Share Of Ear Q3 2019: AM/FM Radio Continues To Lead The Ad-Supported Pack

Edison Research’s “Share of Ear” is the gold standard study of American audio usage. It provides an in-depth look at how Americans consume audio day to day. The report quantifies reach and time spent with all forms of audio.

Here are the key findings from their recently-released Q3 2019 report:

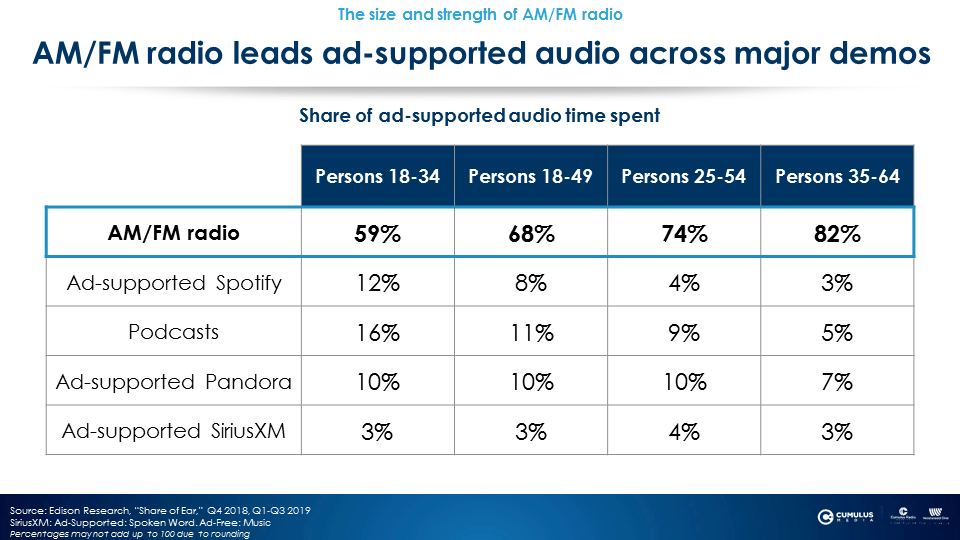

AM/FM radio leads ad-supported audio among major buying demos

For advertisers, focusing on ad-supported audio’s share provides a better picture of the platforms where audio ads can run. From 18-34 Millennials to Boomers, AM/FM radio accounts for over half of all ad-supported audio time spent. AM/FM radio’s ad-supported share grows with age.

AM/FM radio accounts for 59% of ad-supported time spent among persons 18-34. AM/FM radio’s share of ad-supported time spent balloons to 74% among 25-54s and 82% among persons 35-64.

Among the younger generations, ad-supported Spotify and podcasts follow behind AM/FM radio while older generations lean toward ad-supported Pandora and podcasts.

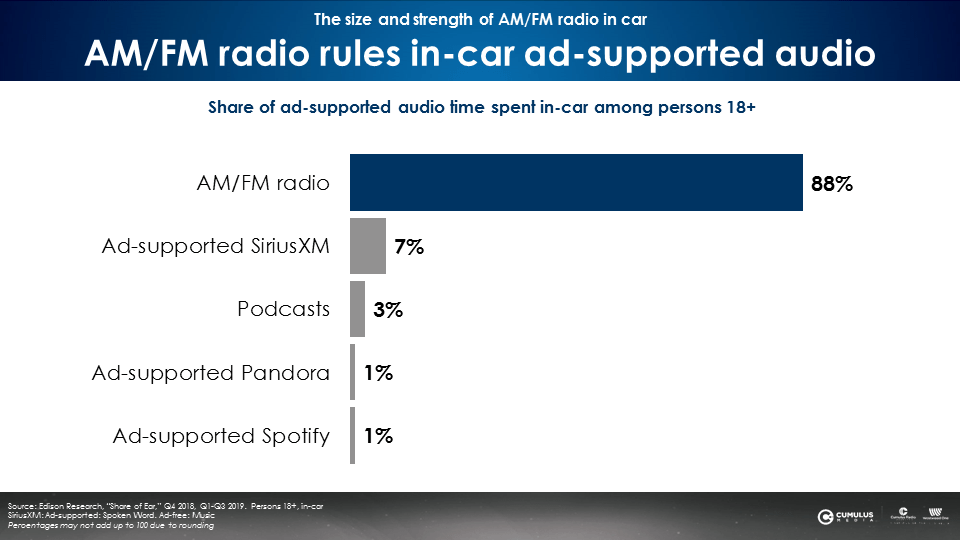

Nearly 90% of ad-supported audio in the car goes to AM/FM radio

Some may perceive that AM/FM radio is losing its hold in the car. Perception is not reality. AM/FM radio continues to dominate audio in the car, especially among ad-supported platforms, with an 88% share of ad-supported audio time spent. There is a steep drop to the next platform, ad-supported SiriusXM, which has only a 7% share of ad-supported time spent.

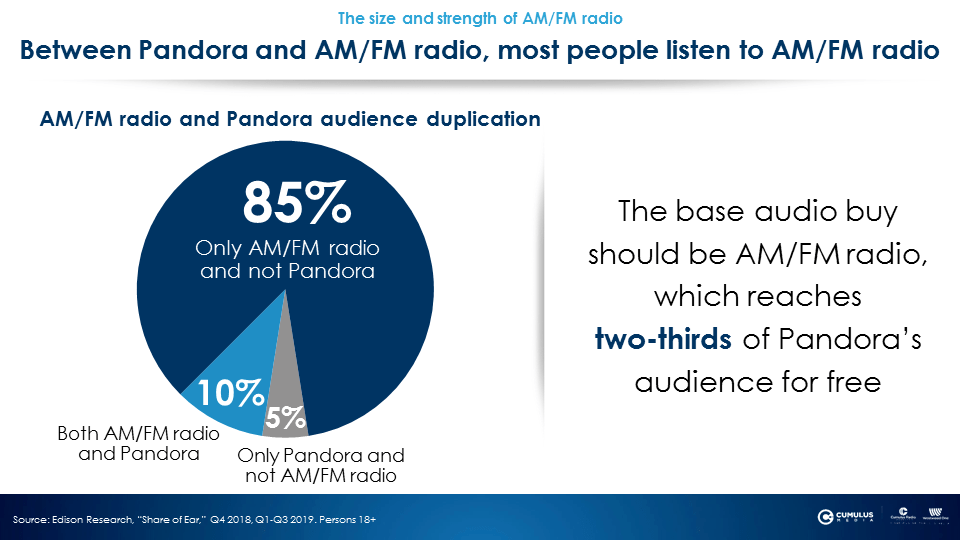

AM/FM radio provides incremental reach to digital-only audio plans

Between AM/FM radio and Pandora, AM/FM radio reaches 95% of the combined audience. As such, AM/FM radio should be the base audio buy. An AM/FM radio buy reaches two-thirds of Pandora’s audience at no extra cost.

Examining the duplication between Pandora’s audience and AM/FM radio’s audience reveals that most adults only listen to AM/FM radio and not Pandora (85%). The audience that listens to only AM/FM radio and not Pandora is 17X bigger than the audience that listens to only Pandora and not AM/FM radio (85% vs. 5%). There is a massive portion of listeners that advertisers are missing with a Spotify/Pandora-only audio plan. It’s like buying one cable network ranked #139 and declaring your TV buy is done.

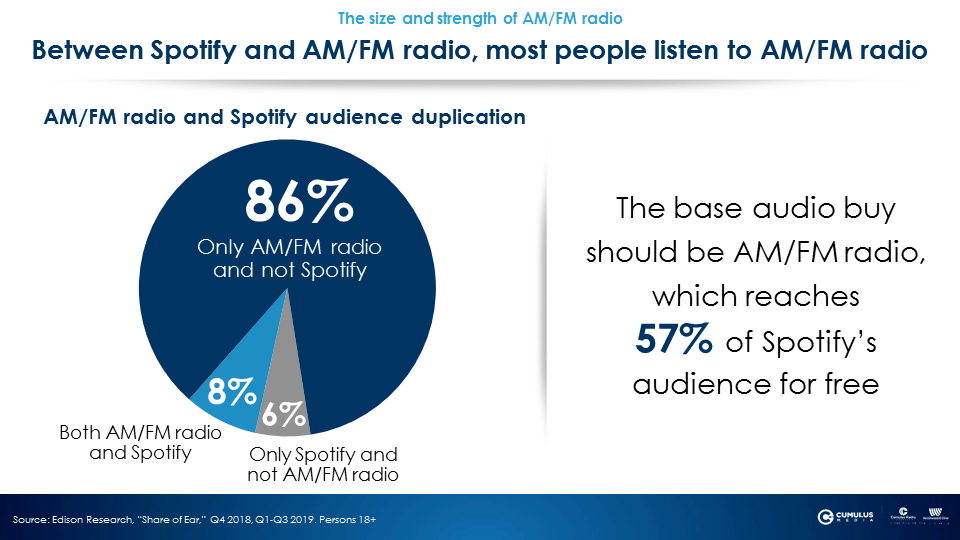

Between AM/FM radio and Spotify, AM/FM radio reaches 94% of the combined audience. As such, AM/FM radio should be the base audio buy. An AM/FM radio buy reaches 57% of Spotify’s audience at no extra cost.

The audience duplication between Spotify and AM/FM radio is nearly identical. The audience that listens to only AM/FM radio and not Spotify is 14X bigger than the audience that listens to only Spotify and not AM/FM radio (86% vs. 6%).

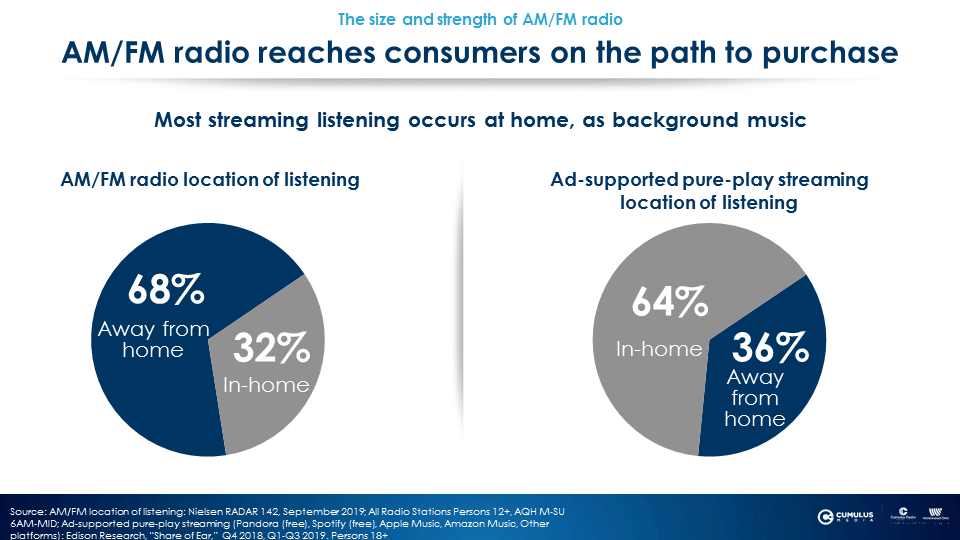

AM/FM radio reaches people on the go; ad-supported pure-play streaming listening mostly occurs at home

The location where most listening to ad-supported pure-play streaming and AM/FM radio takes place is completely different. According to the latest Nielsen RADAR report, over two-thirds (68%) of AM/FM radio listening occurs away from home. This includes in the car, at work, or other places. AM/FM radio is a lean-forward, engaging medium that gives advertisers the opportunity to connect with consumers before they make purchases.

On the other hand, most listening to ad-supported pure-play streaming (including Pandora, Spotify, Apple Music and Amazon) occurs at home (64%). According to a MARU/Matchbox survey, within the home, half of Pandora and Spotify listeners report they cannot hear the voices. Only half of Pandora and Spotify ads can be heard. The use case for streaming is having background music playing in the other room.

Key takeaways:

- AM/FM radio leads ad-supported audio among major buying demos

- Nearly 90% of ad-supported audio in the car goes to AM/FM radio

- AM/FM radio should be the base audio buy, reaching the majority of Pandora and Spotify’s audience for free

- AM/FM radio reaches people on the go; ad-supported pure-play streaming listening mostly occurs at home

Brittany Faison is the Insights Manager at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.