The Wear-Out Myth And AM/FM Radio

Big brands are rediscovering AM/FM radio. A look at 2018 AM/FM radio spend finds well-known brands are significantly increasing their network radio commitments – P&G, Lowe’s, Amazon, CVS, Capital One, and AbbVie, just to name a few. Brands come to AM/FM radio for the reach, to avoid digital fraud, and to supplement television audiences.

One of the first questions big brands ask when they begin using AM/FM radio is, “What about wear-out?”

Wear-out is a TV thing

When you spend big in TV and run lots of GRPs, you wonder about wear-out. When you cut back on creative assets to generate more “working media,” you wonder about wear-out.

The trusted source for agency account planners is the book How Not To Plan: 66 Ways To Screw It Up. In it, authors and marketing effectiveness gurus Les Binet and Sarah Carter explain:

“Most ads don’t get much chance to wear out nowadays. Most TV ads are only seen a handful of times. Prompted ad awareness scores are typically well under 40%. And even when TV weights were higher, there was little evidence of good campaigns wearing out. A major manufacturer once reviewed thousands of econometric analyses and concluded that there was no evidence of wear-out in any of their campaigns they’d run anywhere in the world. Our own econometrics tell the same story.”

How many GRPs can you run?

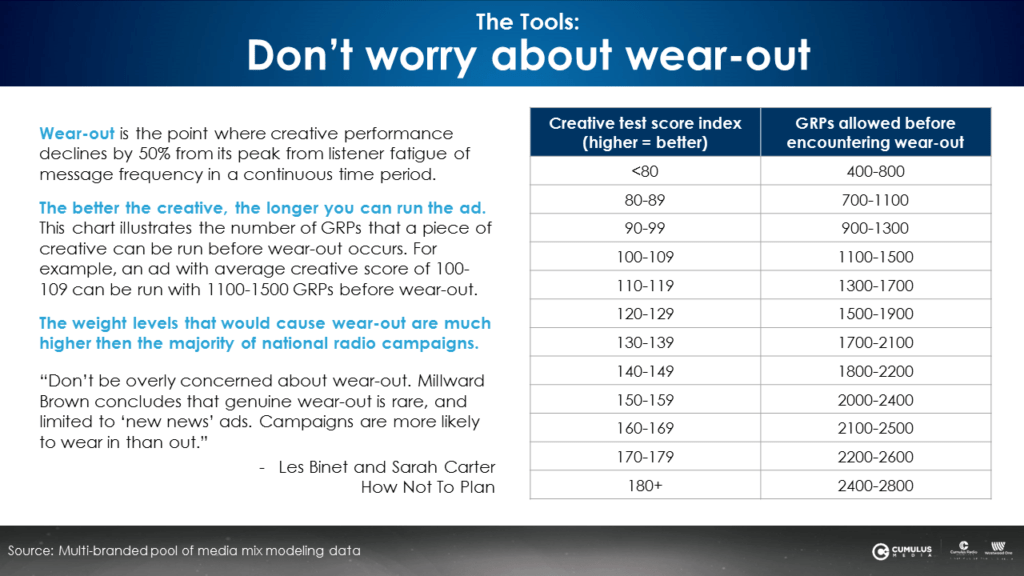

Wear-out is defined as the point where creative testing declines 50% from its peak due to message frequency fatigue. Years of creative testing and analysis reveal the better the creative, the longer you can run an ad.

The chart below from TV reveals the number of GRPs that can run before creative fatigue occurs. An ad with a creative score of 20% below the norm can be run for about 1000 GRPs. An ad with creative scores 50% higher than the norm can be run for 2000-2400 GRPs.

Compared to TV, AM/FM radio campaigns have tiny weights

Using the weights from above, a 1000 GRP network radio campaign would cost about $5M. A 2400 GRP network radio campaign represents a $12M investment.

How many network radio campaigns are spending $10M on the same creative? Not many. The reality is that weight levels in network radio are shockingly small.

TV weight levels are much bigger than network radio campaigns. There are many things to be anxious about with advertising, but AM/FM radio ad wear-out is not one of them.

Do podcast ads experience wear-out?

According to Edison, 10% of Americans listen to a podcast daily. In a typical month, 32% listen to podcasts. Only one in ten Americans have a daily podcast habit. 69% of monthly podcast listeners do not yet have a daily podcast habit. For many Americans, podcast ad exposure is occurring far less often than with AM/FM radio and TV.

There are other reasons why podcasts don’t experience wear-out:

- Not all podcasts have daily episodes. The number of episodes per podcast per week varies. Even diehard fans of a podcast are generally not getting five episodes a week.

- Host-read ads are always fresh and integrated. Most podcast ads are read by the host so the creative changes all the time. Podcast ads are woven into the fabric of the show, not nearly as interruptive as a pre-recorded ad.

- Typical podcast ads run twice a month. Most podcast advertisers buy one ad every other week. Why? An agency told us, “The ads work so well, we sell so much product, we don’t have to run as often.”

- Podcasts have very few ads. Podcasts have about 4 ads an hour. Ads perform better in a low commercial environment. Studies by Turner Network on ads that run on low ad unit networks show stronger awareness and greater return on advertising spend.

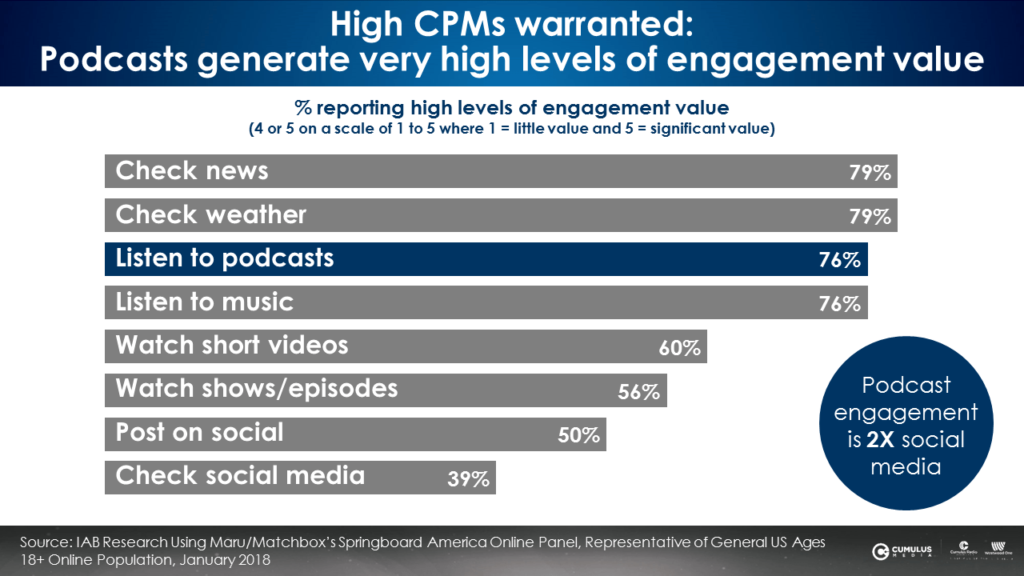

- Podcast content is so valued, ads benefit. Quality of content and content engagement drives ad engagement. When asked to rate the value of media content, podcasts are some of the most valued, per an IAB MARU study. Ads perform better in content that people value.

Pandora and Spotify can burn out ads really fast

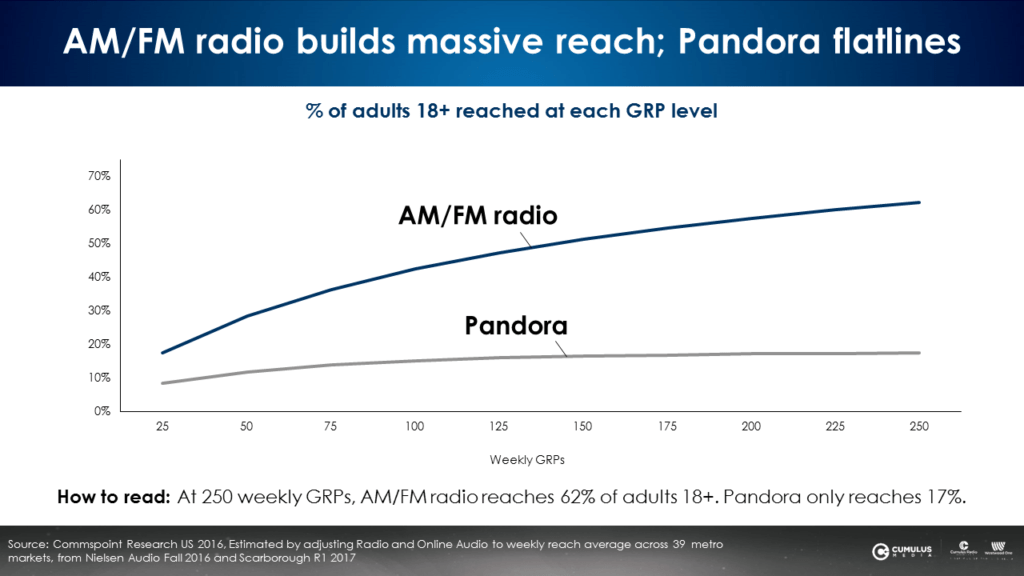

According to Nielsen’s Commspoint media planning platform, when you add media weight to online audio services like Pandora, the reach curve increases at first but quickly flatlines. As Pandora spending increases, reach does not budge.

As you add media weight to AM/FM radio, reach keeps growing and growing. AM/FM radio is America’s number one mass reach media and, according to 500+ Nielsen ROI studies, reach is the number one media factor that drives sales.

Pandora and Spotify have a reach problem

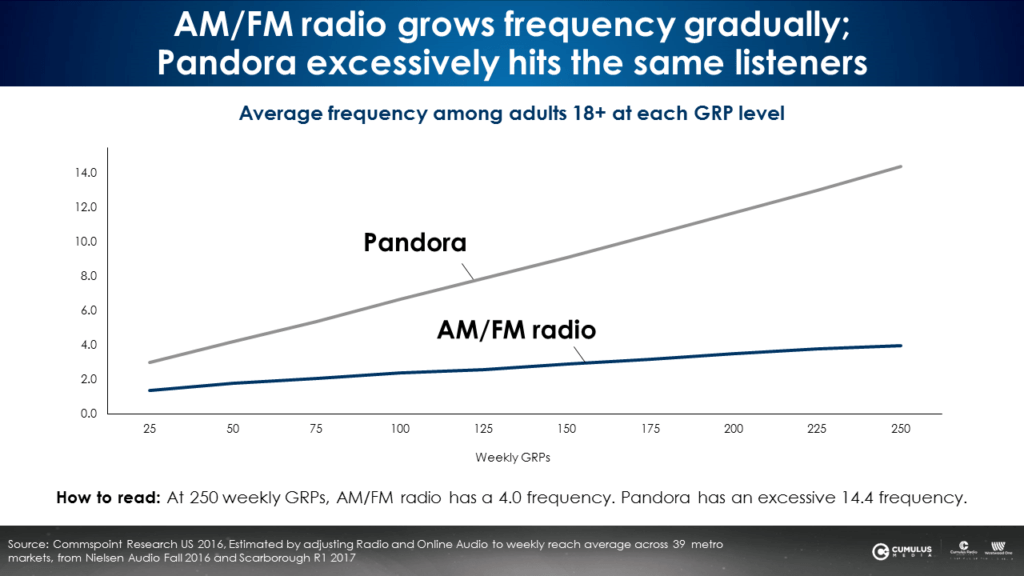

The majority of Pandora and Spotify listening comes from a very small number of people. According to Edison Research’s “Share of Ear” study, 4% of Americans represent 72% of Pandora listening. 4% of Americans represent 76% of Spotify listening. Spend a little money on Spotify and Pandora, you quickly run out of new people to reach.

Pandora and Spotify sell on impressions. They don’t reveal campaign reach (the number of different people exposed to an ad campaign) or campaign frequency (the number of times people hear the ads).

As spending increases on Pandora, frequency skyrockets. People hear the same ad repeatedly. No wonder listeners take to social media to complain about hearing the same ads over and over.

As you add media weight to AM/FM radio, frequency grows very gently. Expanded investment on AM/FM radio results in greater reach, not excessive frequency.

Consistent and familiar package design helps consumers buy – why not ad creative?

Binet and Carter urge agencies to take a lesson from product package design. “There, owned associations are managed in a rigorous way. Change is less frequent. When it does occur, it’s evolutionary. Disruptive change is rare.”

Binet and Carter’s significant sales lift and ROI research finds, “Marketing works best when it goes with the grain of existing memory structures. Behavioural economics shows, all else being equal, people prefer, and choose, the familiar. Familiarity and consistency boost effectiveness.”

The wear-out myth is costly

Binet and Carter indicate unnecessary concern over wear-out leads to over-spending on ad production, research, and agency fees. They advise, “Don’t be overly concerned about wear-out. Millward Brown concludes that genuine wear-out is rare, and limited to ‘new news’ ads. Campaigns are more likely to wear in than out.”

Key takeaways:

- AM/FM radio campaign weight levels are nowhere near wear-out thresholds

- Podcast ad wear-out is a non-issue due to light overall usage and the powerful performance of host-read ads integrated into the program

- As weight is added to AM/FM radio, reach, the number one media factor that drives sales, grows strongly, while frequency increases slightly

- The tiny reach of Pandora and Spotify means excessive frequency happens quickly

- Consumers mostly buy on autopilot, guided by associations that form over many years

- Concern over AM/FM radio and podcast ad wear-out is unnecessary

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.