New Advertiser And Consumer Studies On Media Attentiveness And Ad Skipping From The CUMULUS MEDIA | Westwood One Audio Active Group®

Click here to view an 11-minute video of the key findings.

Click here to download your copy of the Media Attentiveness and Ad Skipping Report.

Key takeaways:

- Two-thirds of advertisers and agencies indicate consumer attentiveness is important for measuring media investments

- Agencies/advertisers correctly perceive strong levels of consumer concentration for information, podcasts, and TV shows; Social media concentration is overestimated

- Among audio platforms, podcasts exhibit the highest concentration levels; AM/FM radio attentiveness is 2X Pandora/Spotify

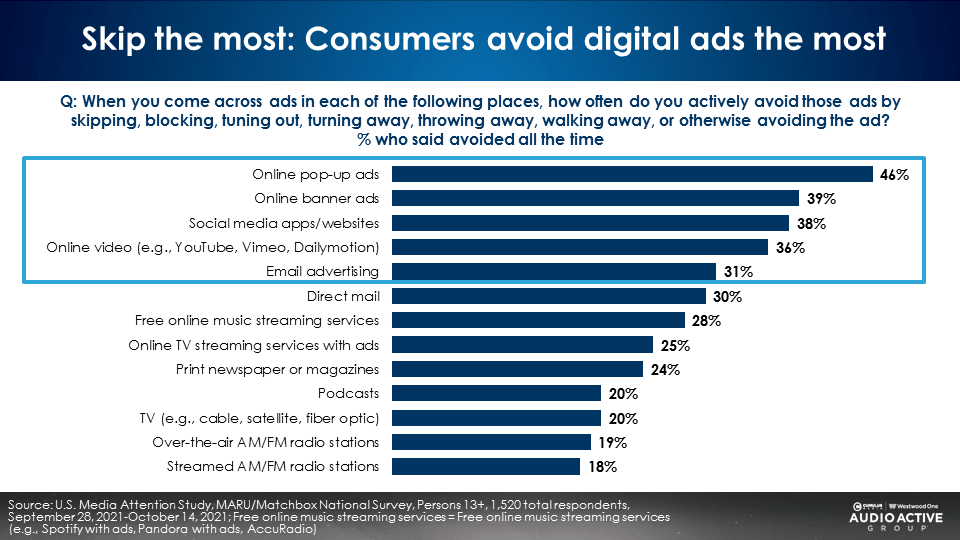

- Consumers skip social and digital ads the most and skip traditional media ads the least

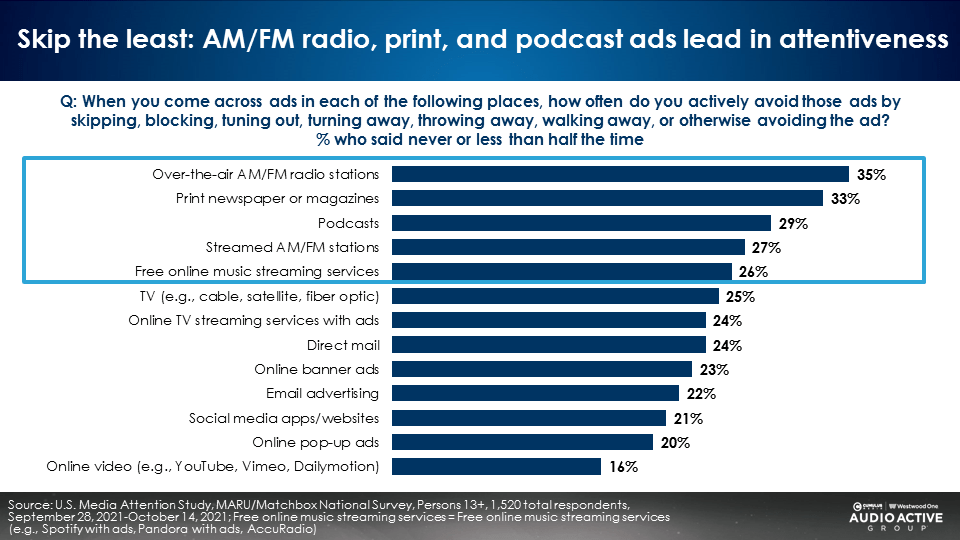

- AM/FM radio, print, and podcast ads lead in attentiveness

Attention measurement is a new trend sweeping through media circles. The Advertising Research Foundation defines advertising attentiveness as “the degree to which those exposed to the advertising are focused on it.”

The Attention Pathway model

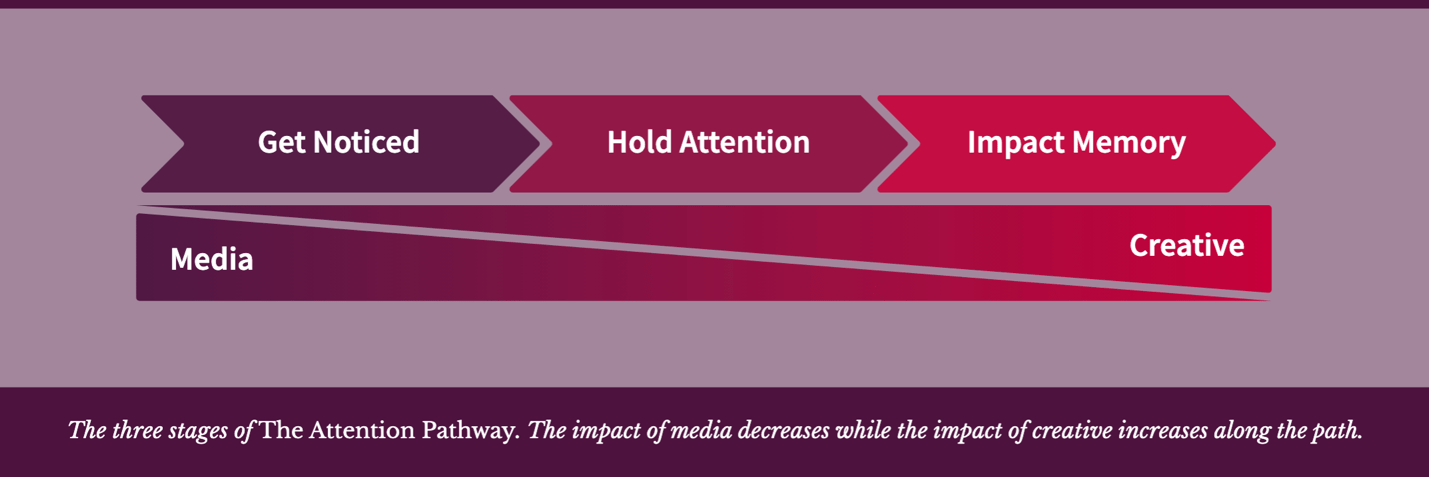

Adelaide, a leading attention measurement firm, and the Association of National Advertisers define the Attention Pathway as having three stages:

- “Get Noticed – advertising requires an environment that fosters attention. This is the job of a media placement. How well it gets that job done is a good indicator of its quality: the best quality placements create the greatest potential for attracting attention.

- Hold Attention – it’s vital to keep the viewer focused on the ad. In some circumstances, this can be measured using duration. This requires a stable media placement and interesting creative.

- Impact Memory – with attention now assured, the creative must deliver a brand message that affects the short- or long-term memory of the person paying attention to the ad.”

Image from The Attention Pathway & How To Measure It Report from Adelaide and the ANA

Along the attention pathway, the impact of media decreases while the impact of creative increases.

Major media agencies like Havas, OMD, and denstu are implementing attention measurement for their clients. A new industry organization, The Attention Council, has formed to promote attention metrics to measure media quality and explore attention-based measurement currency for media buying. The Attention Council was created by leading attention measurement firms Amplified Intelligence, Lumen, Adelaide, and TVision.

Media Attentiveness and Ad Skipping Report from the CUMULUS MEDIA | Westwood One Audio Active Group®

While the initial focus of attentiveness measurement has been on visual media like video and digital, CUMULUS MEDIA | Westwood One believes audio should be included in attention discussion and application. As such, two new studies were commissioned to examine attentiveness from an industry standpoint and a consumer perspective.

The CUMULUS MEDIA | Westwood One Audio Active Group® commissioned Advertiser Perceptions, the gold standard in brand and agency sentiment, to probe 301 media agencies and marketers in December 2021 on the importance of consumer attentiveness and media platform concentration.

The results were compared to a 2018 MARU/Matchbox study of 1,901 persons 18+ commissioned by the Interactive Advertising Bureau (IAB), which measured consumer concentration levels with media platforms. Being able to determine how much consumers concentrate on media is one method of understanding attentiveness.

CUMULUS MEDIA | Westwood One also worked with Signal Hill Insights to conduct a MARU/Matchbox national U.S. study of 1,520 U.S. persons 13+ in October 2021. Respondents were asked about media platform attentiveness and ad skipping. These findings were compared to similar studies Signal Hill Insights has conducted in Canada.

Here are the key findings:

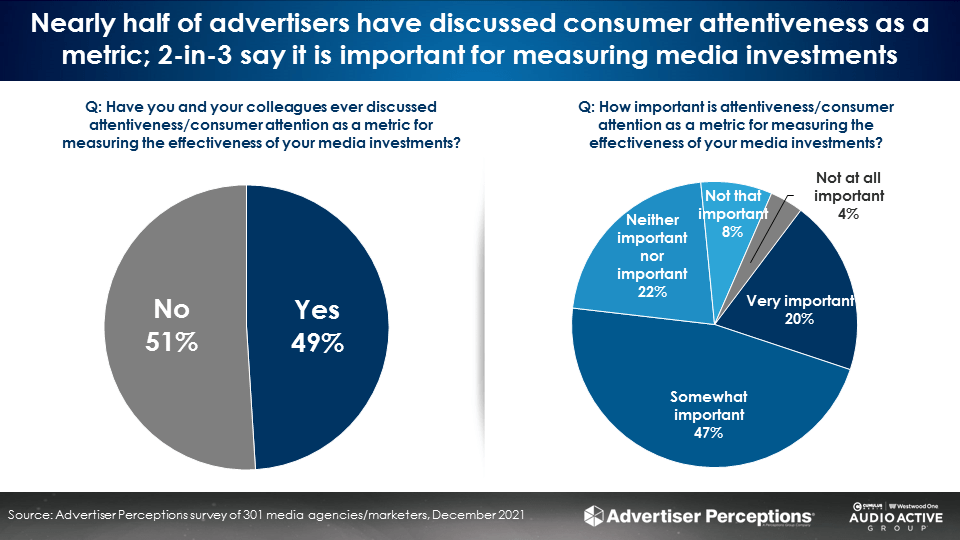

Two-thirds of advertisers and agencies indicate consumer attentiveness is important for measuring media investments

According to the Advertisers Perceptions study conducted in December 2021, half of marketers and media agencies indicate they have discussed attentiveness as a metric for measuring the effectiveness of media investments. Two-thirds say consumer attention metrics are important measurements of advertising effectiveness.

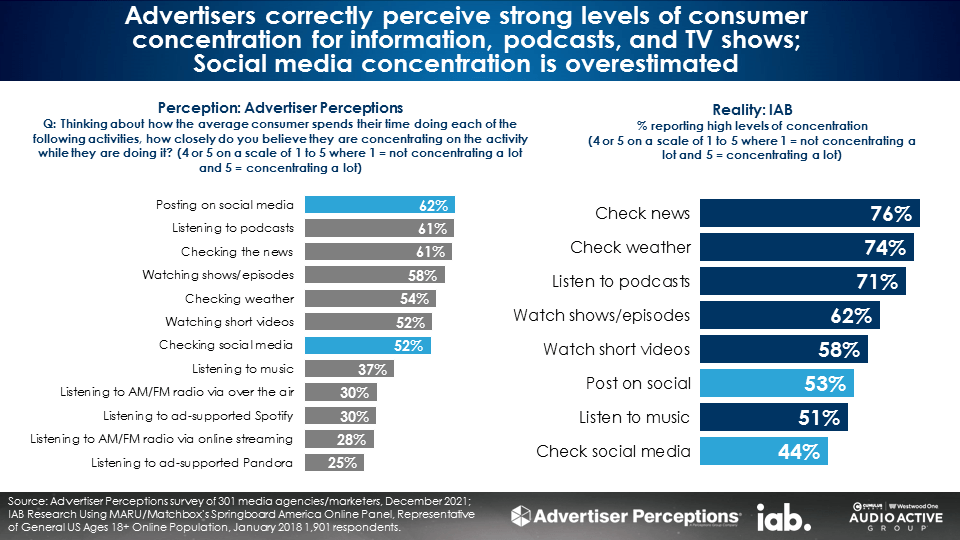

Agencies/advertisers correctly perceive strong levels of consumer concentration for information, podcasts, and TV shows; Social media concentration is overestimated

Media agencies and advertisers rated media platforms on a one to five scale where one indicated consumers did not concentrate a lot on the media platform and five meant consumers concentrated a lot. Industry perceptions were compared to an IAB study, which asked the same questions of consumers.

Information (news and weather), TV shows, and podcasts rated highly in concentration perceptions among both agencies/advertisers and consumers. There was a disconnect with social media.

Media agencies and brands mistakenly think consumers concentrate on social media. The IAB consumer study revealed low levels of social media engagement and concentration.

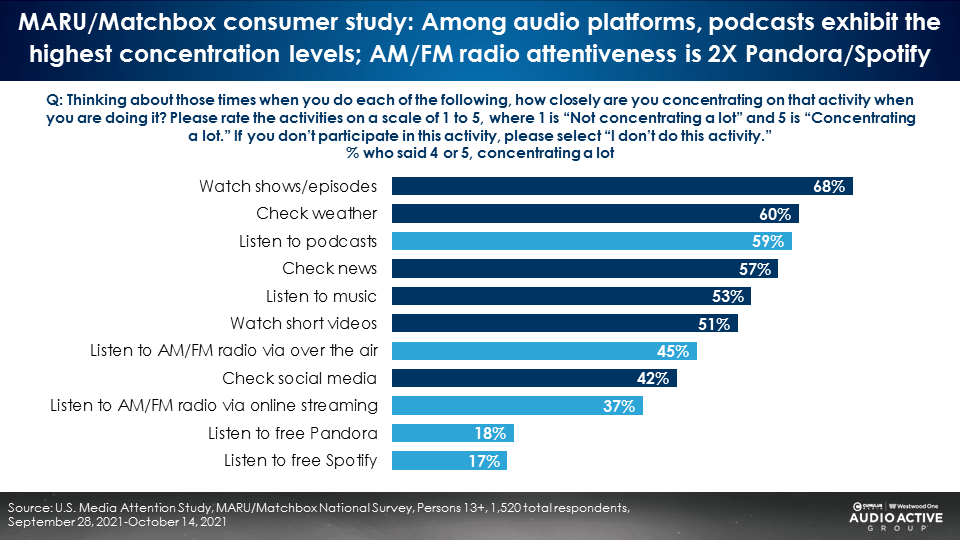

Among audio platforms, podcasts exhibit the highest concentration levels; AM/FM radio attentiveness is double Pandora/Spotify

The MARU/Matchbox consumer study conducted in October 2021 validated the IAB study findings of high concentration levels for information, TV shows, and podcasts. Just like the IAB study, social media exhibited low levels of concentration.

On the audio front, podcasts have the strongest levels of concentration. Consumers report their attention levels to AM/FM radio is double that of Spotify and Pandora. This is an important insight for advertisers as ads on AM/FM radio are noticed more and hold more attention than ads on Pandora and Spotify.

Consumers skip social and digital ads the most and skip traditional media ads the least

AM/FM radio, print, and podcast ads lead in attentiveness

Of all media, AM/FM radio ads are number one for being noticed and holding attention. AM/FM radio ads are stickier than ads on free online streaming services like Pandora and Spotify.

The use cases of AM/FM radio, Pandora, and Spotify determine attentiveness: Pandora and Spotify are background music at home while AM/FM radio is consumed out of the home while consumers are commuting, shopping, and working

Listeners say AM/FM radio is more audible than Pandora and Spotify. 30% more say they “can hear what people are talking about” listening on AM/FM radio versus Pandora and Spotify. Some of this has to do with location of listening.

What people are doing when they are consuming media is a key driver of attentiveness and impacts advertising response. According to Edison’s “Share of Ear,” most Pandora/Spotify listening occurs at home. The use case of music streaming services is “chill out and relax.” Ads on Pandora and Spotify aren’t heard because the streaming services are played too softly in the background or in the other room.

In contrast, the majority of AM/FM radio listening occurs out of the home while consumers are in the car and at work. AM/FM radio’s use case is “commuting, shopping, and working.” More foreground and more engaged.

In Canada, Signal Hill Insights found that listeners say they pay 30% more attention to AM/FM radio versus free online streaming services.

Why does AM/FM radio have far greater attentiveness than Pandora and Spotify? Shared experience with human connection

Sean Ross, VP Music and Programming at Edison Research, explains, “‘Real Radio’ is still defined for me by doing what a playlist cannot do—putting together music in an order that is different each time, but not random; telling me what’s happening in my town, or yours; advocating for the music it introduces to me; being punctuated by people who are funny or thought-provoking. … part of radio’s identifying DNA now, is the shared experience.”

Radio futurologist and editor of Podnews James Cridland says, “[AM/FM radio is] an audio-first shared experience with a human connection.”

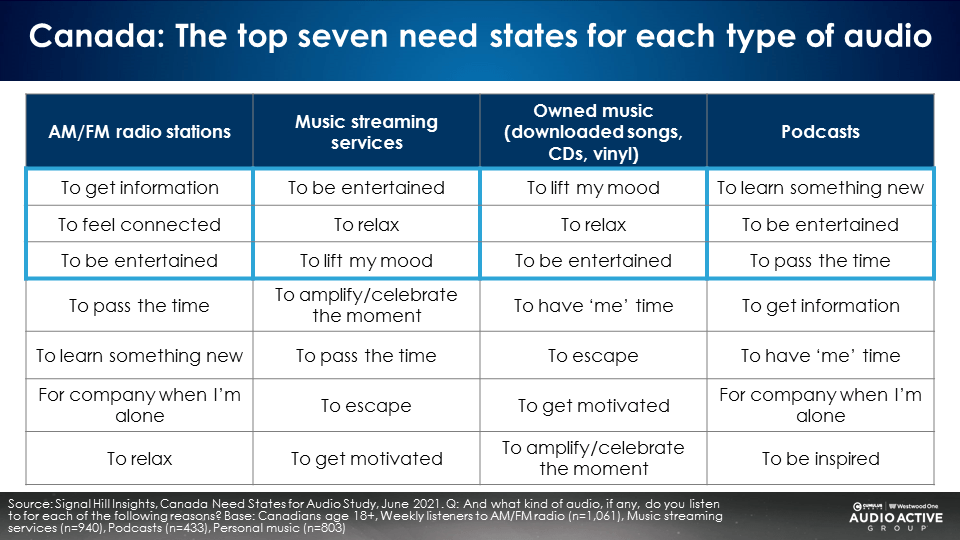

Audio need states

Signal Hill Insights probed listeners on the key benefits audio provides. The findings reveal music streaming entertains, relaxes, and lifts moods. AM/FM radio provides information, connection, and entertainment. Podcasts are about learning, entertainment, and passing the time. Advertising works so much better in AM/FM radio and podcasts because consumers use them to learn, to be connected, and to get information.

“Ears are constantly open” so attention should be paid to audio creative

While understanding media need states is important, creative also plays a major role in driving attentiveness. Mark Barber MBE, Planning Director at Radiocentre based on London, recently wrote an article for WARC about attentiveness. In it, he noted that since “ears are constantly open” there is also a level of audio exposure that is “passive, involuntary, effortless” and “can still have powerful effects.”

He continues, “Every audio advertising audience impression presents an opportunity to communicate something to the passive hearer. This is distinctly different to visual media where the act of looking, no matter how briefly, is required for further processing to take place.” As such, advertisers have an “opportunity to convert passive to active listening.”

One way to do that? By utilizing creative, what many consider to be one of the most important levers that can be pulled for advertising responsiveness. To ensure creative is effective and powerful, click here for the CUMULUS MEDIA | Westwood One Audio Active Group® Audio Creative Best Practices.

Key findings:

- Attention grows in importance among marketers and agencies: Nearly half of advertisers have discussed consumer attentiveness as a metric. 2-in-3 say it is important for measuring media investments.

- Social media disconnect: Agencies/marketers overestimate consumer concentration of social media. Two consumer studies reveal social media has the lowest attentiveness of media platforms.

- Traditional media ads have greater engagement compared to digital ads: AM/FM radio, print, and podcast ads lead in attentiveness. Consumers skip social and digital ads the most.

- Audio platforms satisfy unique need states: AM/FM radio is associated with information, connection, and entertainment. Podcasts are a source of information, learning, and entertainment. Music streaming entertains, relaxes, and lifts moods.

Implications:

- Traditional media impressions are worth more than digital impressions. Linear TV, print, and audio enjoy much stronger attentiveness than digital platforms. Consumers notice ads in traditional media more and skip ads less.

- AM/FM radio CPMs should be a premium to Pandora and Spotify: Pandora/Spotify audio impressions are not the same as AM/FM radio impressions. AM/FM radio attentiveness is 2X Pandora/Spotify. The greater proportion of spoken word content on AM/FM radio generates much higher levels of concentration and attentiveness. The information and personalities of AM/FM radio satisfy consumer need states for information and connection.

- High CPMs for podcasts are warranted: Podcasts generate high attentiveness levels as they satisfy multiple “lean in” consumer need states: information, learning, and entertainment.

Click here to view an 11-minute video of the key findings.

Click here to download your copy of the Media Attentiveness and Ad Skipping Report.

Download your copy of the Media Attentiveness and Ad Skipping Report.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One and President of the CUMULUS MEDIA | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.