Share Of Ear Q3 2018 Trends: Advertiser Misconceptions, Spotify’s Ad-Supported Stall, AM/FM Radio Stability, And Smart Speaker Growth

Edison Research, the leaders in studying American audio use, just published their Q3 2018 Share of Ear report. The quarterly tracking study provides an in-depth view into U.S. audio usage.

The most recent edition demonstrates the large gap between advertiser perception and reality of audio time spent, as well as how AM/FM radio stacks up against streaming services. Here are the key trends from this quarter’s study.

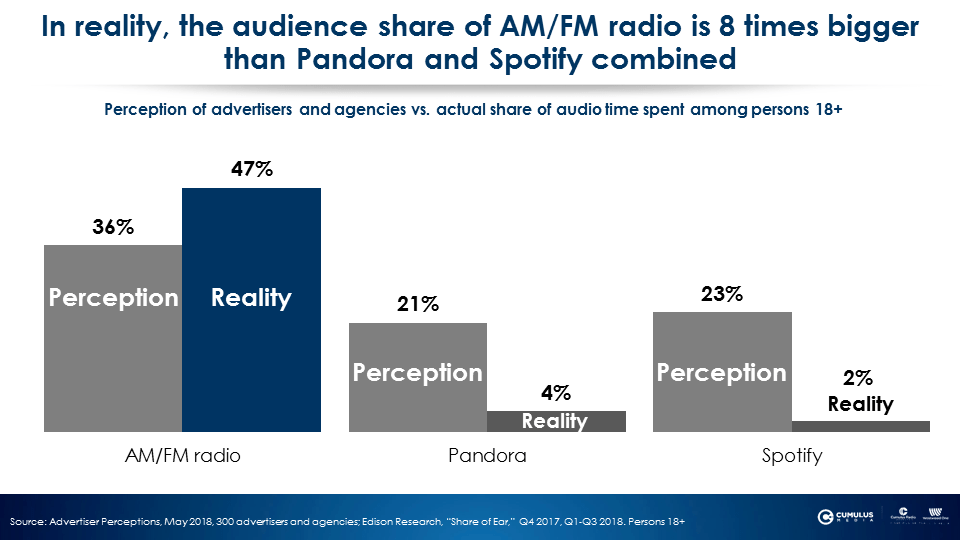

1. Advertisers and agencies incorrectly perceive the audience size of Pandora and Spotify. Studies reveal that media planners, buyers, and brands do not always know how Americans spend their media time. One reason is that media decision makers have very different media habits than the average American as they often live in major metropolitan cities. As a result, media planners and their clients incorrectly project their media habits to all consumers, and underestimate time spent with mass reach platforms like television and AM/FM radio, while they overestimate time spent with small digital players.

In May 2018, Advertiser Perceptions, the “Nielsen of advertiser sentiment,” conducted a study of 300 brands and media agencies. A simple question was asked: “Please estimate the audience share of Pandora, Spotify, and AM/FM radio.” The perceptions? Spotify has a 23% share, Pandora has a 21% share, and AM/FM radio has a 36% share.

The truth according to Q3 2018 “Share of Ear”? AM/FM radio has a 47% share, ad-supported Pandora has a 4% share, and Spotify ad-supported streams have a 2% share. AM/FM radio is 11X bigger than Pandora and 24X larger than Spotify.

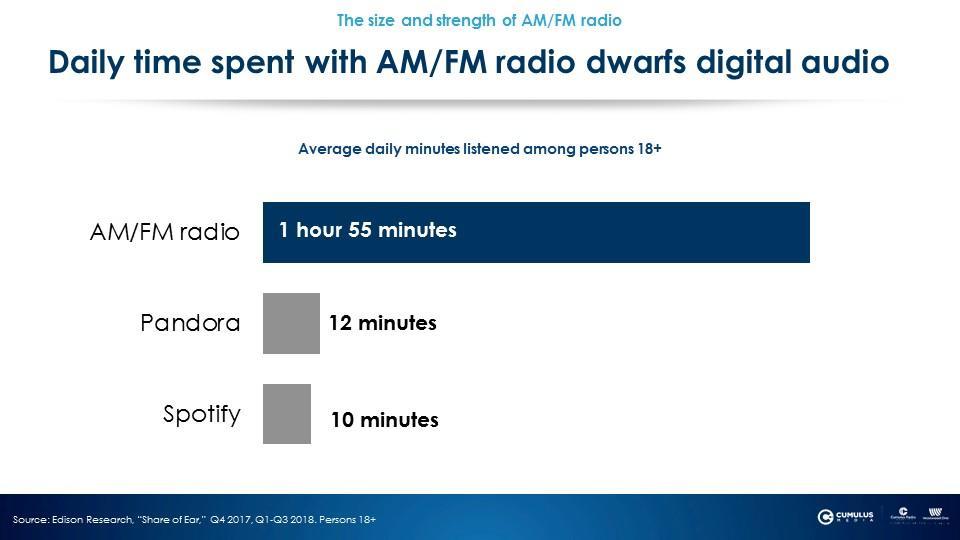

2. Americans spend substantially more time daily with AM/FM radio than Spotify and Pandora. While agencies and advertisers are completely misinformed about the strength of AM/FM radio, Spotify’s CEO is not. On a recent Spotify earnings call Daniel Ek observed, “When you look at the landscape overall, and you think about something like radio, the truth is that the vast majority of the minutes that that are being spent on radio today haven’t yet moved online.”

AM/FM radio remains dominant with nearly two hours of daily time spent among persons 18+. Pandora’s daily time spent is 12 minutes while Spotify is slightly less at 10 minutes daily.

Listening to music at home used to mean albums and CDs. Today, that has shifted to Spotify and Pandora. Now listening to music at home means audio streaming is playing softly in the other room. According to a MARU/VisionCritical study, only 54% of Pandora and Spotify listeners actually pay attention to the ads. Background music like this was never meant for advertising.

Advertising works best in the foreground context of AM/FM radio, where news and entertaining personalities keep listeners engaged and paying attention. Listeners are also hearing the ads. On average, 84% of the AM/FM radio audience hears the ads when they listen to AM/FM radio at home, at work, or traveling in the car, according to MARU/VisionCritical.

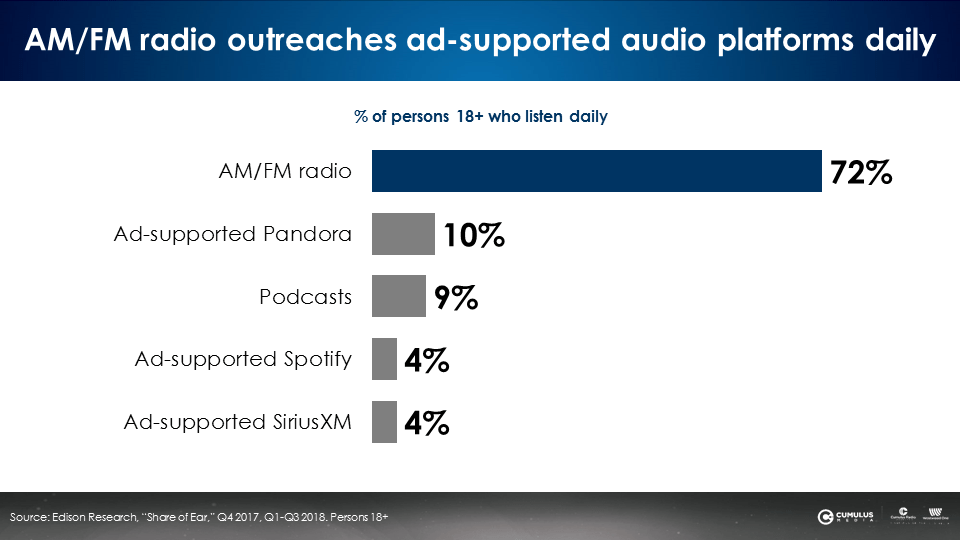

3. AM/FM radio outreaches all other ad-supported platforms. According to a Nielsen analysis of 500 ROI studies, the media factor most responsible for sales lift is reach. In fact, reach trumps targeting 2.5 to one in sales lift. When it comes to reach, AM/FM radio dominates all other audio platforms. AM/FM radio’s daily reach is 7X ad-supported Pandora and 18X ad-supported Spotify and ad-supported SiriusXM.

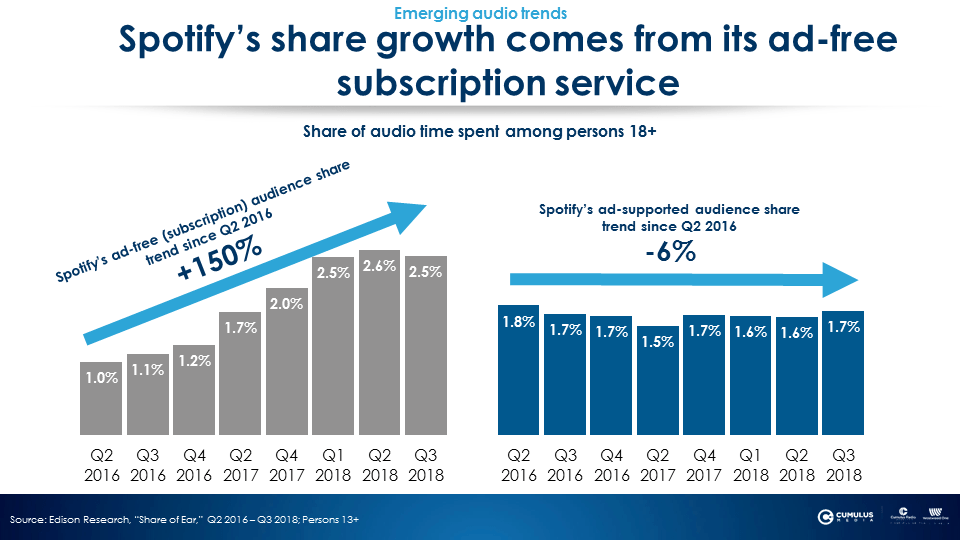

4. Spotify’s ad-supported audience has not grown in over two years: all of Spotify’s growth comes from their commercial-free subscription service. Spotify’s audience growth over the last three years has been completely driven by its ad-free subscription service. The growth of subscription streaming services comes at the expense of the time consumers used to spend with music they purchased.

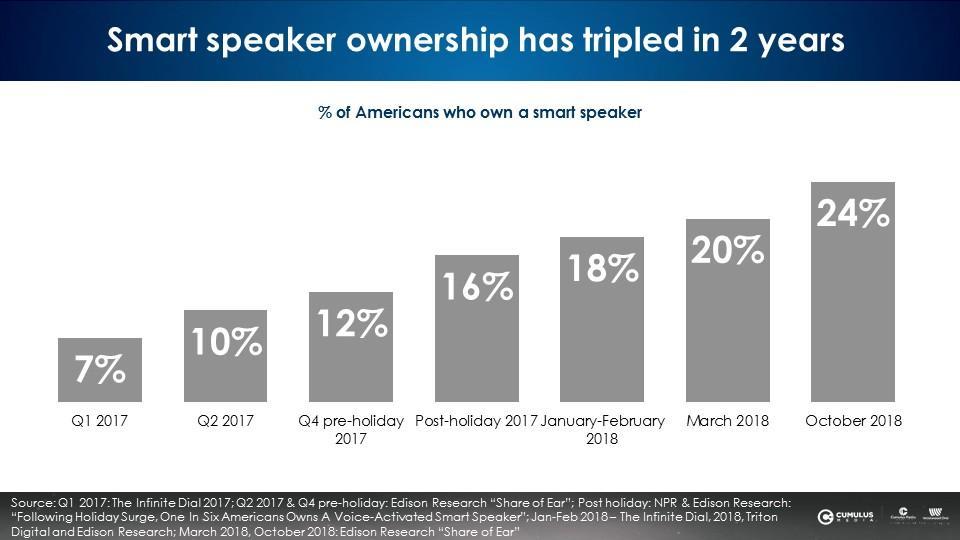

5. Smart speaker ownership soars to 24% of all Americans in October 2018. Edison has been tracking smart speaker adoption since the beginning. It was 7% in January of 2017 and has tripled to 24% in October 2018. No doubt smart speaker ownership and adoption will grow further this holiday season. There is the potential to see smart speaker ownership in the high 20% range post-holiday.

There are many audio options available to Americans today. With AM/FM radio as strong as ever, Spotify’s ad-supported stall in share, and smart speaker ownership on the rise, Edison Research’s “Share of Ear” gives advertisers and agencies a real look at how consumers are spending their time with audio platforms.

Key takeaways:

- Advertisers and agencies incorrectly perceive the audience size of Pandora and Spotify as much larger than they are.

- Americans spend substantially more time daily with AM/FM radio than Spotify and Pandora.

- AM/FM radio outreaches all other ad-supported platforms.

- Spotify’s ad-supported audience has not grown in over two years. All of Spotify’s growth comes from their commercial-free subscription service.

- Smart speaker ownership soars to 24% of all Americans in October 2018.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.