Podcast Advertising Is Ideal For Reaching The Ad-Free Subscription Video Audience; Audio Is Also Ideal For Video Streamers to Promote Their Brands, According To Cumulus Media And Signal Hill Insights’ Podcast Download Fall 2025 Report

Click here to download Cumulus Media and Signal Hill Insights’ Podcast Download – Fall 2025 Report.

Click here to view a 10-minute video of the key findings.

In November of last year, Cumulus Media | Westwood One and Signal Hill Insights released the fifteenth installment of the Podcast Download series. Quantilope conducted an in-depth study of 603 weekly podcast consumers October 8th-21th 2025. The Fall 2025 report highlighted audience trends such as platform preference, content preferences, advertiser usage of podcast advertising, and more.

Today’s focus is how advertisers can use podcasts to reach consumers who are difficult to reach with TV or advertising-free streaming video platforms.

Key takeaways:

- Advertising on podcasts is how marketers can reach the ad-free video streaming audience

- Video streamers should lean into audio to promote their brands: While the profile of heavy audio consumers is a perfect match for the video streaming audience, most of video streaming media budgets go to linear TV

- Podcast consumers are avid users of video streaming services and watch ad-free Netflix and Amazon Prime Video the most

- Podcast consumers are cord cutters with a third of weekly consumers not subscribing to pay TV

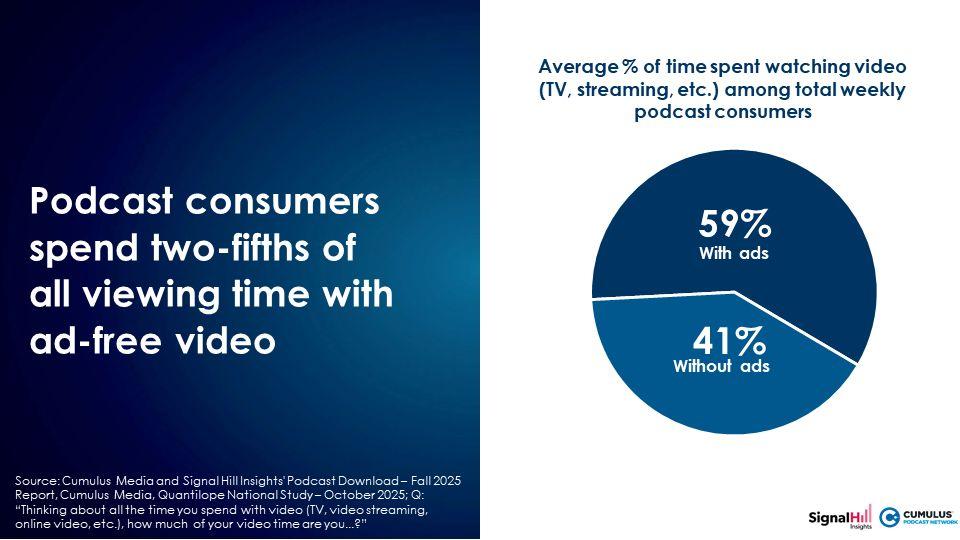

- Podcast consumers spend 41% if their video viewing time watching ad-free platforms; The heavier the podcast listener, the more TV streaming content consumed

- The audience profile of video streamers closely aligns with podcast and AM/FM radio listeners, not linear TV viewers, according to Screen Engine/ASI

Podcast consumers are avid users of video streaming services

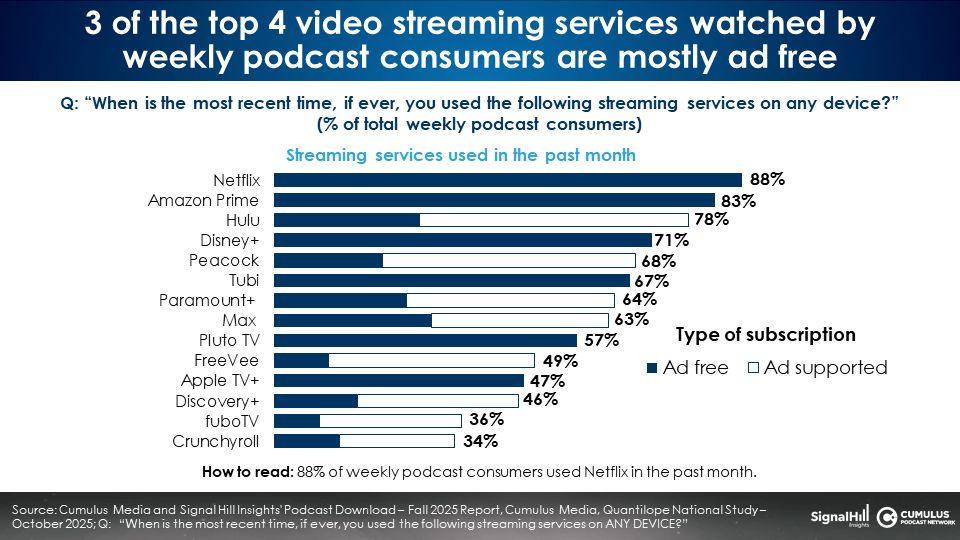

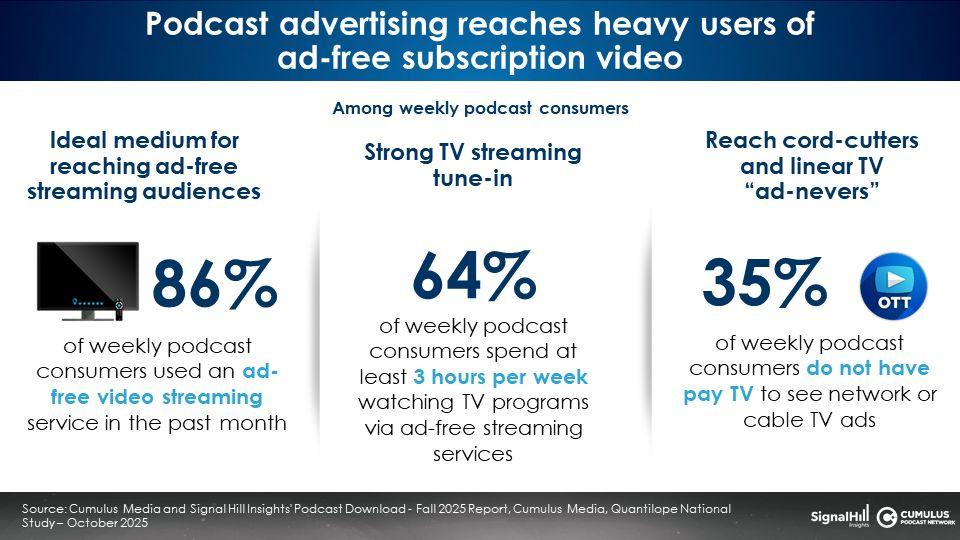

Advertisers can find displaced TV viewers with podcasts. According to the Podcast Download, weekly podcast consumers are flocking to streaming services. 94% have used a video streaming service in the past month. 86% have used an ad-free video streaming service.

Weekly podcast consumers watch ad-free streaming services (Netflix and Amazon Prime Video) the most

88% of weekly podcast consumers have used Netflix in the past month. Number two is Amazon Prime Video at 83%. While these podcast consumers are streaming ad-free video content, they can be reached by podcast ads.

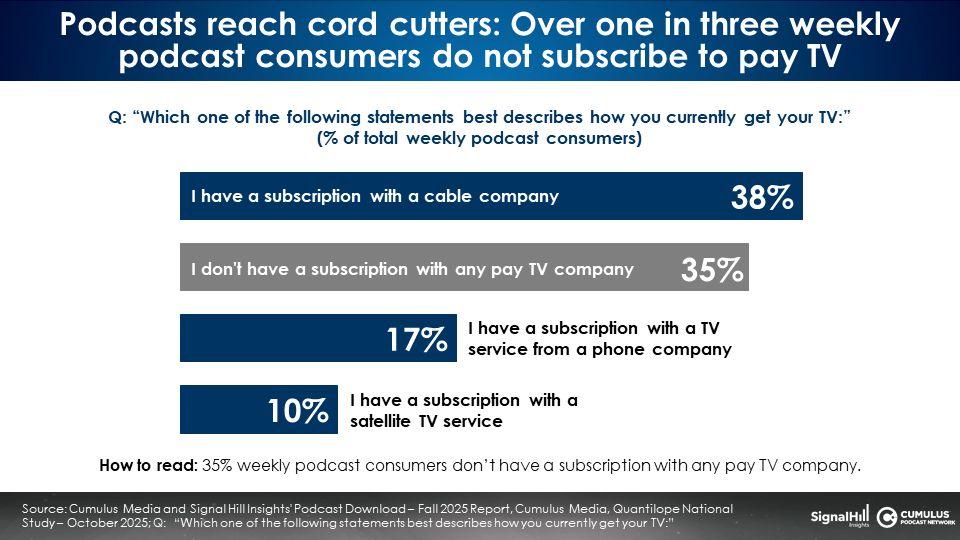

Podcast consumers are cord cutters with a third of weekly consumers not subscribing to pay TV

When asked how they currently get their TV, 35% of weekly podcast consumers reveal they do not have a subscription with any pay TV company.

Podcast consumers spend 41% if their video viewing time watching ad-free platforms

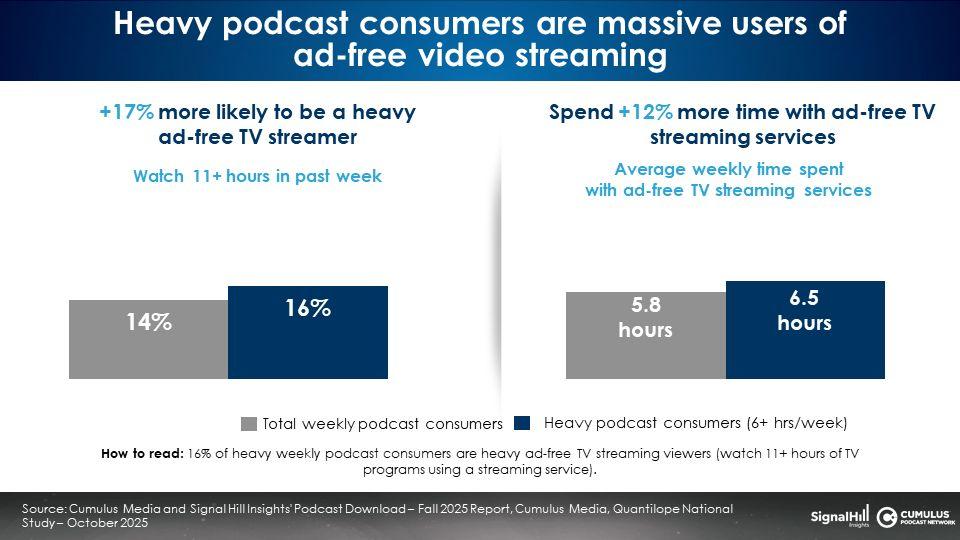

The heavier the podcast listener, the more TV streaming content consumed

Heavy podcast consumers, those who have listened to 6+ hours in the past week, are even more inclined to be heavy TV streamers who are difficult to reach with traditional TV advertising.

Compared to weekly podcast consumers, heavy podcast consumers are +17% more likely to be heavy ad-free video streamers. On average, heavy podcast consumers spend 6.5 hours with ad-free TV streaming services, +12% more time than the weekly podcast listener (5.8 hours).

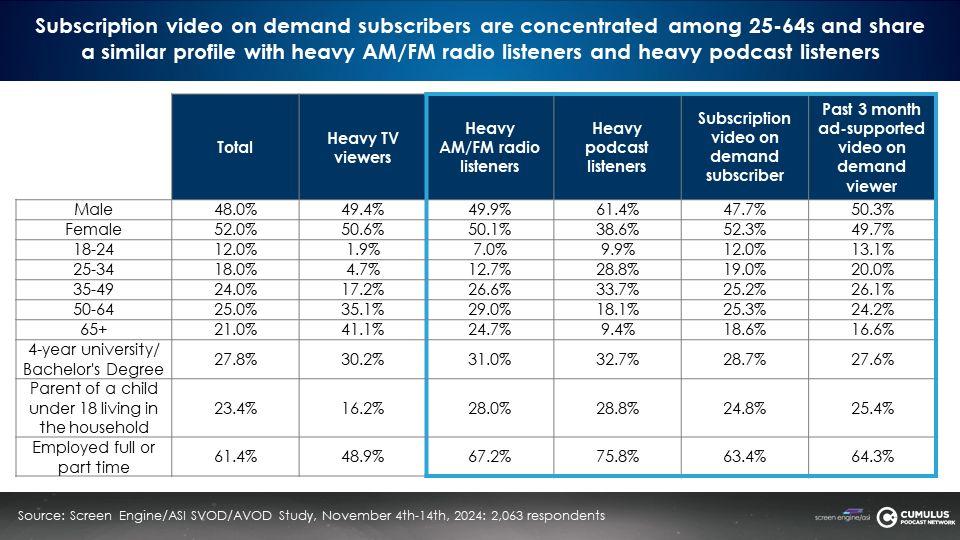

Screen Engine/ASI: The audience profile of video streamers closely aligns with podcast and AM/FM radio listeners, not linear TV viewers

Each quarter, Screen Engine/ASI, a leading market researcher for movie studios, video streamers, and TV networks, conducts a study of 2,000 Americans to understand their awareness and usage of video services.

The age profile, presence of children, and employment levels of video streaming subscribers and viewers closely match the profile of heavy podcast and AM/FM radio listeners. Linear TV viewers are much older and less likely to be employed and have children in the home.

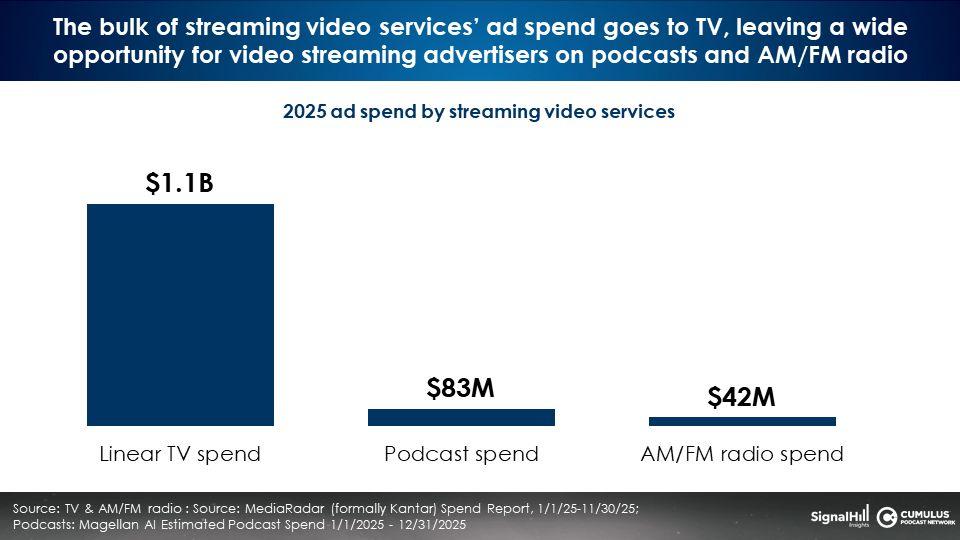

While the profile of heavy audio consumers is a perfect match for the video streaming audience, most of the media budgets go to linear TV

According to Kantar, video streaming platforms spent $1.1 billion from January to November 2025 on linear TV to market their subscription services and promote show launches. Podcasts and AM/FM radio received significantly less investment.

The historical high spend in TV and lower spend in podcasts and AM/FM radio create an opportunity for video streaming platforms to have a strong share of voice on these platforms.

According to Kantar Millward Brown, a high share of voice is important for brands: “If you increase your marketing investment at a time when competitors are reducing theirs, you … substantially increase the saliency of your brand. This could help you establish an advantage that could be maintained for many years.” Increasing spend on these audio platforms while others are not can benefit video streaming platforms.

Podcast advertising is the ideal medium for reaching heavy users of ad-free subscription video platforms

Key takeaways:

- Advertising on podcasts is how marketers can reach the ad-free video streaming audience

- Video streamers should lean into audio to promote their brands: While the profile of heavy audio consumers is a perfect match for the video streaming audience, most of video streaming media budgets go to linear TV

- Podcast consumers are avid users of video streaming services and watch ad-free Netflix and Amazon Prime Video the most

- Podcast consumers are cord cutters with a third of weekly consumers not subscribing to pay TV

- Podcast consumers spend 41% if their video viewing time watching ad-free platforms; The heavier the podcast listener, the more TV streaming content consumed

- The audience profile of video streamers closely aligns with podcast and AM/FM radio listeners, not linear TV viewers, according to Screen Engine/ASI

Click here to download Cumulus Media and Signal Hill Insights’ Podcast Download – Fall 2025 Report.

Click here to view a 10-minute video of the key findings.

Lauren Vetrano is the VP of Advertiser Measurement & Insights of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.