82 Million Reasons To Keep AM Radio In Vehicles, Why AM/FM Radio Is Still The Queen Of The Road, And Growing Advertiser Interest For In-Dash Visuals That Accompany An AM/FM Radio Ad

Click here to view an 11-minute video of the key findings.

The value of AM radio in the car just received some powerful support in the form of newly released Nielsen audience data. The Nielsen Fall 2022 survey reveals:

- 82,346,800 Americans listen to AM radio monthly

- One out of three American AM/FM radio listeners are reached monthly by AM radio

- 57% of the AM radio audience listens to News/Talk stations, the very outlets that Americans turn to in times of crisis and breaking local news

MRI Simmons: Ford owners represent 20% of all U.S. AM radio listeners and are more likely to listen to AM radio

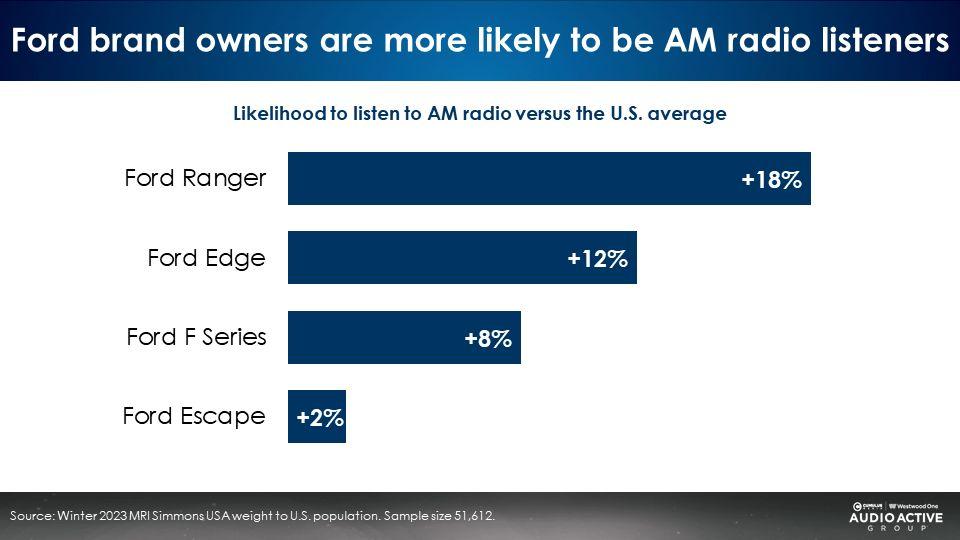

Recently Ford indicated a desire to remove AM radio from their vehicles. MRI Simmons, the gold standard of what Americans buy and where they shop, reveals Ford owners are massive users of AM radio.

One out of five American AM radio listeners owns a Ford vehicle. 23% of American AM radio listeners own a General Motors vehicle.

Owners of major Ford vehicle models over-index on AM listening. This means Ford owners are more likely than the U.S. average to listen to AM radio.

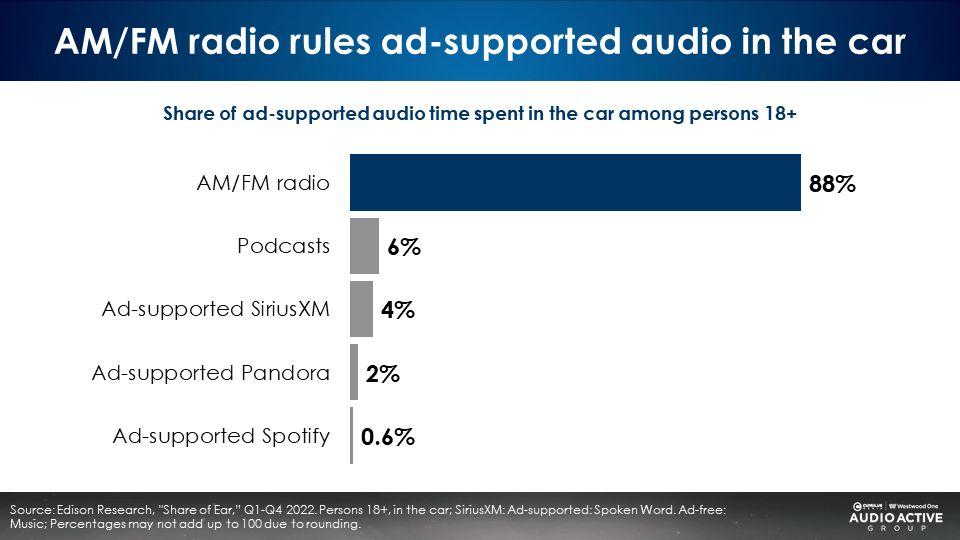

AM/FM radio dominates listening in the car with an 88% share of ad-supported audio

Edison Research’s quarterly “Share of Ear” study is the authoritative examination of time spent with audio in America. Edison Research surveys 4,000 Americans to measure daily reach and time spent for all forms of audio.

The Q4 2022 “Share of Ear” study reveals out of all ad-supported audio in the car, AM/FM radio has an 88% share. Podcasts have a 6% share of time spent listening in the car. Ad-supported Spotify represents less than a 1% share of ad-supported audio time spent.

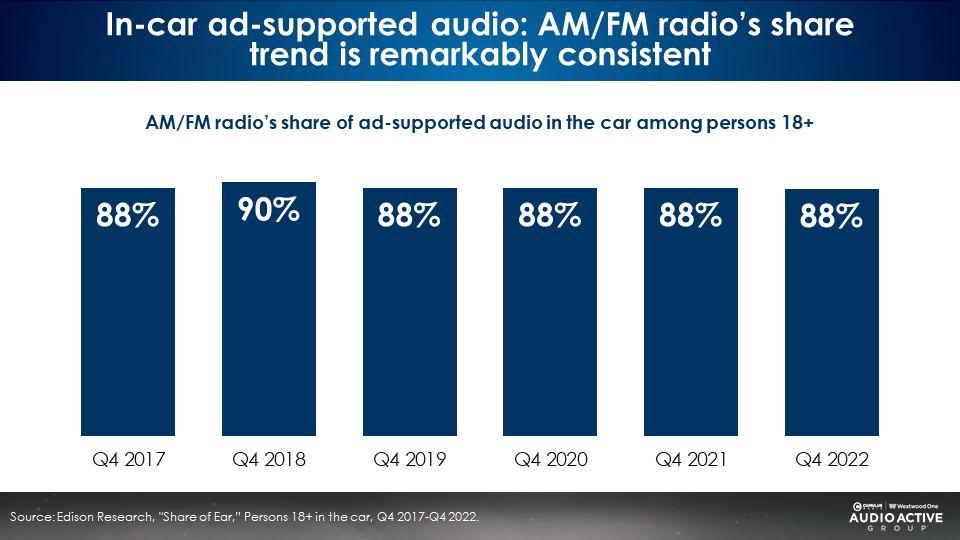

AM/FM radio’s near-90 share of in-car ad-supported audio has been steady as a rock for the last six years

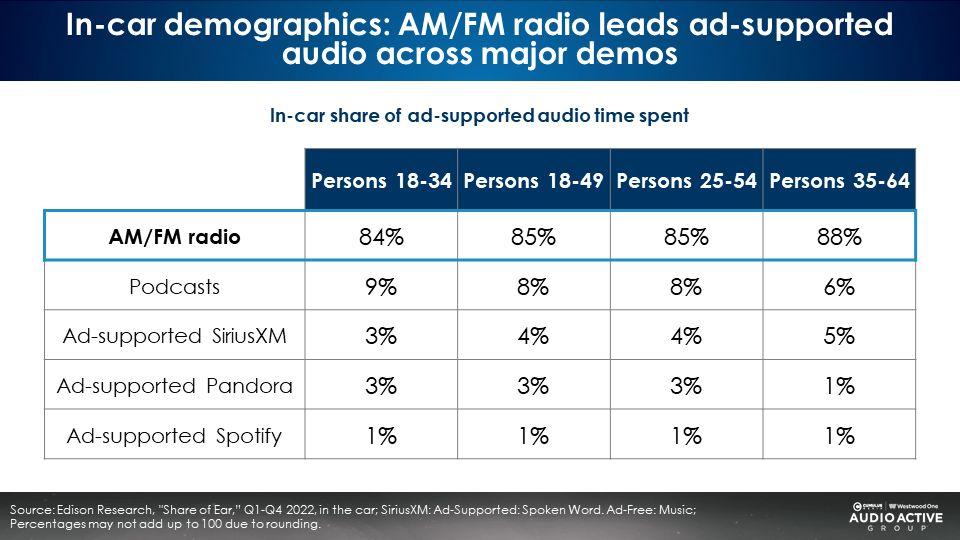

AM/FM radio’s ad-supported shares in the car are dominant across all demographics, even among 18-34s

Among 18-34s, AM/FM radio’s ad-supported audience share is 9 times larger than podcasts and 28 times bigger than SiriusXM and Pandora.

Daniel Ek, founder and CEO of Spotify, acknowledges that AM/FM radio remains the dominant audio platform: “When you look at the landscape overall, and you think about something like radio, the truth is that the vast majority of the minutes that that are being spent on radio today haven’t yet moved online.”

The biggest risk for AM/FM radio is perception, not reality

Duncan Stewart, Director of Research, Technology, Media & Telecommunications at Deloitte says, “Why do people think that nobody listens to radio anymore? Because there is a narrative that new media kills old media, so nobody bothers to look at evidence that doesn’t fit the narrative.”

Colin Kinsella, the former CEO of media buying giant Havas Media North America, says there is an erroneous narrative among big city media planners that no one listens to AM/FM radio. According to Kinsella, “The biggest risk for radio is the 26-year-old planner who lives in New York or Chicago and does not commute by car and does not listen to radio and thus does not think anyone else listens to radio.”

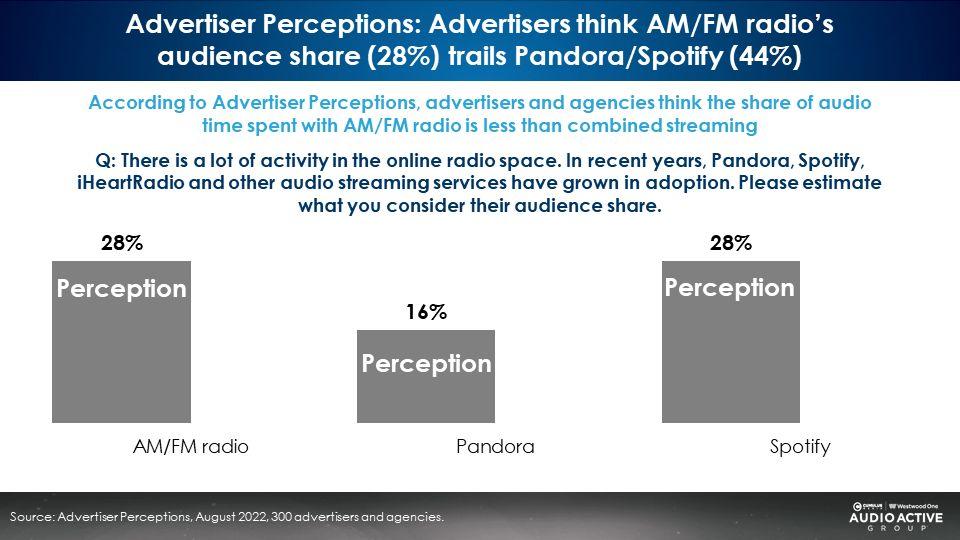

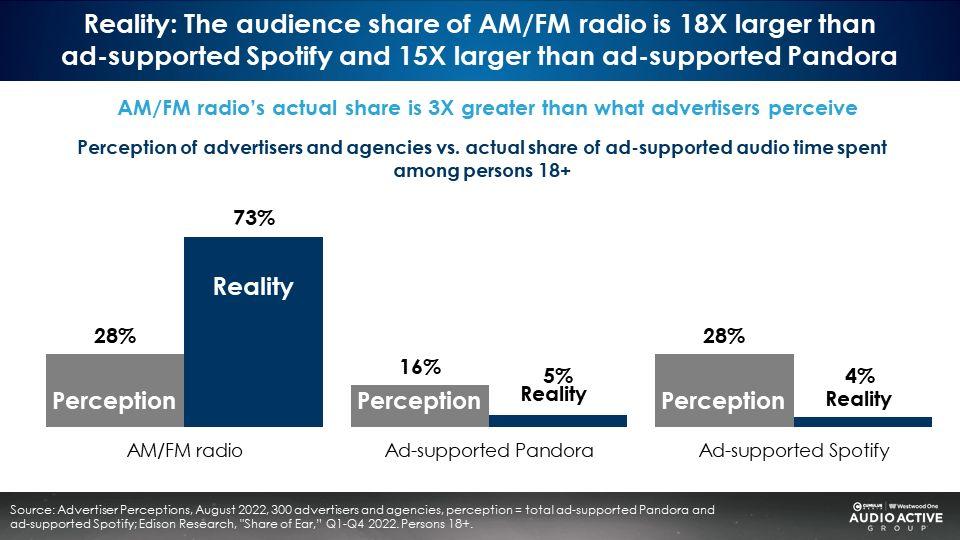

Perception vs. reality: Agencies and advertisers underestimate AM/FM radio shares and overestimate Pandora and Spotify audiences

There is a yawning gap in agency/marketer perceptions of audio audiences. A study of 300 media agencies and marketers conducted in August 2022 by Advertiser Perceptions, the gold standard measurement firm of advertiser sentiment, found the perceived combined audience share of Pandora/Spotify is 44%, much greater than the perceived share of AM/FM radio (28%).

Per Edison’s “Share of Ear,” AM/FM radio’s actual share (73%) is three times larger than what advertisers perceive (28%). Agencies and advertisers vastly overestimate Pandora and Spotify shares.

According to the Q4 2022 “Share of Ear,” AM/FM radio’s persons overall 18+ share of ad-supported audio (73%) is 15 times larger than Pandora (5%) and 18 times greater than Spotify (4%).

Advertiser Perceptions: Agencies and marketers show greater interest and willingness to pay for in-car visuals that accompany AM/FM radio ads

In 2021 and 2022, the Cumulus Media | Westwood One Audio Active Group® commissioned Advertiser Perceptions to survey 300 media agencies and advertisers on their awareness, interest, and willingness to pay for in-dash visuals that sync to AM/FM radio ads.

- Greater awareness: Advertisers and agencies were shown a photo of an in-dash visual associated with an AM/FM radio ad and asked, “How familiar are you with this new vehicle technology that shows an advertising message and logo on the in-car radio display that syncs to the radio ad?” Those who say they are somewhat familiar or very familiar has grown from 39% in 2021 to 52% in 2022.

- Increased interest: Agencies and Advertisers were probed, “How interested are you in the ability to display visuals that sync to radio ads through in-car radio displays?” Those who are “somewhat interested/very interested” grew from 64% to 74%.

- More willingness to pay: Clients and agencies were queried, “How much on top of a typical radio buy would you be willing to invest in this new in-car visual display capability?” In 2021, marketers and media agencies felt 12% was a fair price increase to pay for in-car visuals. In 2022, this grew to 14%.

Key takeaways:

- AM radio reaches 82 million Americans monthly, representing one out of three AM/FM radio listeners

- MRI Simmons: Ford owners represent 20% of all U.S. AM radio listeners and are more likely to listen to AM radio

- AM/FM radio dominates listening in the car with an 88% share of ad-supported audio

- AM/FM radio’s near-90 share of in-car ad-supported audio has been steady as a rock for the last six years

- AM/FM radio’s ad-supported shares in the car are dominant across all demographics, even among 18-34s

- Perception vs. reality: Agencies and advertisers underestimate AM/FM radio shares and overestimate Pandora and Spotify audiences

- Advertiser Perceptions: Agencies and marketers show greater interest and willingness to pay for in-car visuals that accompany AM/FM radio ads

Click here to view an 11-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.