Share of Ear Q1 2019: AM/FM Radio Dominates Ad-Supported Media, Spotify Inches Out Pandora Again, and Podcast Audiences Surge

Edison Research recently released its quarterly report, “Share of Ear,” the media industry’s go-to for understanding how Americans consume audio each day. The “Share of Ear” report quantifies the reach and time spent with all forms of audio.

Here are some key findings from the latest “Share of Ear” Q1 2019 report:

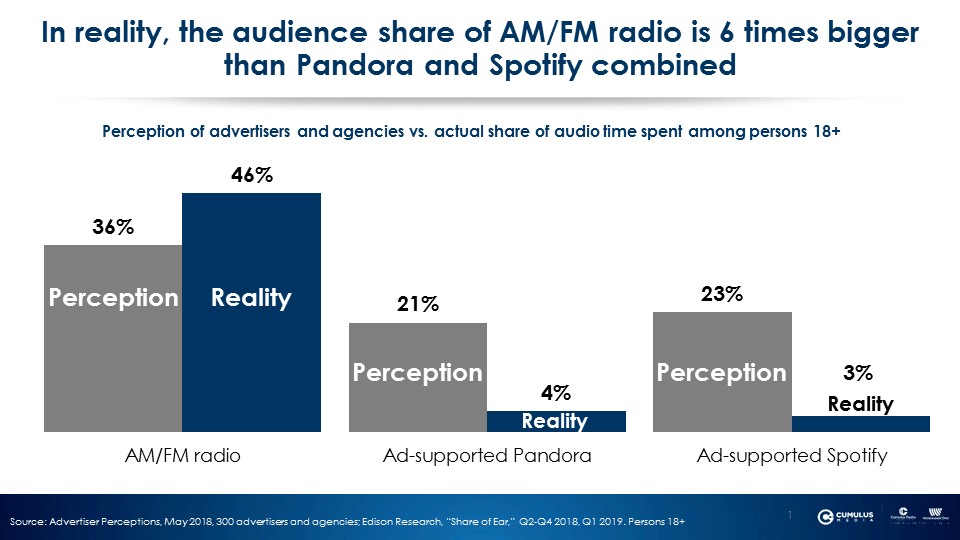

Perception doesn’t match reality: The audience share of AM/FM radio is 6 times bigger than ad-supported Pandora and Spotify combined

According to an Advertiser Perceptions study of strategists, media buyers, and planners, the perception of Spotify and Pandora’s combined audience share is larger than AM/FM radio.

“Share of Ear” data proves that advertisers are not taking the “me” out of media. According to Edison Research, AM/FM radio has a 46% share of audio time spent, 6 times bigger than ad-supported Pandora and ad-supported Spotify combined.

Mark Ritson, Marketing Professor, describes this phenomenon: “There is increasing global evidence that marketers are basing their media choices on their own behavior or that stoked by the digitally obsessed marketing media, rather than actual audience data.” Perception is shaded by personal experience and for marketers and agencies, creates a major disconnect with reality.

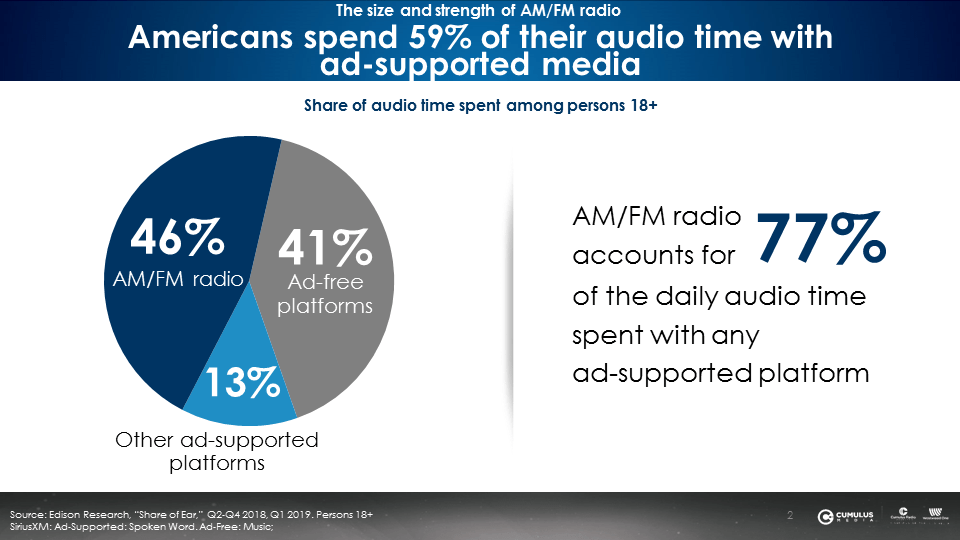

AM/FM radio accounts for 77% of audio time spent with any ad-supported platform

On its own, AM/FM radio accounts for 77% of daily audio time spent with any ad-supported audio platform. AM/FM radio’s share of total audio time spent is 46%. AM/FM radio is not only the centerpiece of audio – it also dominates as the king of ad-supported audio.

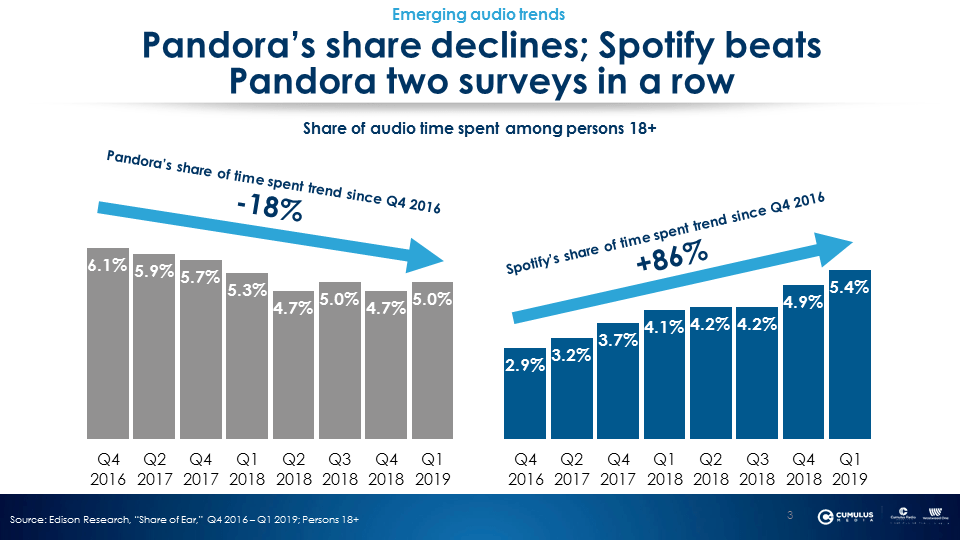

For the second quarter in a row, Spotify beats Pandora in share of audio time spent

Following in the footsteps of Q4 2018’s “Share of Ear,” Spotify (5.4%) was able to edge out Pandora (5.0%) in share of audio time spent among adults 18+ for the second time, a result of Spotify’s consistent growth over the years, increased consumer desire for on-demand content, and Pandora’s ongoing decline.

Spotify’s growth is powered by its ad-free subscription service. Since the Q4 2016 “Share of Ear” report, Spotify’s ad-free subscription share has grown +47%, from 1.7% in Q4 2016 to 2.5% in Q1 2019.

For Spotify, this is a double-edged sword. On one end, more consumers are buying their ad-free subscription option. On the other, Spotify’s advertisers are reaching less and less listeners, and the ones they do reach are hit continuously with the same ad.

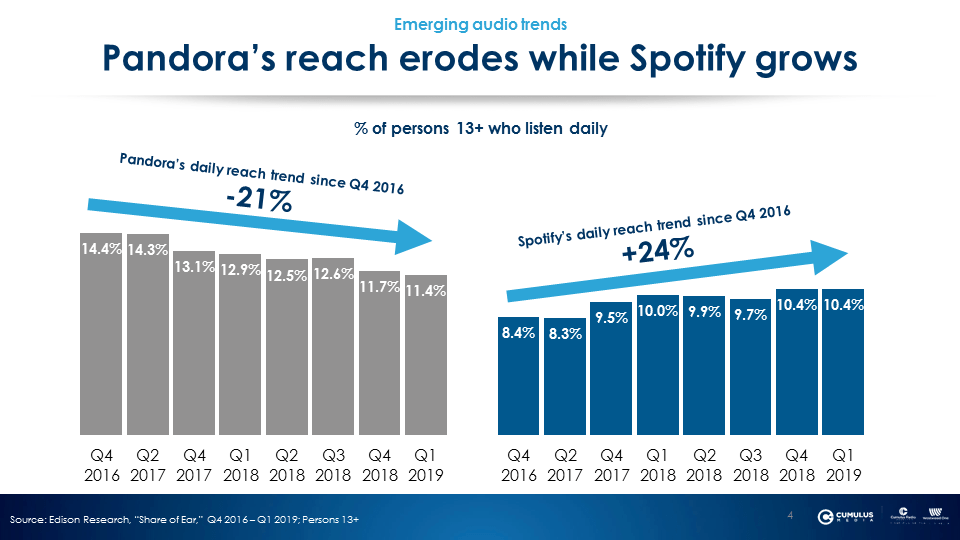

Pandora’s audience continues to freefall

Since Q4 2016, Pandora’s share of audio time spent and reach have taken a nosedive. Pandora’s time spent share fell from 6.1% in Q4 2016 to 5% in Q1 2019, an -18% decline.

Pandora’s daily reach decreased from 14.4% in Q4 2016 to 11.4% in Q1 2019, a -21% decline.

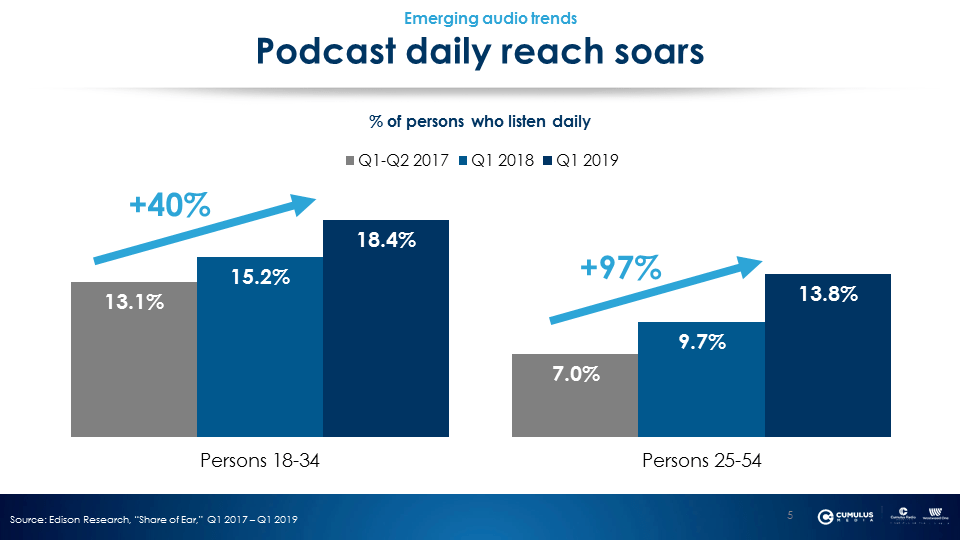

Podcast daily audiences are surging

Podcasts continue to experience a renaissance. New content, innovative audio devices, and spikes in audience interest are all playing a role in podcasting growth. Ad dollars follow the audience. This week, the IAB announced that in 2018, podcast ad revenues soared 53%.

“Share of Ear” reveals the daily reach for podcasts has grown dramatically among major buying demos over the past two years. Millennials 18-34 daily reach grew +40% from Q1-Q2 2017 to Q1 2019 (13.1% to 18.4%). Adults 25-54 podcast daily reach is up +97% since Q1-Q2 2017, from 7% to 13.8% in Q1 2019. Podcasting is a promising audio platform on the rise for both advertisers and media companies.

Barton Crocket, FBR Capital Markets Analyst, has said, “Mainstream America is still in love with AM/FM radio.” According to “Share of Ear,” that remains true. While Pandora sees consistent declines in audience and Spotify’s growth comes from the ad-free service, AM/FM radio dominates in share of audio time spent among all ad-supported platforms. With podcasting also on the rise, the future of audio remains bright for advertisers.

Key takeaways:

- Perception doesn’t match reality: The audience share of AM/FM radio is 6 times bigger than ad-supported Pandora and Spotify combined

- AM/FM radio accounts for 77% of audio time spent with any ad-supported platform

- For the second quarter in a row, Spotify beats Pandora in share of audio time spent

- Pandora’s audience continues to freefall

- Podcast daily audiences are surging

Lauren Vetrano is Director of Content Marketing at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.