What Are Podcast Spending Intentions Among Marketers And Agencies?

Welcome to podcast advertising’s biggest week. Now in its fourth year, the IAB (Interactive Advertising Bureau) Podcast Upfront 2018 presentations for advertisers and agencies will take place Thursday in New York. It will be the most attended upfront presentation ever with an attendee list swelling to nearly three times that of last year.

This past June, the IAB and PwC (PricewaterhouseCoopers) released their blockbuster Podcast Revenue Study for the second year. Here are a few highlights:

- Podcast advertising surged 86% from 2016 ($169M) to 2017 ($314M)

- From Q4 2016 to Q4 2017, the podcast advertising quarterly compound growth rate was 94%

- IAB/PwC forecasts podcast advertising will be $659M by 2020

To further understand the space, Westwood One commissioned Advertiser Perceptions to conduct our fourth annual study of brand and agency podcast spending sentiment. Here are the key findings:

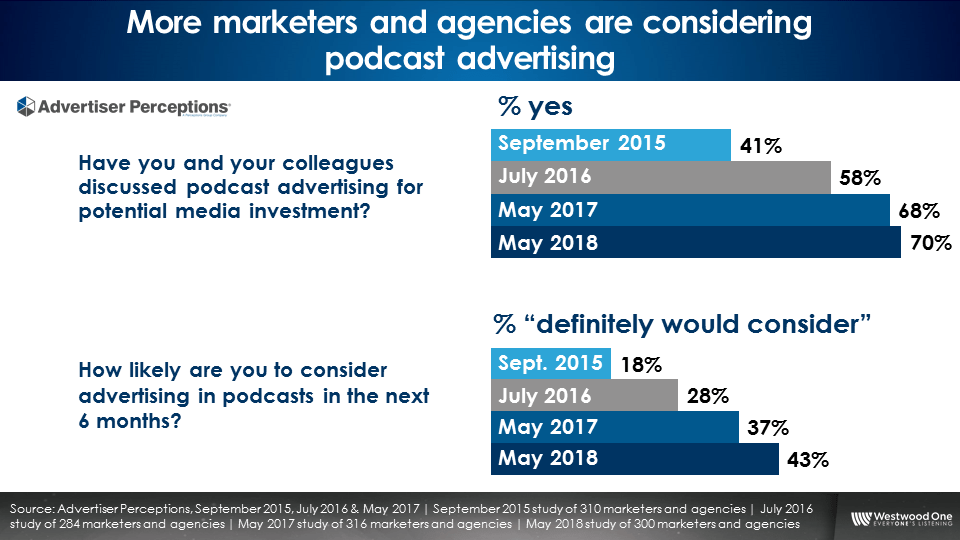

Marketer and agency discussions about podcast advertising have plateaued, but advertising consideration increases. 70% of brands and agencies have discussed the potential of investing in podcast advertising, a small increase over the prior year. Advertising consideration has more than doubled since the very first IAB Podcast Upfront in 2015 and has grown 37% to 43% from the prior year.

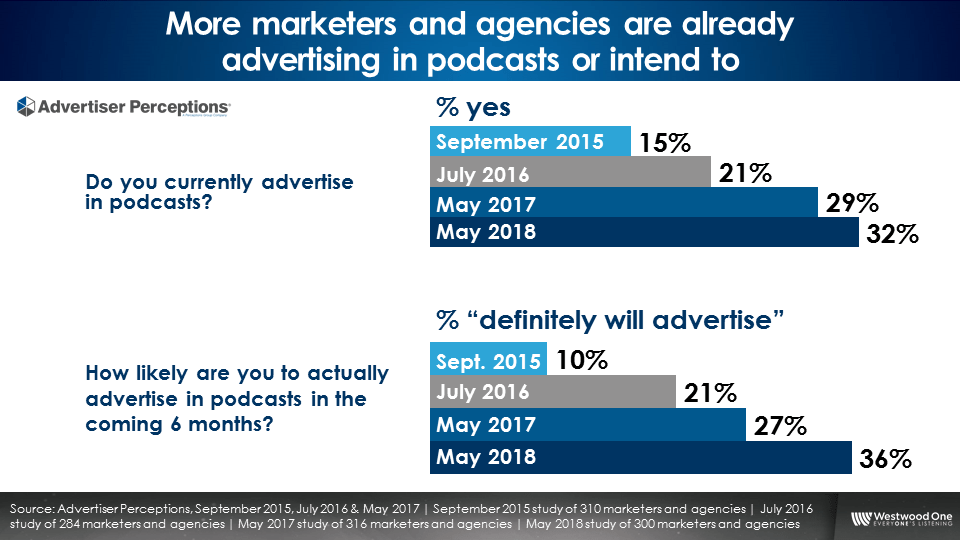

The proportion of brands and agencies who currently advertise in podcasting only grew slightly over the prior year, but spending likelihood surged. The number of brands and agencies currently using podcast advertising has doubled from 2015 to this year. Growth over the prior year (29% to 32%) was slight.

On the spending likelihood front, fervor for podcasting is exceptionally strong. Since 2015, brands and agencies saying they “definitely will advertise in the coming 6 months” has more than tripled from 10% to 36%. Compared to last year, spending intentions have grown strongly (27% to 36%). This growth is the strongest spending likelihood seen since 2016.

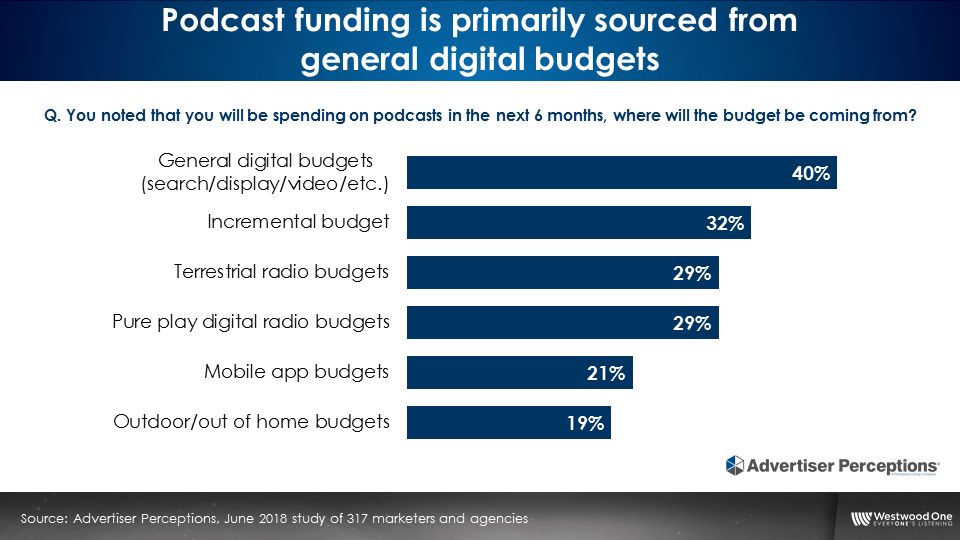

Podcast funding is primarily sourced from general digital budgets. Brands and agencies indicate podcast spend comes from general digital budgets, incremental budgets, and pure play digital audio budgets.

Should we be worried that advertiser podcast usage growth is weaker than spending intentions? It is common for new advertising platforms to experience far greater advertiser interest and spending intentions than actual spending. The IAB and PwC report indicates direct response advertiser fervor for podcast advertising is insatiable. Performance-based advertisers report podcast advertising ROI is much stronger than many traditional media platforms.

One would think the podcast euphoria among direct response advertisers would translate over to brands. Not necessarily.

Brands want to understand how advertising platforms will grow their awareness, images, and brand equity. Usually, audience measures such as reach and frequency are good surrogates for brand advertisers. The lack of podcast audience measurement from a reputable firm like Nielsen could be keeping some brand marketers on the sidelines.

However, podcast sales platforms are conducting brand lift and campaign effect studies to provide brands the confidence of impact while long term audience solutions emerge. This should attract more brands to the space.

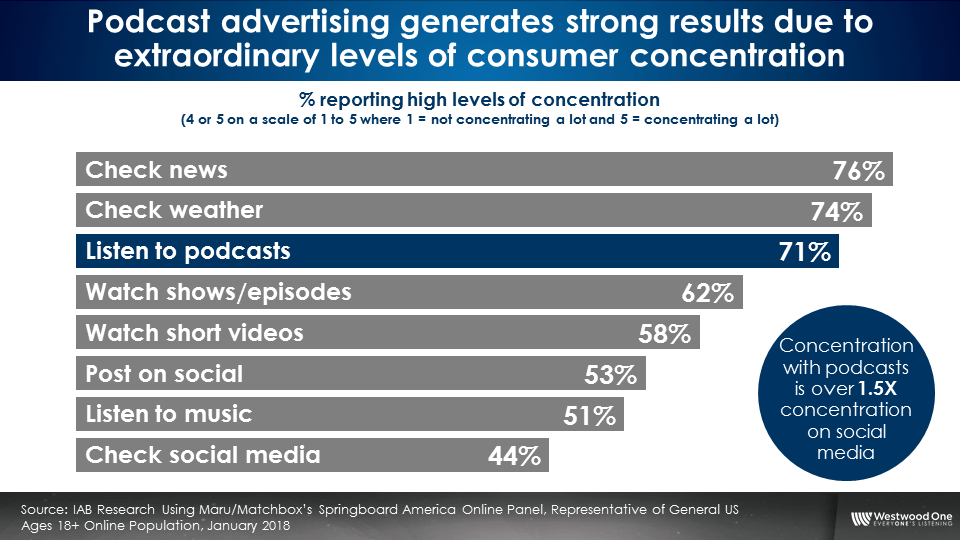

Podcast CPMs are warranted due to stunning levels of listener concentration and engagement. As advertisers consider the presentations from this week’s IAB Podcast Upfront, this one chart should convince hesitant brands to take the podcast advertising plunge. Earlier this year, IAB commissioned a study from MARU/Vision Critical to measure consumer engagement with a variety of content platforms.

The main takeaway: Consumer engagement and concentration to podcasts is amazingly strong. Podcasts have stronger engagement than all forms of video and music. Podcast ad effectiveness is 1.5X more powerful than social media.

This is a good time for marketers and agencies who are looking to try podcast advertising. With spending likelihood up and engagement with the medium at an all time high, everything’s looking positive for podcast sentiment heading into the IAB Podcast Upfront.

In summary:

- Marketer and agency discussions about podcast advertising have plateaued, but advertising consideration increases.

- The proportion of brands and agencies who currently advertise in podcasting only grew slightly over the prior year, but spending likelihood surged.

- Podcast funding is primarily sourced from general digital budgets.

- Podcast CPMs are warranted due to stunning levels of listener concentration and engagement.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.