Edison’s “Share Of Ear” Q4 2022: Streaming Is Now 20% Of AM/FM Radio Listening, Podcasts Have Surged, And AM/FM Radio Dominates Ad-Supported Time Spent

Click here to view an 11-minute video of the key findings.

Edison Research’s quarterly “Share of Ear” study is the authoritative examination of time spent with audio in America. Edison Research surveys 4,000 Americans to measure daily reach and time spent for all forms of audio.

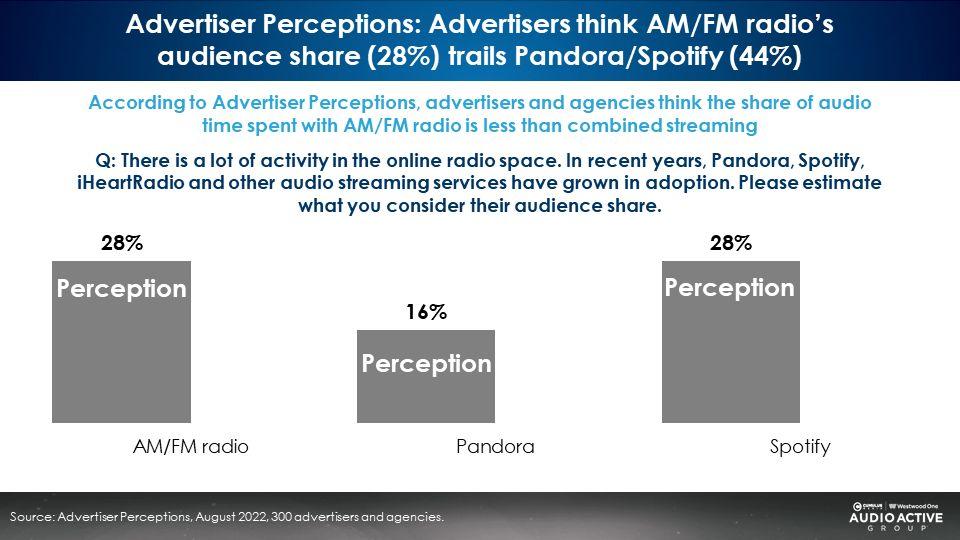

Perception vs. reality: Agencies and advertisers underestimate AM/FM radio shares and overestimate Pandora and Spotify audiences

The just released Q4 2022 report reveals a yawning gap in agency/marketer perceptions of audio audiences. A study of 300 media agencies and marketers conducted in August 2022 by Advertiser Perceptions, the gold standard measurement firm of advertiser sentiment, found the perceived combined share of Pandora/Spotify is 44%, much greater than the perceived share of AM/FM radio (28%).

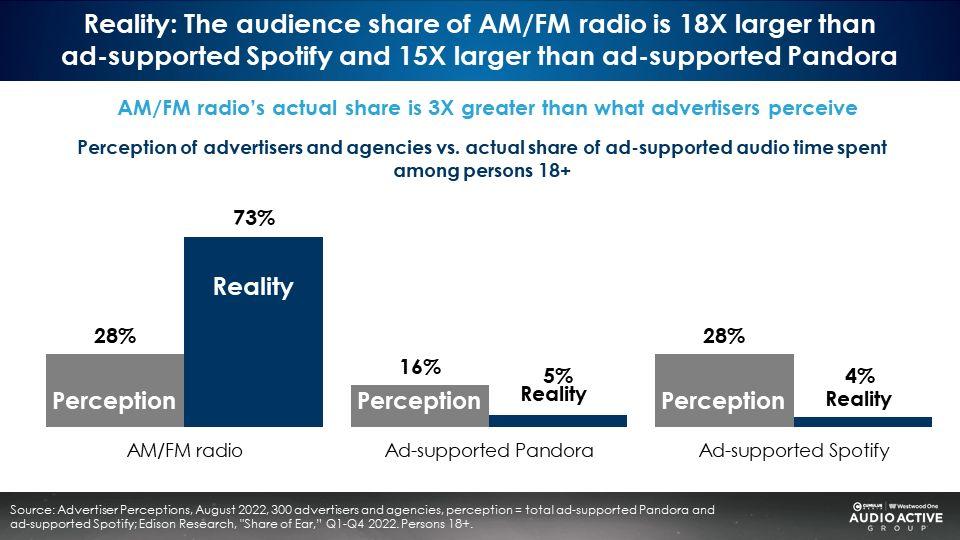

AM/FM radio’s actual share (73%) is three times larger than what advertisers perceive (28%).

Agencies and advertisers vastly overestimate Pandora and Spotify shares. According to the Q4 2022 “Share of Ear,” AM/FM radio’s persons 18+ share of ad-supported audio (73%) is 15 times larger than Pandora (5%) and 18 times greater than Spotify (4%).

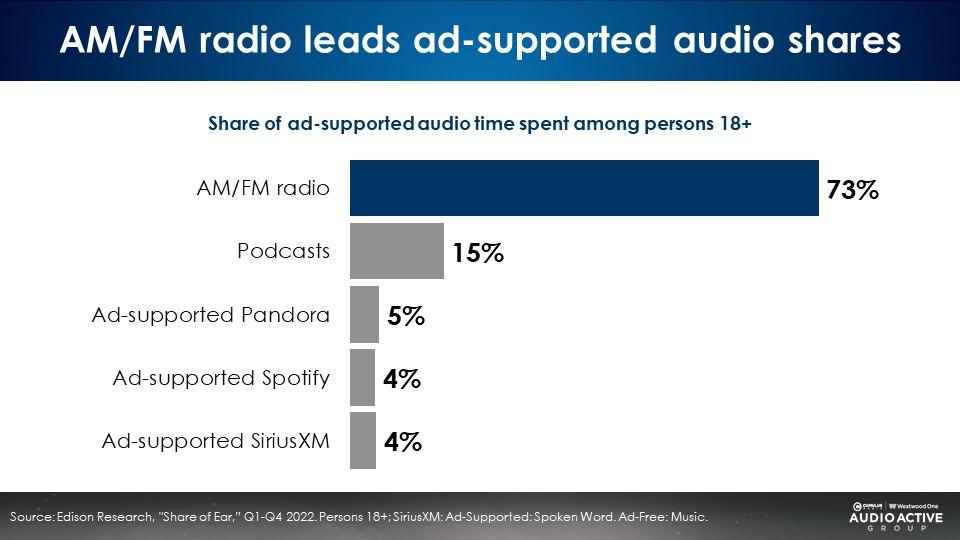

AM/FM radio dominates ad-supported audio share of time spent

AM/FM radio is the leader of ad-supported audio with a 73% share of ad-supported audio time spent among persons 18+. Podcasts take the second-place spot with a 15% share. Ad-supported Pandora, Spotify, and SiriusXM lag behind with mid-single digital shares.

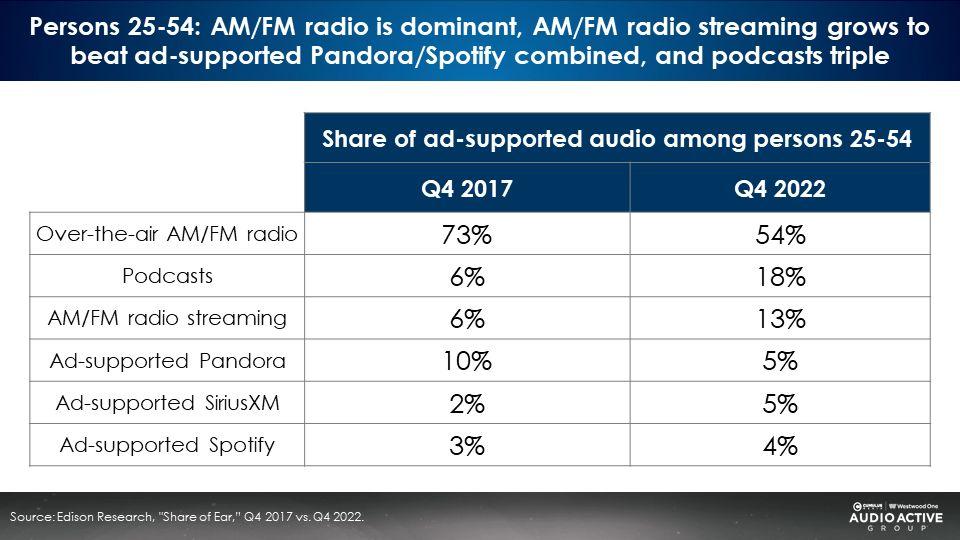

2022 versus 2017: AM/FM radio is dominant, AM/FM radio streaming grows to beat ad-supported Pandora/Spotify combined, and podcasts triple

Looking back over the last five years, among persons 25-54, AM/FM radio streaming (13%) has grown to beat ad-supported Pandora/Spotify combined (9%). Podcasts have tripled from 6% to 18%. Pandora is down significantly (10% to 5%). Spotify is small and up slightly (3% to 4%).

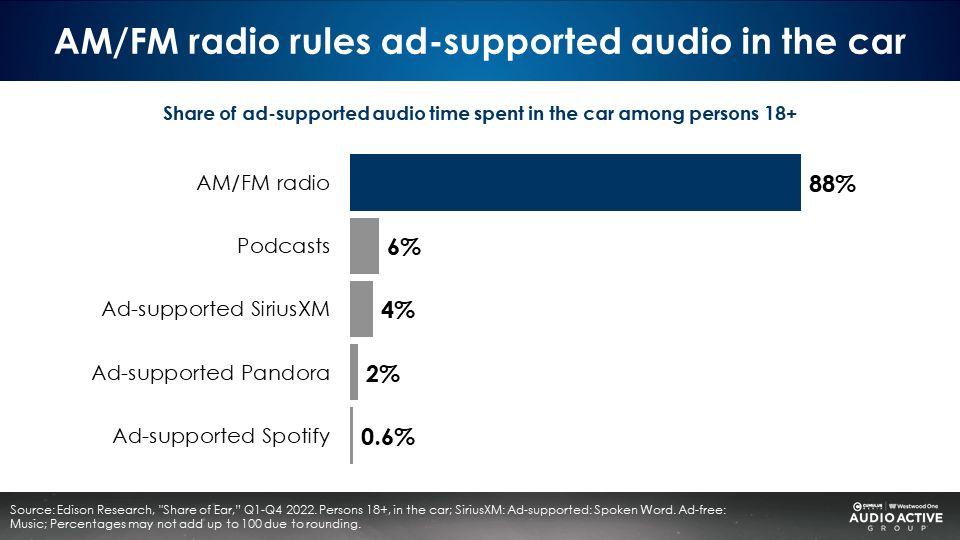

AM/FM radio dominates listening in the car with an 88% share of ad-supported audio

Out of all ad-supported audio in the car, AM/FM radio has an 88% share. Over the last four years, AM/FM radio’s share of ad-supported audio in the car has been steady at an 88% share.

Podcasts have a 6% share of time spent listening in the car. Ad-supported Spotify represents less than a 1% share of ad-supported audio time spent.

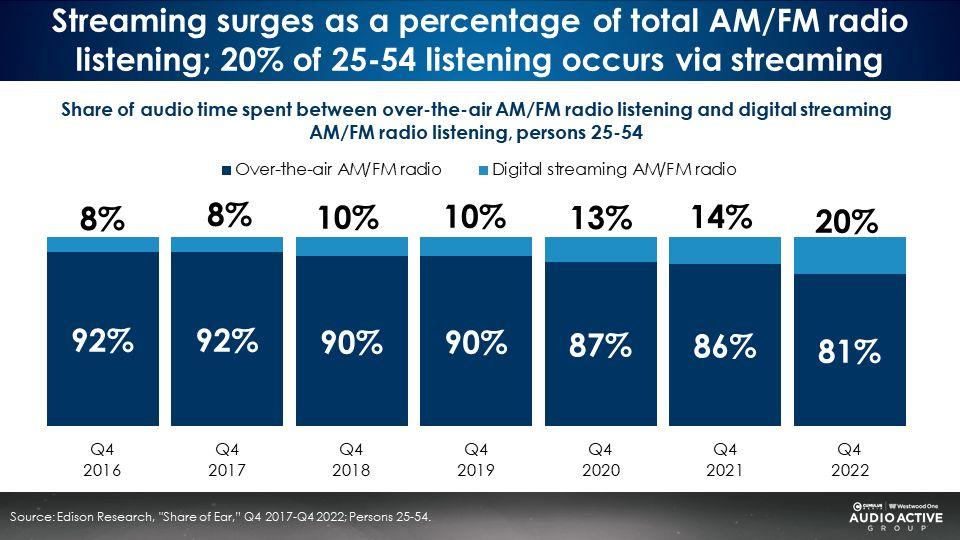

Streaming soars to 20% of all 25-54 AM/FM radio listening

From 2016 to 2019, streaming grew slightly to represent 10% of all AM/FM radio listening. Over the last three years, streaming has surged to represent 20% of 25-54 AM/FM radio time spent.

This growth is really a “tale of two cities,” men versus women.

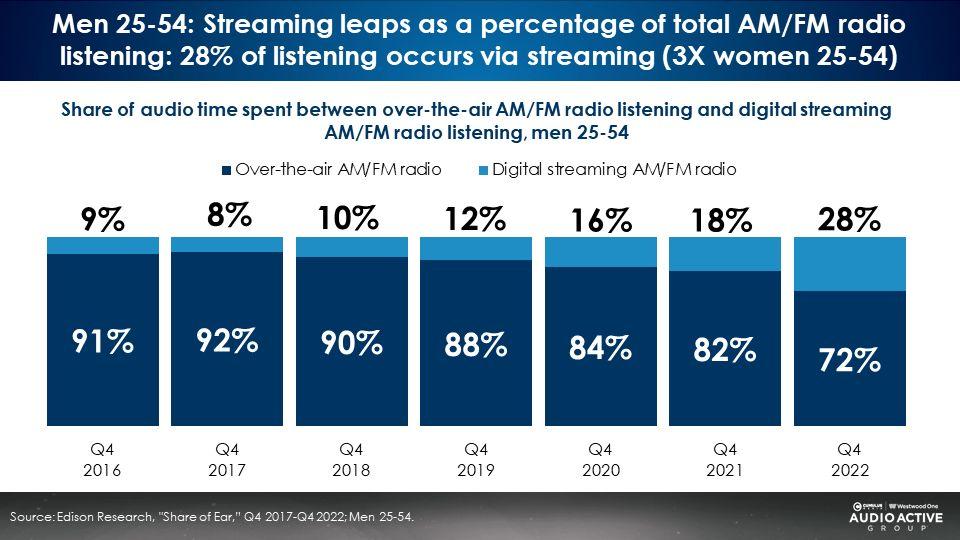

A whopping 28% of men 25-54 AM/FM radio listening occurs via the stream, nearly three times the proportion of women 25-54

Men 25-54 are driving all of the growth in AM/FM radio streaming. Since 2019, the share of men 25-54 AM/FM radio time spent going to the stream has jumped from 12% to 28%.

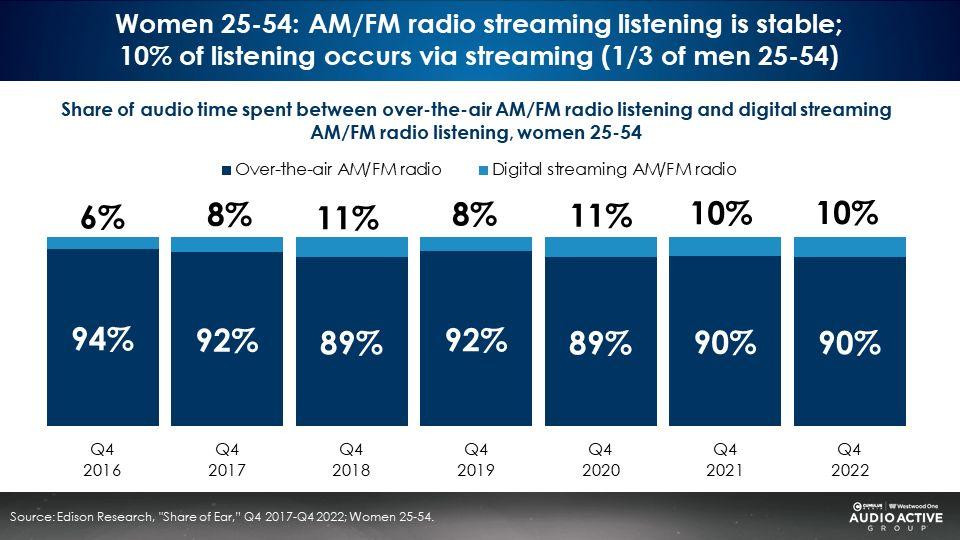

Comparatively, women 25-54 only spend 10% of total AM/FM radio listening time with AM/FM radio streaming. This number has remained stable, hovering around 10% for the past few years.

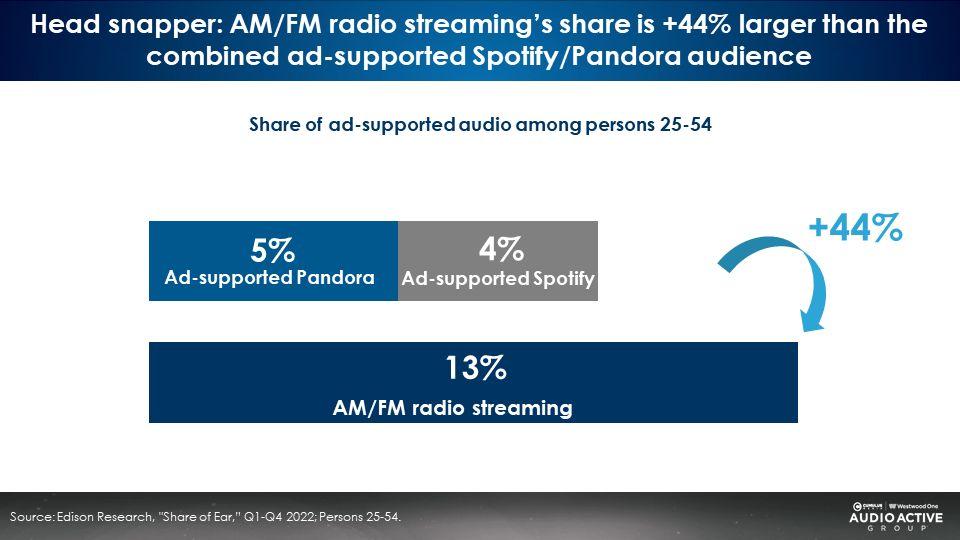

Head snapper: AM/FM radio’s 25-54 streaming audiences are +44% larger than ad-supported Spotify and Pandora combined

Among 25-54s, the ad-supported audiences of Pandora (5%) and Spotify (4%) are quite small. AM/FM radio’s streaming share of 13% is +44% larger than Pandora and Spotify combined.

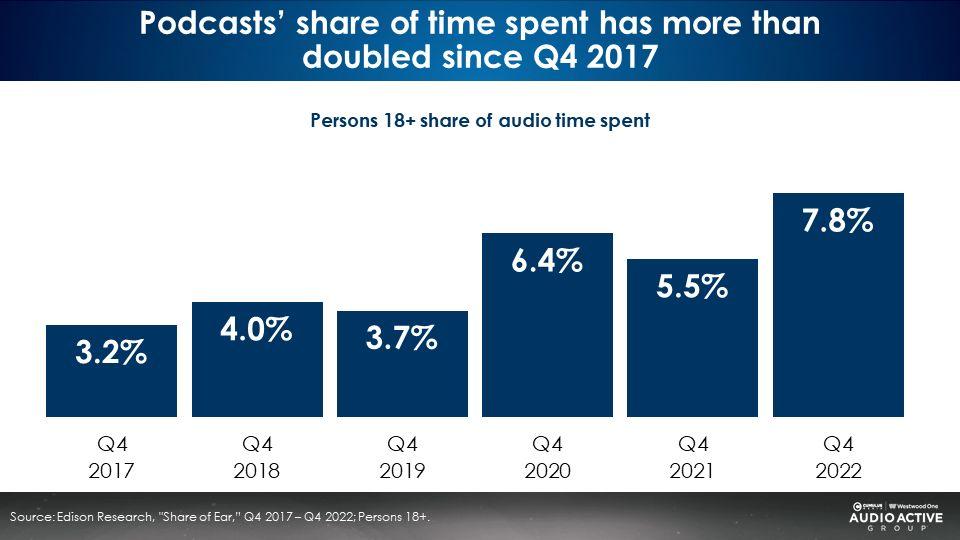

2022 was the year podcast audiences exploded

Prior to 2020, podcast audience growth was gradual. In 2020, podcast audiences went into hyper drive. Podcasts now have a 7.8 share of overall audio and a 15 share of all U.S. ad-supported audio.

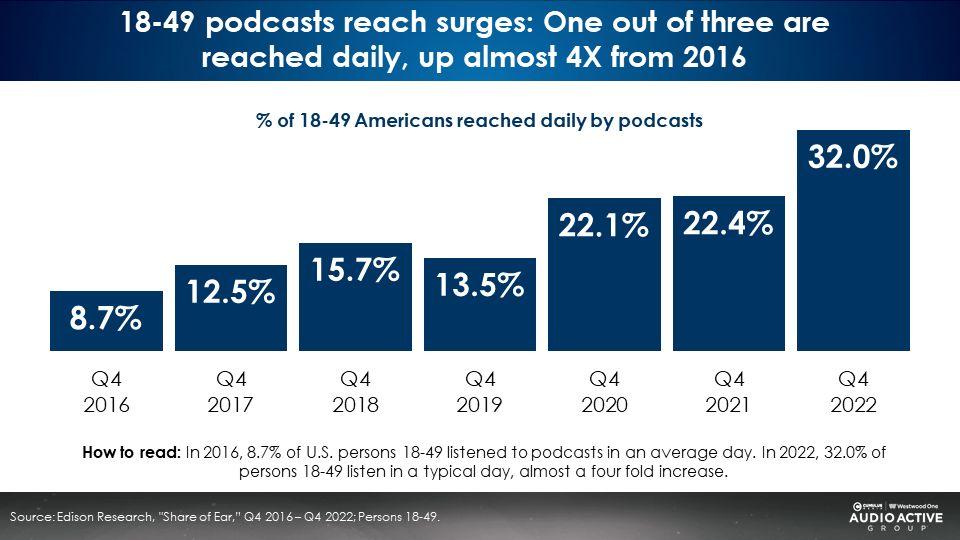

Podcasts’ daily reach among persons 18-49 hits an astonishing 32%, a +43% increase over the prior year

The daily reach of podcasts for Americans 18-49 has almost quadrupled since 2016. Podcasts now reach nearly a third (32%) of Americans 18-49 daily.

The past year (Q4 2021 to Q4 2022) has seen a substantial spike in podcast reach. Versus 2021, 18-49 daily reach has increased +43% (22.4% to 32%).

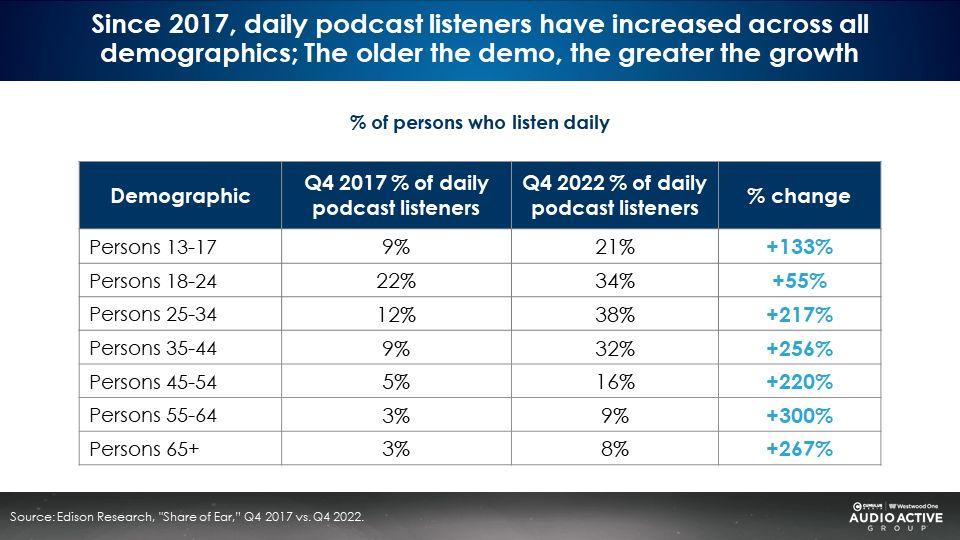

Podcast growth is not limited to younger audiences

Podcasts may be perceived as a younger person’s medium but all age demos are increasing. One out of three 18-44s now listen to podcasts daily. Off a small base, persons 55-64 have seen the biggest change from 2017 to 2022 (+300%).

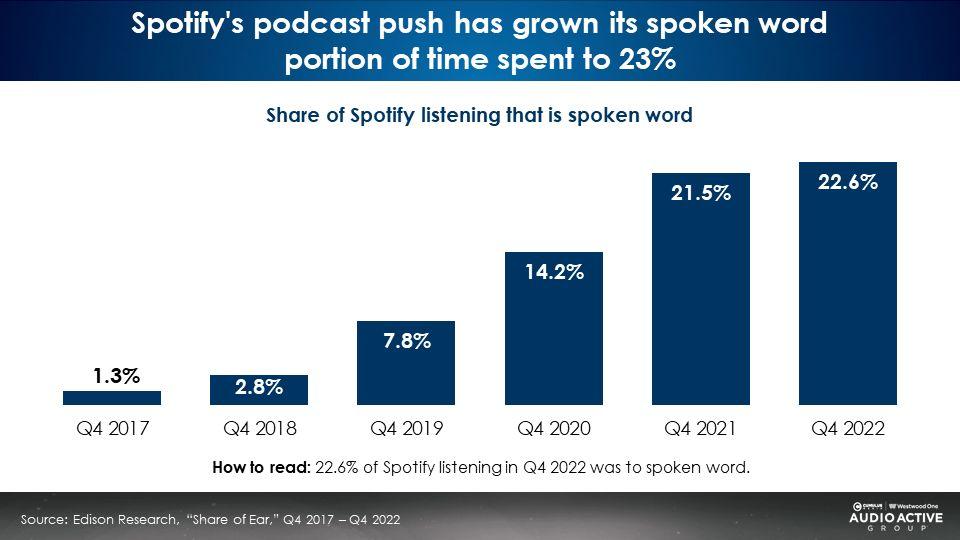

Spotify’s push to promote podcast listening on their platform has paid off: 23% of time spent on the platform goes to podcasts

In 2018, Spotify introduced podcasts on their platform. Since then, they have promoted podcasts including “Spotify original” podcasts that are exclusive to the platform.

Before podcasts were introduced, in 2017, only 1.3% of Spotify listening was to spoken word. Since then, the proportion of podcast listening on Spotify has exponentially increased to 22.6%.

Key takeaways:

- Perception vs. reality: Agencies and advertisers underestimate AM/FM radio shares and drastically overestimate Pandora and Spotify audiences

- AM/FM radio’s persons 18+ share of ad-supported audio (73%) is 15 times larger than Pandora (5%) and 18 times greater than Spotify (4%)

- 2022 versus 2017: AM/FM radio is dominant, AM/FM radio streaming grows to beat ad-supported Pandora/Spotify combined, and podcasts triple

- In the car, AM/FM radio dominates ad-supported listening with an 88% share

- Streaming soars to 20% of all 25-54 AM/FM radio listening driven by growth among men

- Head snapper: AM/FM radio’s 25-54 streaming audiences are +44% larger than ad-supported Spotify and Pandora combined

- Podcasts’ share of time spent has grown since the pandemic

- Podcasts’ daily reach has grown sharply and shows no signs of stopping

- Podcast growth is happening among all age demos, not just Gen Z and Millennials

- Spotify’s push to promote podcast listening on their platform has paid off: 23% of time spent on the platform goes to podcasts

Click here to view an 11-minute video of the key findings.

Liz Mayer is the Insights Manager of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.