WPP Media: Major New Sales Effect Study Reveals Digital Audio And AM/FM Radio Excel In Return On Advertising Spend

Click here to view a 13-minute video of the key findings.

Click here to download a PDF of the slides.

Looking for fresh evidence on audio and radio advertising ROI? Look no further than one of the world’s largest media agencies.

WPP Media and Radiocentre, the UK-based audio effectiveness think tank, have released a major new analysis of the sales effect of AM/FM radio and digital audio. The objectives of the study:

- Compare the ROI of broadcast radio and digital audio to other media

- Quantify short-term audio ROI (one week to thirteen weeks) and long-term ROI (one week to two years)

- Explore how multiplatform audio amplifies overall media campaign ROI

Here are the key findings:

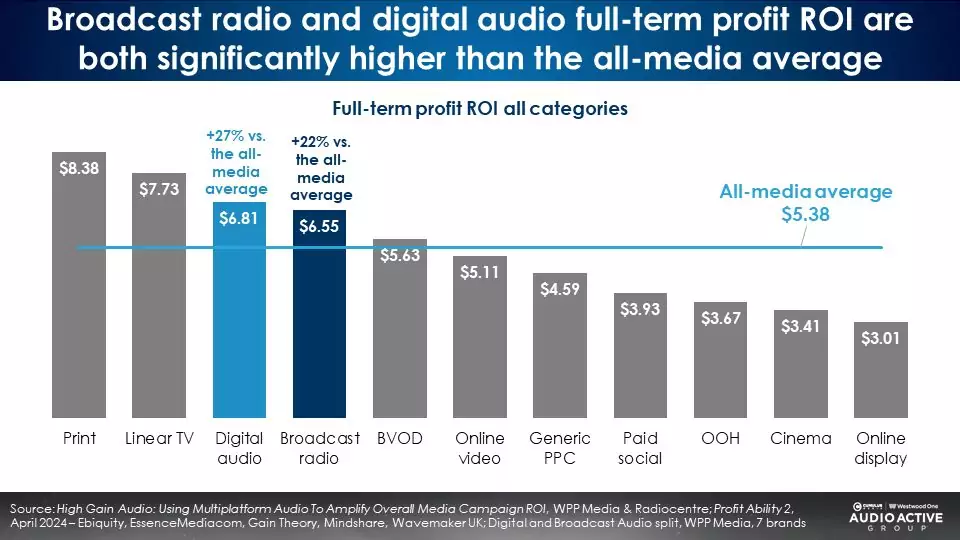

- Across a two-year period, digital audio ROI is +27% greater than the all-media average; Broadcast radio ROI outperforms the average by +22%; Of eleven media, digital audio is number three in ROI and broadcast radio is number four in two-year ROI

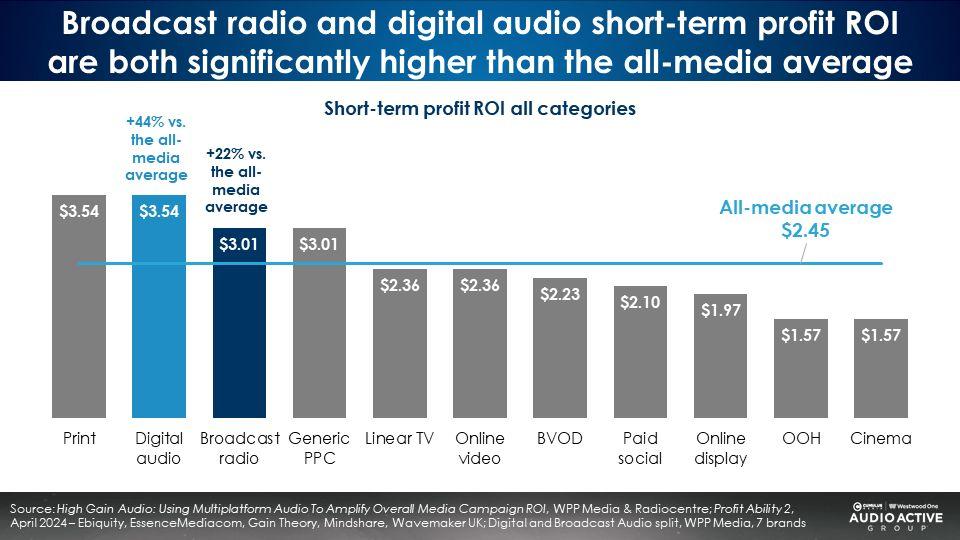

- Across thirteen weeks, digital audio’s short-term ROI is tied for first, outperforming the all-media average by 44%; Broadcast radio is second in short-term ROI, surpassing the all-media average ROI by +23%

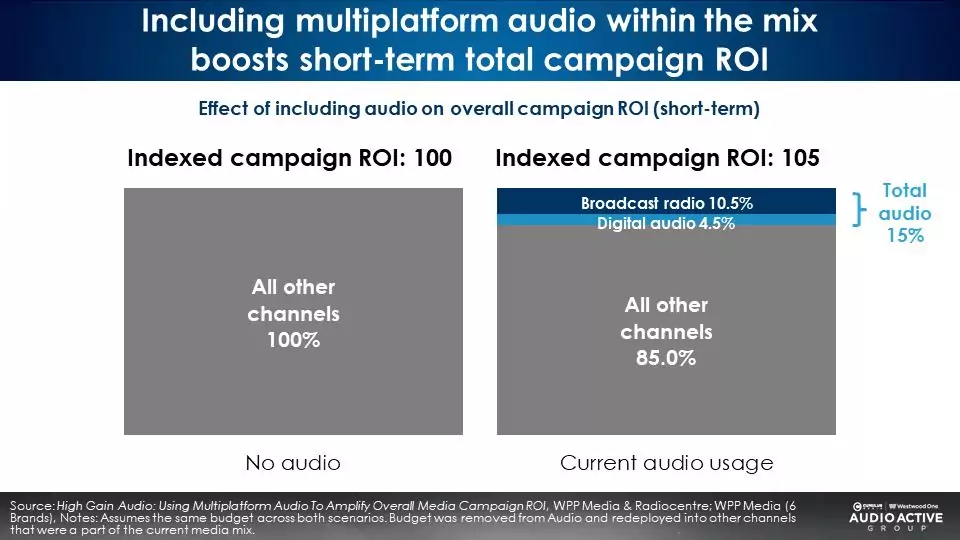

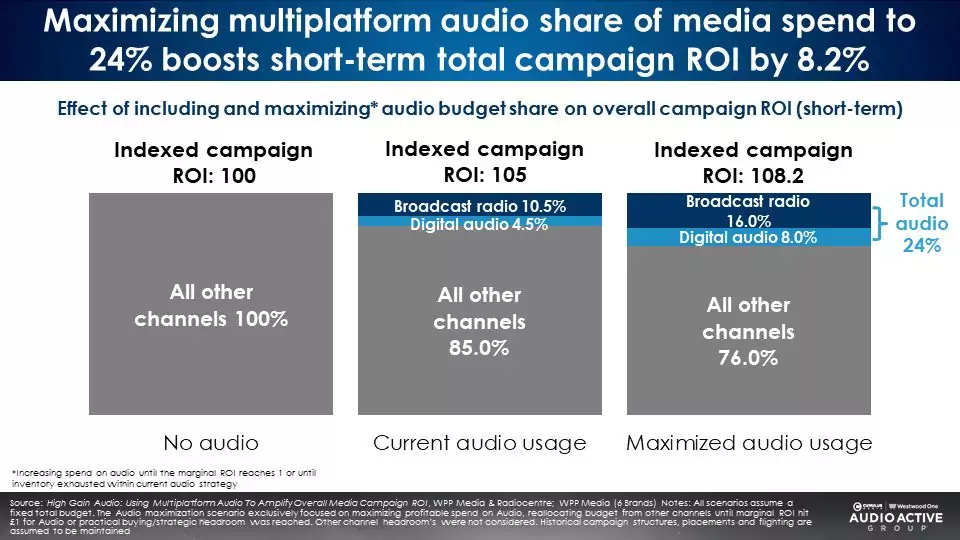

- Reallocating 15% of a cross-platform buy to include 10% broadcast radio and 5% digital audio lifts the entire campaign ROI by 5% across one-to-thirteen-weeks

- Allocating 24% of a media plan to audio lifts the one-to-thirteen-week total campaign ROI by 8.2%

- The paradox of ROI: As profits increase, ROI drops; The smart strategy is go for big sales and profit growth with lower ROI

The study High Gain Audio: Using Multiplatform Audio To Amplify Overall Media Campaign ROI was conducted by Jane Christian, EVP Analytics for WWP Media and Mark Barber, Planning Director for Radiocentre. The report was sourced from the Profit Ability 2 project, one of the world’s largest advertising effectiveness studies every conducted.

Profit Ability 2: The New Business Case for Advertising was a massive undertaking that involved:

- $2.2 billion in media spend analyzed (2021-2023)

- 142 brands

- 14 sectors

- 10 media channels

- 53 brands matched pre- and post-COVID

Profit Ability 2: The New Business Case for Advertising is a meta-analysis of econometric benchmarks to understand the short- and long-term payback of advertising to business profit. All of the analysis in the new study was post-pandemic, examining advertising business effects from 2021 to 2023.

The study uses marketing mix modelling (MMM) to link advertising spend to incremental profit. Marketing mix modeling is the gold standard for understanding media effectiveness. It’s a statistical modelling approach that isolates the contribution of advertising from other factors that drive a business (pricing, distribution, seasonality, etc.).

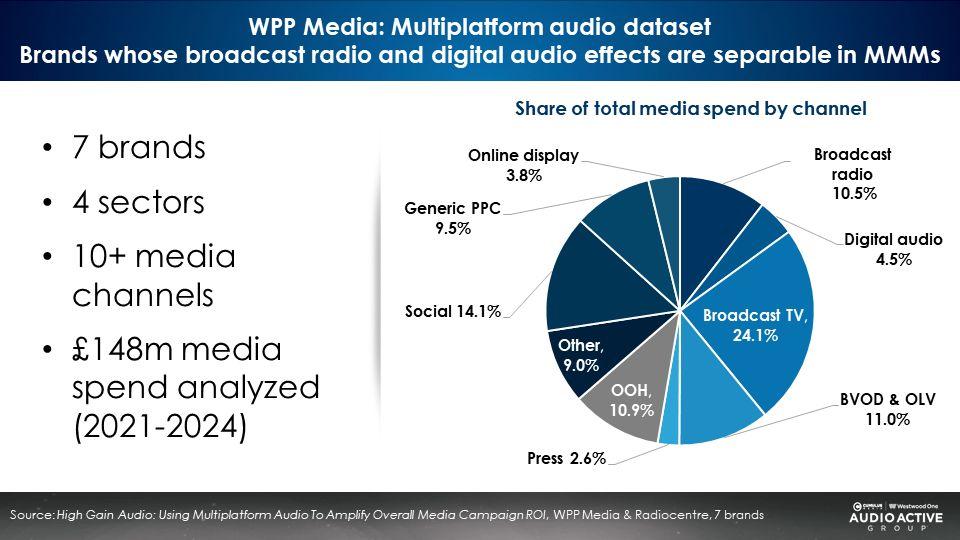

WWP Media examined seven brands who have studied the impact of digital audio and broadcast radio.

The brands had diverse media mixes, which included TV, out of home, social, search, and online video, to name a few. The outputs of those seven models were then linked to the Profit Ability 2 dataset to provide a comparison to other media channels.

Across a two-year period, digital audio ROI is +27% greater than the all-media average and broadcast radio ROI outperforms the average by +22%; Of eleven media, digital audio is number three in ROI and broadcast radio is number four in two-year ROI

Across thirteen weeks, digital audio’s short-term ROI is tied for first, outperforming the all media average by 44%; Broadcast radio is second in short-term ROI surpassing the all-media average ROI by +23%

Reallocating 15% of a cross platform buy to include 10% broadcast radio and 5% digital audio lifts one-to-thirteen-week ROI by 5%

Audio is both a driver of short-term sales effect as well as long-term sales effect. Recently, the major sales effect study from marketing effectiveness firm Effie named AM/FM radio and podcasts “Super Touchpoints,” media that create immediate sales and lasting brand effects.

Allocating 24% of a media plan to audio lifts one-to-thirteen-week total campaign by 8.2%

Audio elevates the media plan. Shifting from a “no-audio” media plan to a media plan with a 24% audio allocation results in an 8.2% lift in total campaign ROI.

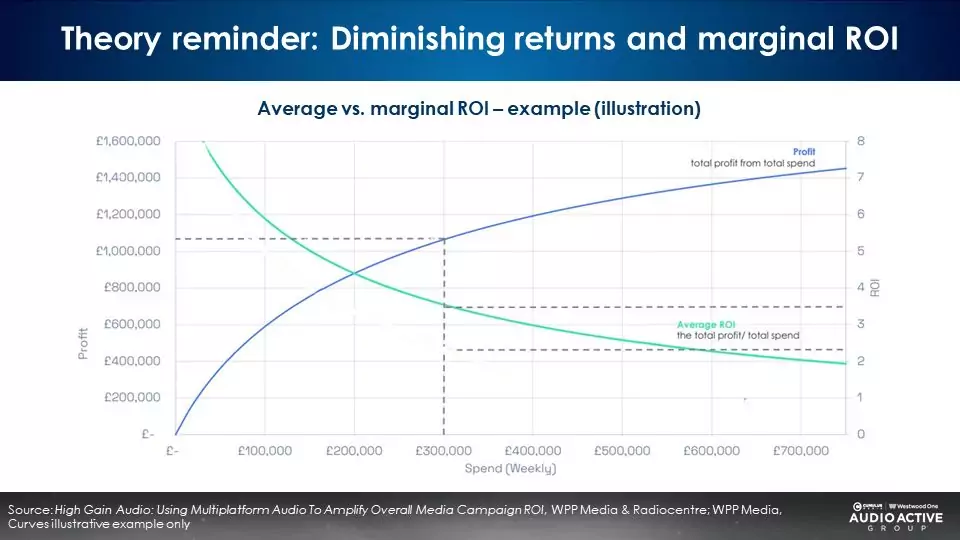

The paradox of ROI: As profits increase, ROI drops

The advertising world easily throws the word ‘ROI’ around. We mistakenly use it as a catch-all for every good business outcome: sales growth, profit growth, and customer growth.

Sales growth, profit growth, and customer growth are effectiveness measures. ROI is none of those things.

ROI is an efficiency measure. To determine ROI, divide short-term revenue growth by media investment.

As the WPP Media visual below reveals, as ad spend goes up, so does profit. ROI reduces.

Les Binet and Sarah Carter, marketing effectiveness gurus, explain in their book How NOT To Plan: 66 Ways To Screw It Up:

“As you spend more on advertising, it often gets more effective (sales and profits generated go up), but less efficient (ROI goes down). That’s the nature of diminishing returns. It means that in practice, the highest ROIs tend to come from small budgets.

If your aim was to maximize ROI, you’d go for the small-budget campaign. But that would mean smaller profit. Going for the big-budget campaign would mean lower ROI, but bigger profit. And that’s the nub of it.

As Tim Ambler points out in his classic article ‘ROI is dead: now bury it’, advertisers should try to maximize profits, not ROI. ROI is usually highest when sales and budget are close to zero. So trying to maximize ROI is a good way to destroy your brand.”

Key findings:

- Across a two-year period, digital audio ROI is +27% greater than the all-media average; Broadcast radio ROI outperforms the average by +22%; Of eleven media, digital audio is number three in ROI and broadcast radio is number four in two-year ROI

- Across thirteen weeks, digital audio’s short-term ROI is tied for first, outperforming the all-media average by 44%; Broadcast radio is second in short-term ROI, surpassing the all-media average ROI by +23%

- Reallocating 15% of a cross-platform buy to include 10% broadcast radio and 5% digital audio lifts the entire campaign ROI by 5% across one-to-thirteen-weeks

- Allocating 24% of a media plan to audio lifts the one-to-thirteen-week total campaign ROI by 8.2%

- The paradox of ROI: As profits increase, ROI drops; The smart strategy is go for big sales and profit growth with lower ROI

Click here to view a 13-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.