Q3 2025 Edison “Share Of Ear”: AM/FM Radio Dominates Ad-Supported Audio While Podcast Audiences Age As Older Audiences Surge

Click here to view an 11-minute video of the key findings.

Edison Research’s quarterly “Share of Ear” study is the authoritative examination of time spent with audio in America. The study, in its eleventh year, surveys 4,000 Americans annually to measure daily reach and time spent for all forms of audio.

Here are the key findings from Edison’s Q3 2025 “Share of Ear” report:

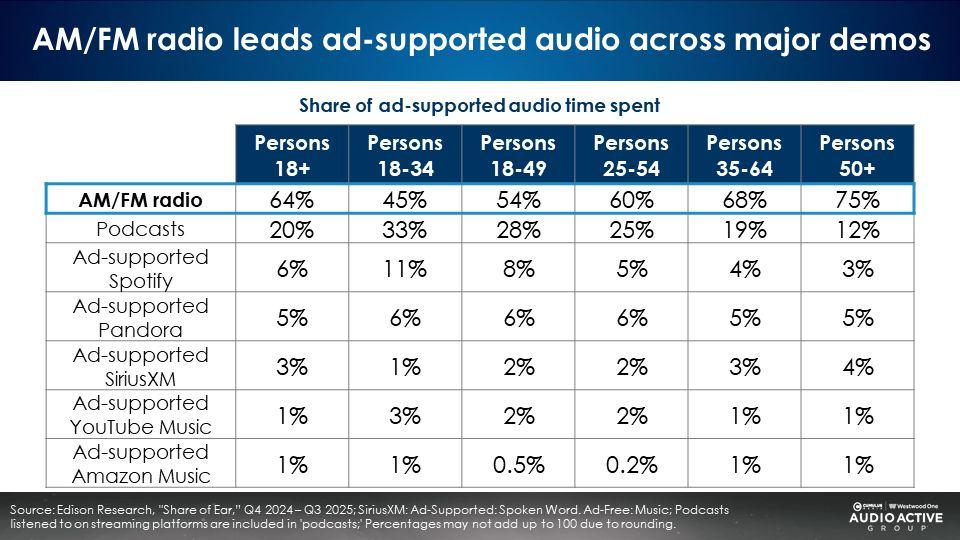

- AM/FM radio dominates ad-supported audio with a 64% share, followed by podcasts (20%).

- Ad-supported music streaming platforms have audience shares in the low to mid-single digits: Spotify (6%), Pandora (5%), YouTube Music (1%), and Amazon Music (1%).

- Marketers and media agencies significantly overestimate audience shares to Pandora/Spotify and massively underestimate AM/FM radio audiences.

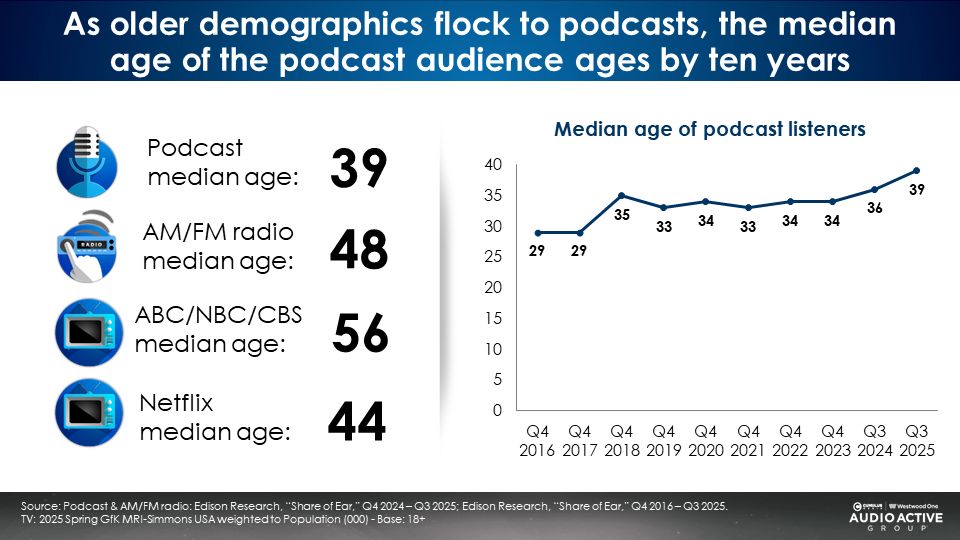

- As older demographics flock to podcasts, the median age of the podcast audience ages sharply from 29 in 2017 to 39.

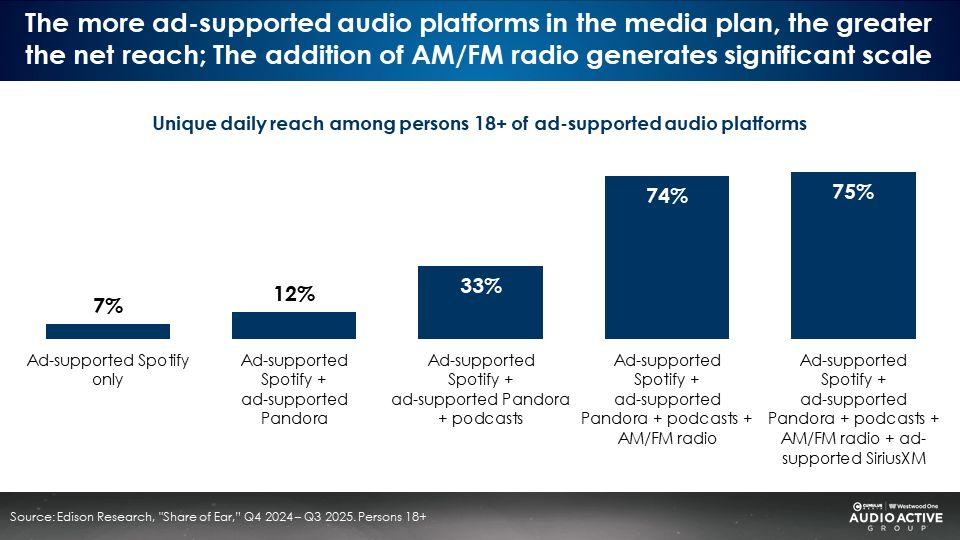

- You’ll miss two-thirds of America if your audio media plan only has digital audio; Adding AM/FM radio causes reach to surge from 33% to 74% of the U.S.

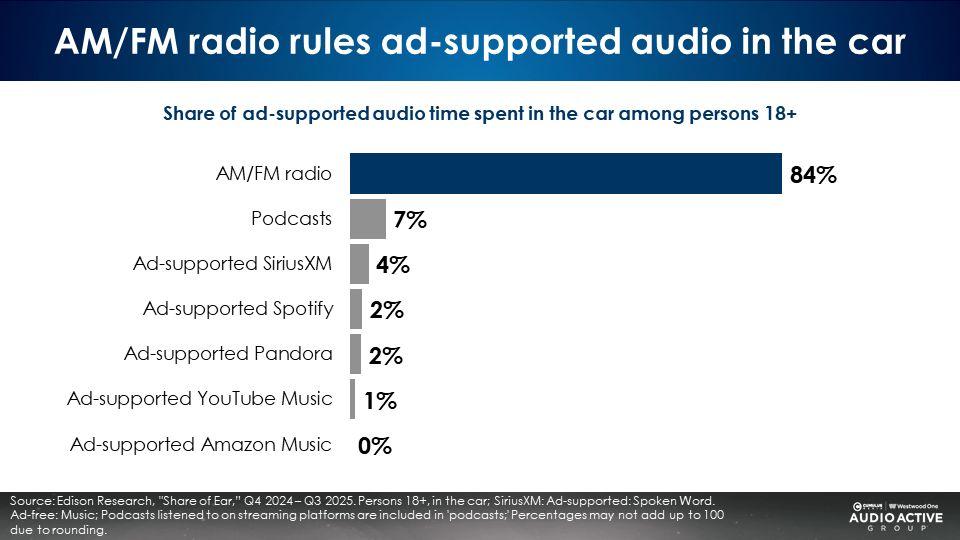

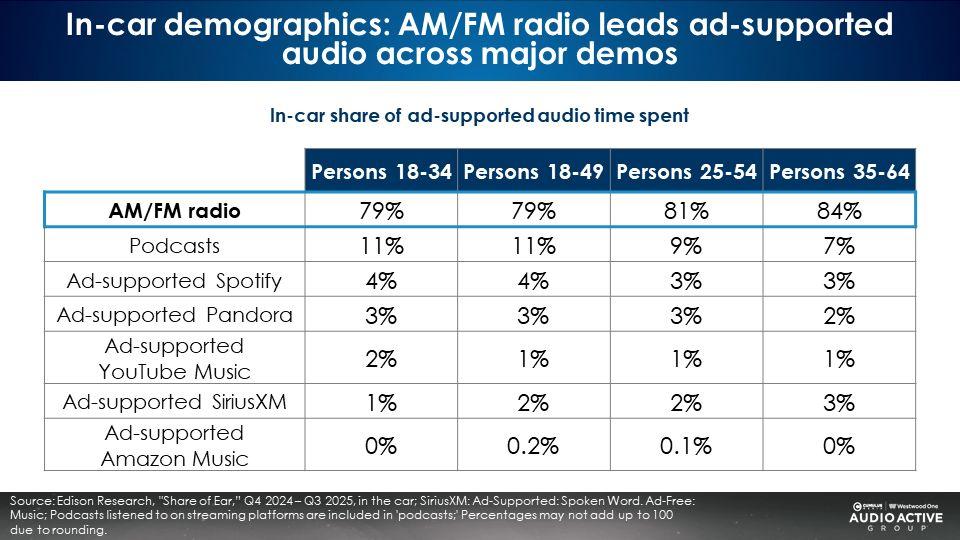

- To reach consumers on the path to purchase, look no further than AM/FM radio; With an 84% in-car share, AM/FM radio is the “queen of the road.”

AM/FM radio and podcasts dominate ad-supported audio

With a 64% share of ad-supported audio, AM/FM radio remains the dominant audio platform for marketers. At a 20% share, podcasts now have the scale and demographic mass appeal to be considered a major media solution. Streaming music services remain niche players with only a combined 13% ad-supported audio share between Spotify, Pandora, YouTube, and Amazon Music.

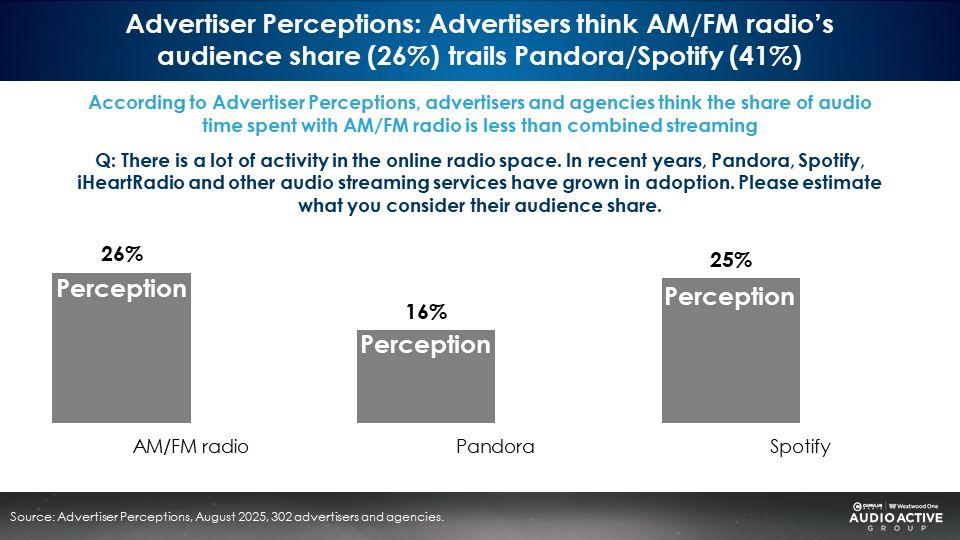

Marketers and media agencies significantly overestimate audience shares to Pandora/Spotify and massively underestimate AM/FM radio audiences

In an August 2025 study, Advertiser Perceptions asked 302 media agencies and marketers for the perceived audience shares of Spotify, Pandora, and AM/FM radio. The perceived audience shares of Pandora/Spotify (41%) are much greater than AM/FM radio (26%).

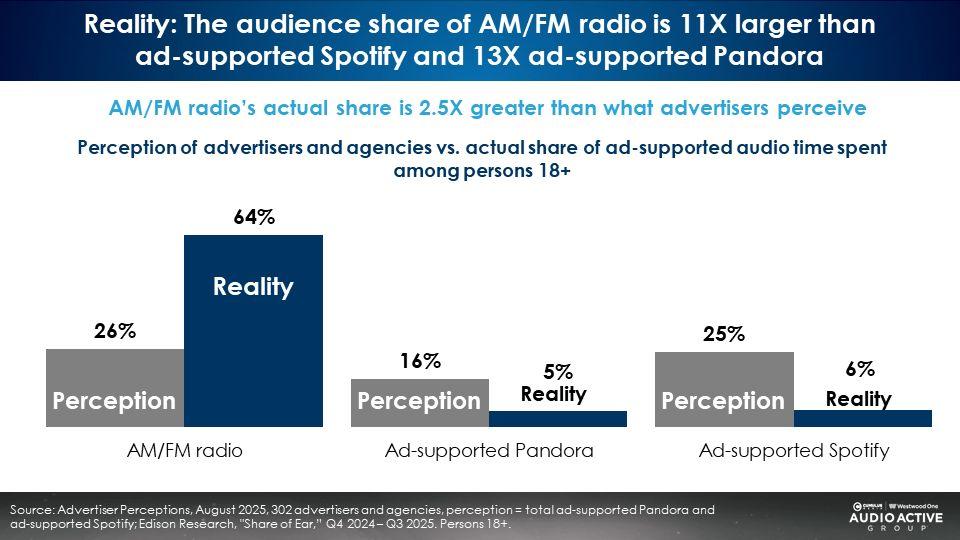

The reality? Edison’s “Share of Ear” reveals AM/FM radio shares are 2.5X greater than agency/advertiser perceptions.

What’s the Spotify/Pandora reality? AM/FM radio is 11X larger than ad-supported Spotify and 13X bigger than ad-supported Pandora.

As older demographics flock to podcasts, the median age of the podcast audience ages sharply

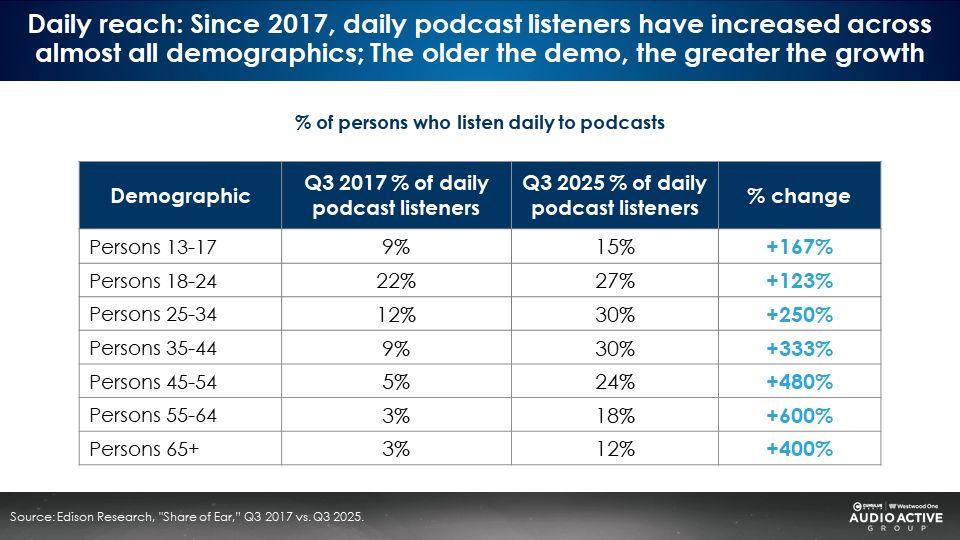

In 2017, podcasts’ daily reach was greatest among 18-24s. Eight years later, podcasts’ daily reach has surged, especially in older demographics.

The older the age group, the greater the growth in the podcast daily audience. Today, podcasts’ greatest reach centers on 25-44s, with significant growth among 45-64s.

The podcast median age soars from 29 in 2017 to 39 due to a massive influx of older listeners

The last two years have seen podcasts’ median age grow from 34 in 2023 to 39 in this recent Q3 2025 report. Still, podcasts remain one of the youngest media platforms.

You’ll miss two-thirds of America if your audio media plan only has digital audio; Adding AM/FM radio causes reach to surge from 33% to 74% of the U.S.

The net reach of Spotify, Pandora, and podcasts only reaches one-third of Americans. Adding AM/FM radio to the media plan causes reach to surge from 33% to 74%.

To reach consumers on the path to purchase, look no further than AM/FM radio; With an 84% in-car share, AM/FM radio is the “queen of the road”

AM/FM radio’s in-car shares are consistently strong among 18-34s (79%), 25-54s (81%), and 35-64s (84%).

Key findings:

- AM/FM radio dominates ad-supported audio with a 64% share, followed by podcasts (20%).

- Ad-supported music streaming platforms have audience shares in the low to mid-single digits: Spotify (6%), Pandora (5%), YouTube Music (1%), and Amazon Music (1%).

- Marketers and media agencies significantly overestimate audience shares to Pandora/Spotify and massively underestimate AM/FM radio audiences.

- As older demographics flock to podcasts, the median age of the podcast audience ages sharply from 29 in 2017 to 39.

- You’ll miss two-thirds of America if your audio media plan only has digital audio; Adding AM/FM radio causes reach to surge from 33% to 74% of the U.S.

- To reach consumers on the path to purchase, look no further than AM/FM radio; With an 84% in-car share, AM/FM radio is the “queen of the road.”

Click here to view an 11-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.