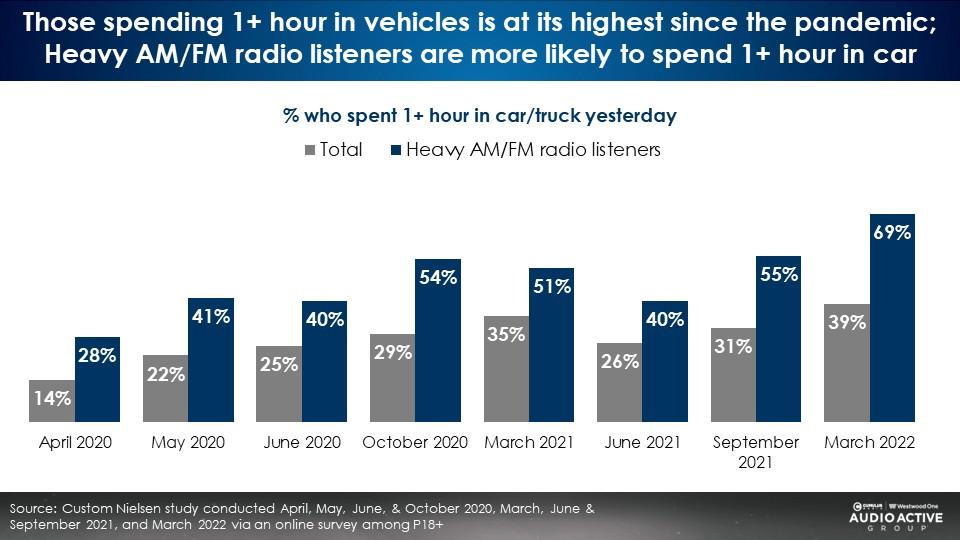

Time spent in the car reaches a post-pandemic high

As driving traffic volumes surge, Nielsen reports 69% of heavy AM/FM radio listeners spent an hour or more in their car in the prior day, a two-year high.

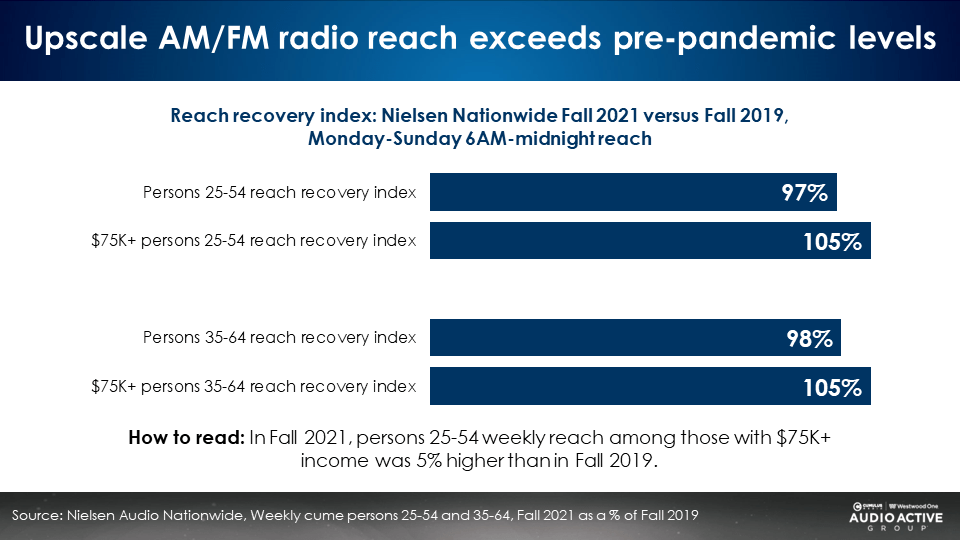

AM/FM radio has retained its pre-pandemic reach and increased its $75K+ audience

Nielsen’s Nationwide study is their twice annual roll-up of all measured markets and total U.S. AM/FM radio listening. Comparing the Fall 2021 survey with the Fall 2019 pre-COVID report provides the best understanding of how AM/FM radio has retained its audience since the pandemic.

AM/FM radio’s persons 25-54 audience reach in Fall 2021 was 97% of its Fall 2019 reach. Similarly, AM/FM radio has retained 98% of its persons 35-64 audience.

The audience profile of U.S. AM/FM radio has become more upscale since COVID. Interestingly, AM/FM radio’s current $75K+ audience reach is 5% bigger than before the pandemic.

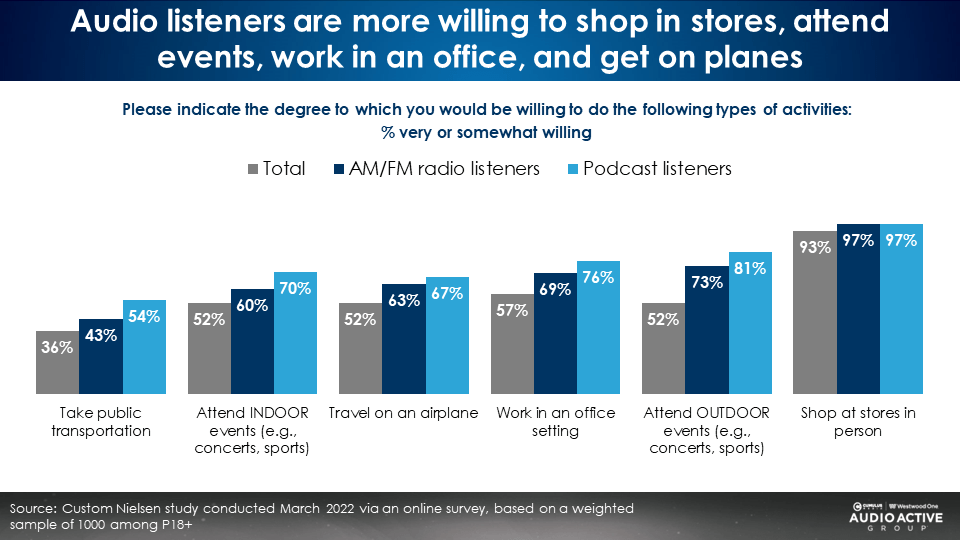

Audio listeners are more likely to travel and attend events

67% of podcast listeners and 63% of AM/FM radio listeners say they are very or somewhat willing to travel on an airline versus only 52% of all Americans.

Compared to the total U.S., a much larger proportion of AM/FM radio and podcast listeners say they are willing to attend indoor and outdoor events. Audio is the ideal advertising platform to reach those who want to travel and attend events.

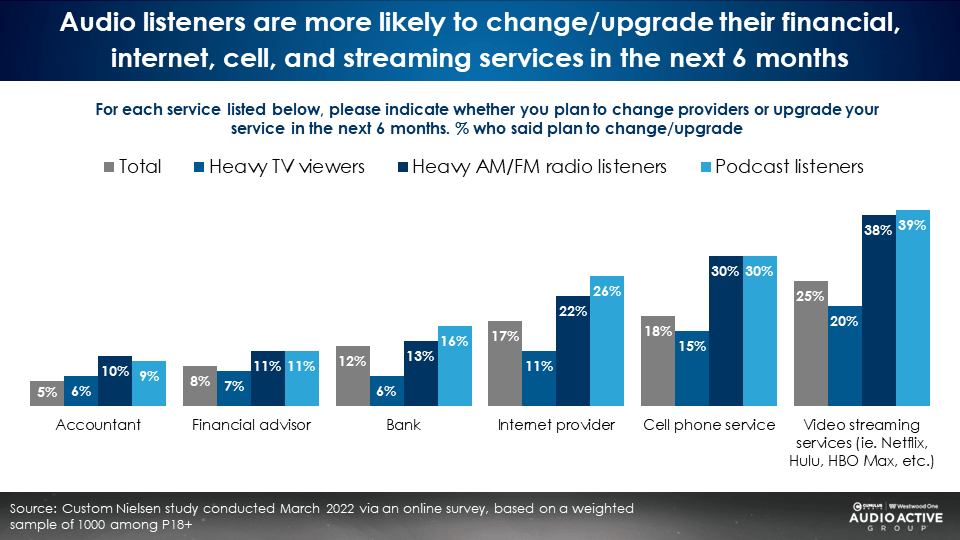

Compared to TV viewers, audio listeners are much more likely to be in the market for an accountant, financial advisor, broadband provider, cell service, or video streaming service

Compared to TV viewers, podcast and AM/FM radio listeners are twice as likely to say they plan to change or upgrade these services.

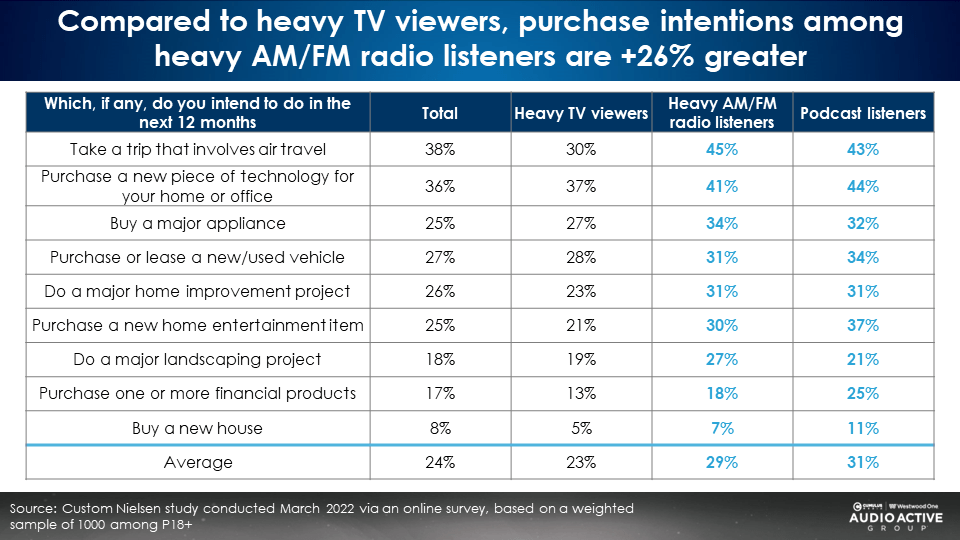

Audio listeners are far more likely than TV viewers to make a major purchase

Whether purchasing a new vehicle, funding a major home improvement project, or buying a new house, tech for a home office, or a major appliance, audio listeners are more likely to be in the market than TV viewers. Purchase intentions among TV viewers are much lower.

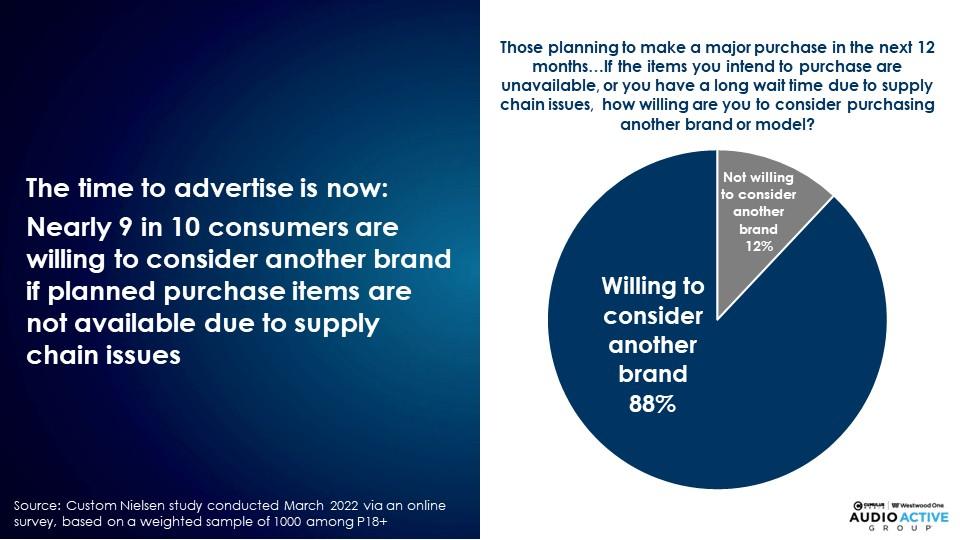

Now is the time to advertise: Supply chain issues are causing consumers to consider purchasing brands they normally would not consider

88% of consumers planning to make a major purchase say they are willing to consider purchasing another brand due to shortages caused by supply chain issues.

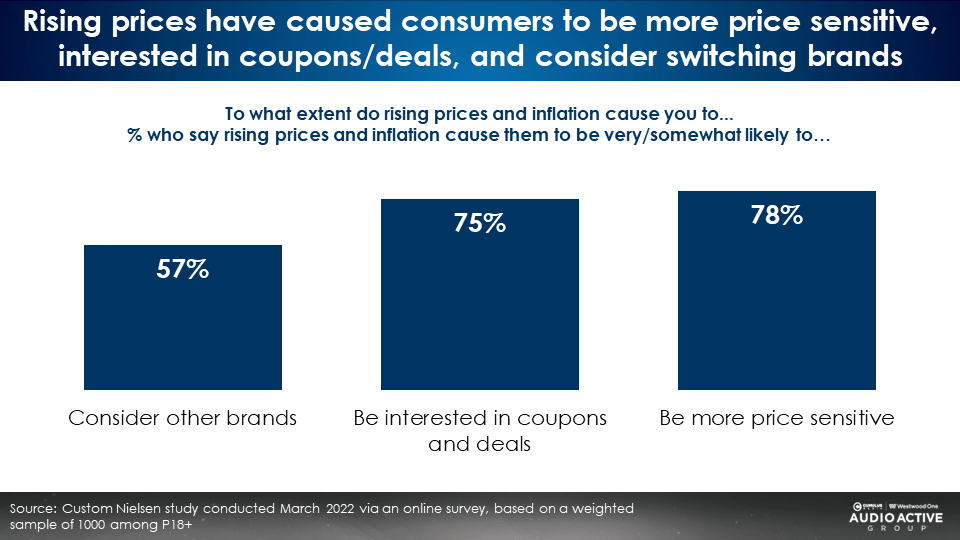

Another reason to advertise: Rising prices are causing consumers to consider switching brands

75% of consumers are interested in deals and coupons as an offset to rising prices. 57% say they would consider other brands. Inflation and supply chain issues present an opportunity for marketers as consumers are now more willing to consider other brands.

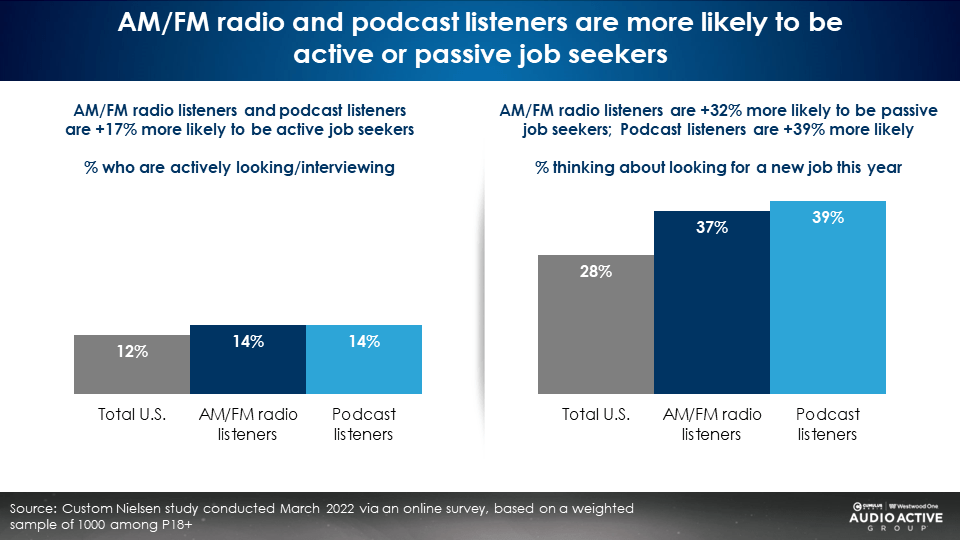

Recruit employees with AM/FM radio and podcast ads: Audio listeners are more likely to be active or passive job seekers

12% of total Americans say they are actively looking or interviewing for a new job. 28% say they are thinking of looking for a new job this year.

Both AM/FM radio and podcast listeners are much more likely to be active or passive job seekers. Audio listeners are 17% more likely to be actively looking and 32% to 39% more likely to begin this job search this year.

Key takeaways:

- 86% of pre-COVID commuters are now working outside the home

- Apple Maps: Driving search soars +66% over pre-COVID levels as Apple ends their post-pandemic reporting

- Time spent in the car reaches a post-pandemic high

- AM/FM radio has retained its pre-pandemic reach and increased its $75K+ audience

- Audio listeners are more likely to travel and attend events

- Compared to TV viewers, audio listeners are much more likely to be in the market for an accountant, financial advisor, broadband provider, cell service, or video streaming service

- Audio listeners are far more likely than TV viewers to make a major purchase as AM/FM radio is the soundtrack of the American economic recovery

- Now is the time to advertise: Supply chain issues are causing consumers to consider purchasing brands they normally would not consider

- Another reason to advertise: Rising prices are causing consumers to consider switching brands

- Recruit employees with AM/FM radio and podcast ads: Audio listeners are more likely to be active or passive job seekers

Click here to view a 12-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer at Cumulus Media | Westwood One and President of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.