Michigan Sports Betting Big Bang: Ten Authorized Operators Flood Airwaves As New Study Reveals AM/FM Radio Listeners Show Significantly More Interest And Engagement In Online Sports Betting Than TV Viewers

According to the Variety Intelligence Platform’s 2021 report on sports betting, “When the U.S. Supreme Court handed down its May 2018 decision opening the door for legalized sports betting, there was widespread speculation about the impact it could have on the fortunes of media companies and the economy as a whole.” Analysts forecast annual revenues in the $10 billion range. Twenty-five states and Washington D.C. have legalized or are operating sports betting.

Variety reports that over the last two years “there has been a flurry of big-money sportsbook deals, many involving major media companies. Sponsorship and branding are at the core of most of these pacts. Typically, the sportsbook commits to a minimum annual advertising buy and in return, its logo is splashed across the media company’s distribution platforms while its product, projections and experts are integrated into programming. In a few cases, media companies have also taken ownership stakes in sportsbooks.”

Michigan sports betting big bang

On January 25, 2021, ten brands in the state of Michigan went live with sports betting. With so many firms live from day one, Wall Street Analysts Oppenheimer & Co. observed:

“We believe Michigan will offer unique insight into future competitive dynamics given that it’s the first time that all key players are entering the market simultaneously … We believe real product differentiation through increased live betting offerings is still 12-24 months away; therefore we see the combination of brand awareness, incentives, and performance marketing being the main acquisition channels.”

To better understand the consumer reaction in Michigan to the launch of sports betting, CUMULUS MEDIA | Westwood One commissioned MARU/Matchbox to conduct a study of 700 Michigan adults 21+ from January 29 through February 1, 2021.

Here are the key findings:

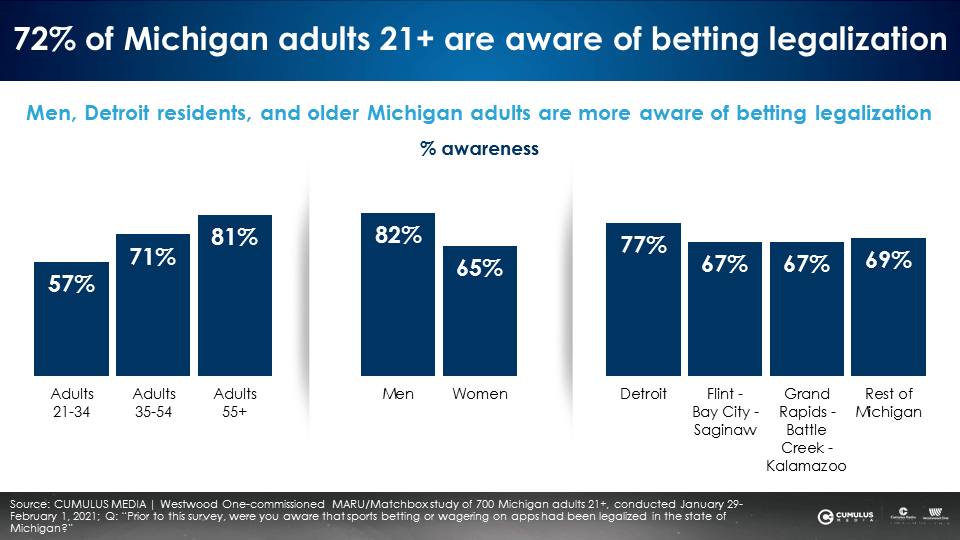

72% of Michigan residents are aware of sports betting legalization

While the majority of people in Michigan (72%) are aware of sports betting legalization, this awareness skews older. Awareness of the change in policy is also higher among men and Detroit residents.

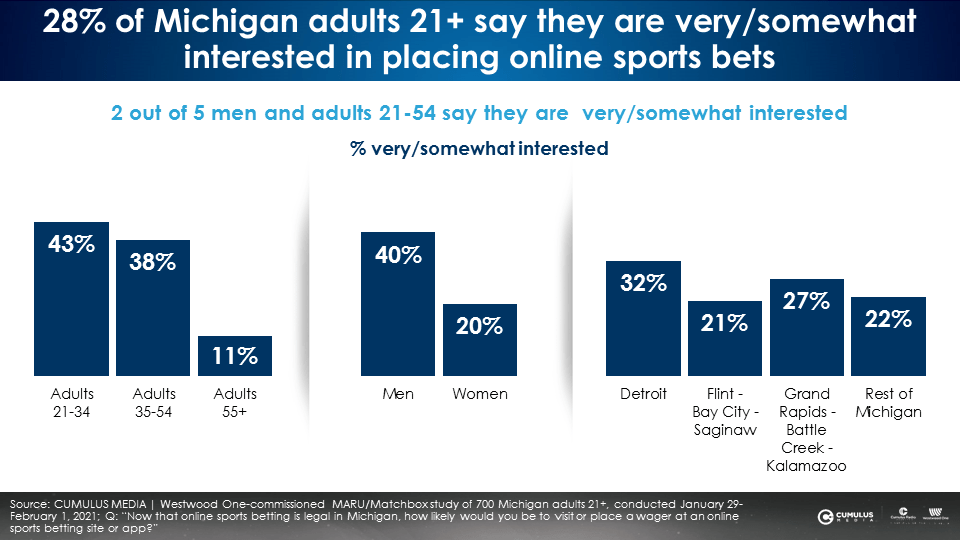

Sports betting interest is concentrated among men 21-54

While awareness of sports betting is strong among older demographics, Michigan adults over the age of 55 have little interest in app-based sports betting. Only one out of ten say they are very/somewhat interested.

28% of all adults 21+ in Michigan are very or somewhat interested in online sports betting. About 40% of adults 21-54 say they are very/somewhat interested.

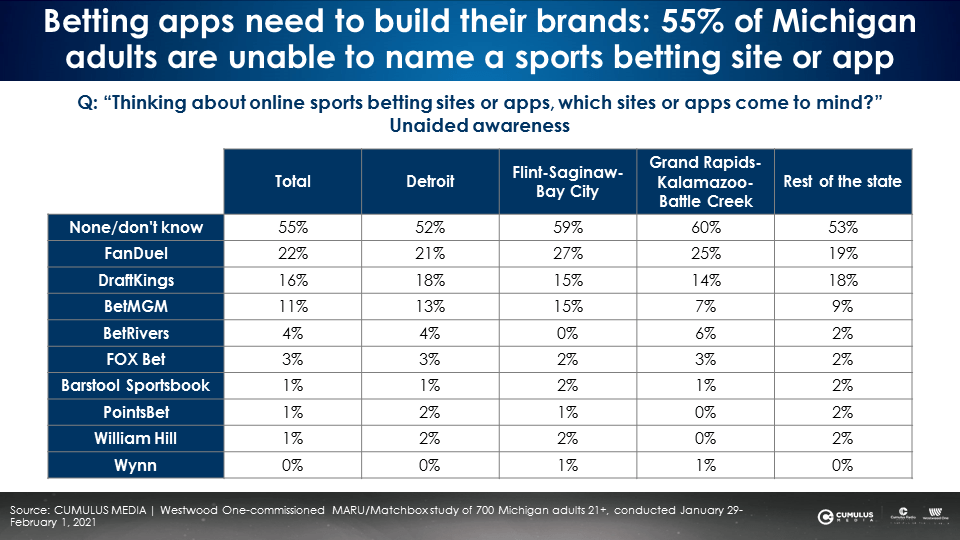

Unaided awareness: 55% of Michigan residents are unable to name an online sports betting brand

These are still early days for the Michigan online sports betting industry as over half of consumers are unable to name a sports betting site or app. When asked to name a sports betting site or app, 55% of Michigan adults 21+ are unable to name any firm. 22% name FanDuel, 16% cite DraftKings, and 11% name BetMGM. FOX Bet, Bartsool Sportsbook, PointsBet, and William Hill have unaided awareness between 1% and 4%.

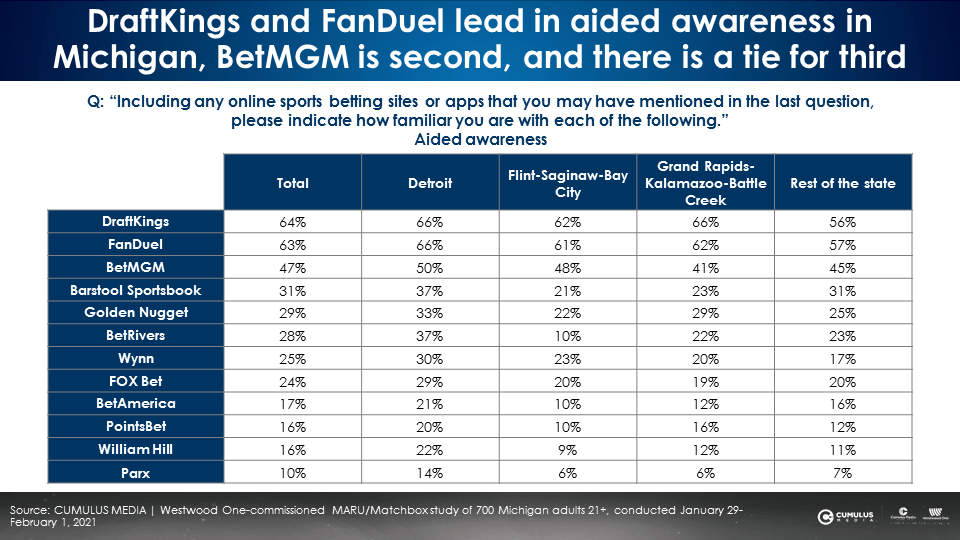

Aided awareness: DraftKings and FanDuel lead, BetMGM places second, five firms tie for third

Versus the rest of the state, Detroit residents have greater interest and affinity for online sports betting. Detroit residents exhibit higher levels of aided awareness for sports betting brands.

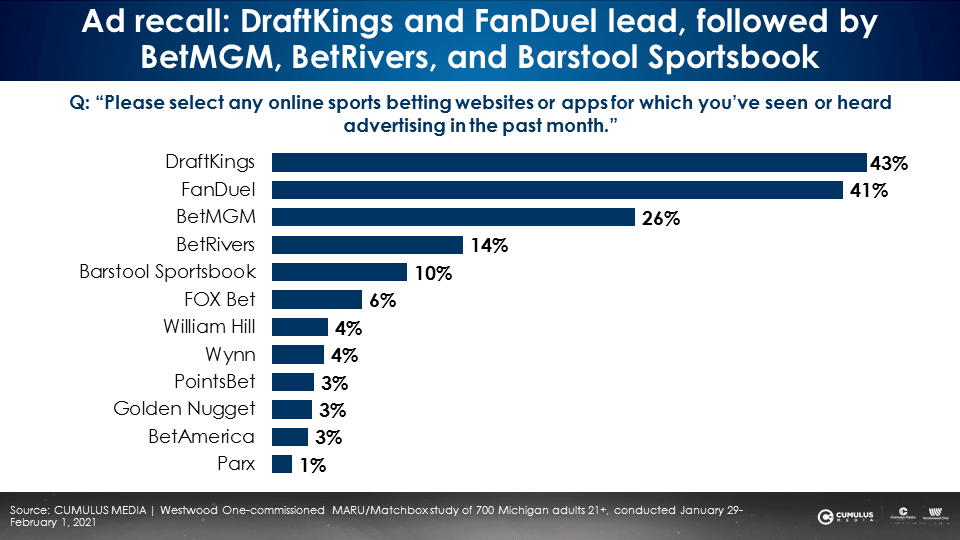

Advertising recall: DraftKings and FanDuel lead, followed by BetMGM, BetRivers, and Barstool Sportsbook

Advertising works. In the first week or so of legalization, 7% of Michigan adults 21+ placed a wager at an online sports betting site. One out of ten adults 21-54 have placed a bet and one out of four sports fans have placed a wager.

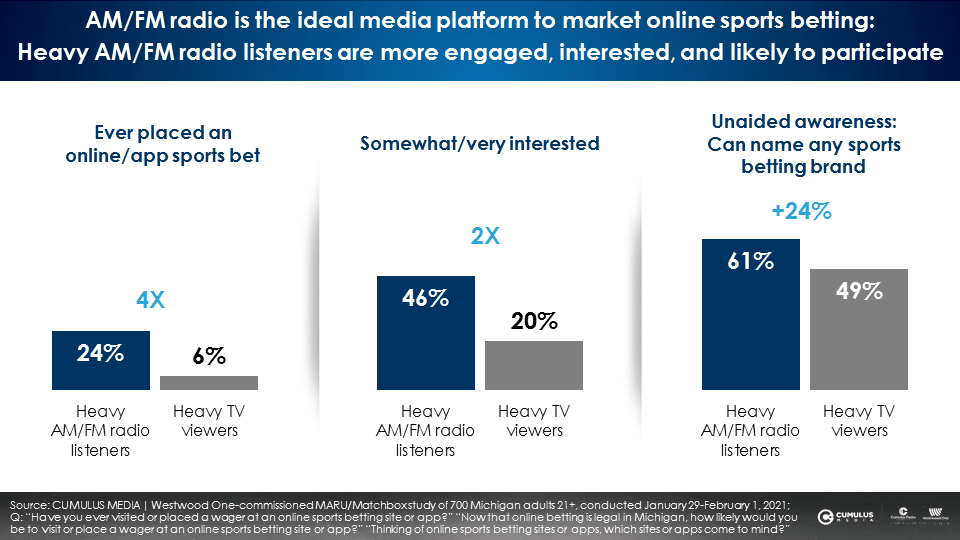

AM/FM radio is the ideal platform for online sports betting sites to build their brands and business

Heavy AM/FM radio listeners in Michigan show significantly more interest, engagement, and experience in online sports betting as well as greater awareness of sports betting brands compared to heavy TV viewers. Versus older skewing heavy TV viewers, heavy AM/FM radio listeners are twice as interested in online sports betting and four times as likely to have placed an online wager. AM/FM radio is the ideal platform for online sports betting sites to build their brands and business.

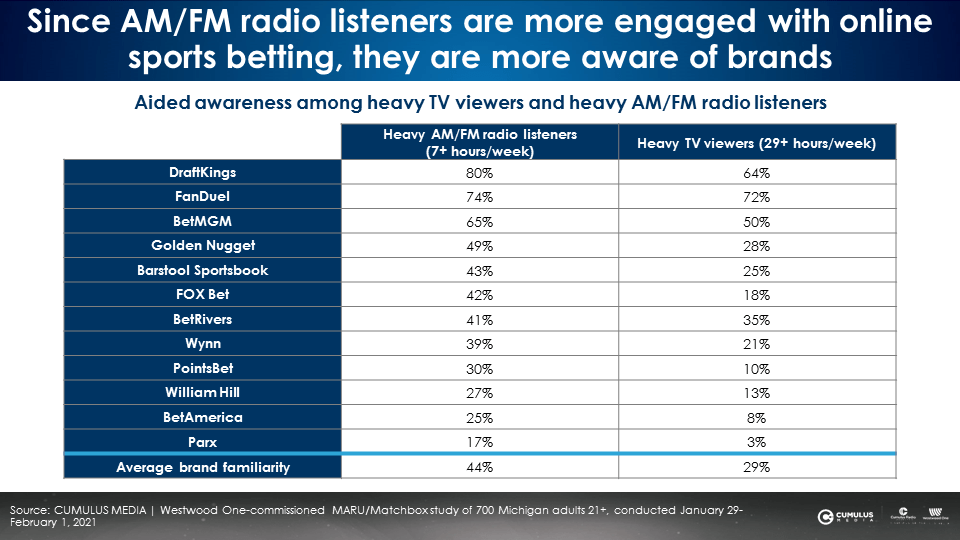

Compared to heavy TV viewers, heavy AM/FM radio listeners are 52% more aware of sports betting brands

In Michigan, among heavy AM/FM radio listeners, the average brand awareness of twelve sports betting firms is 44% compared to only 29% among heavy TV viewers.

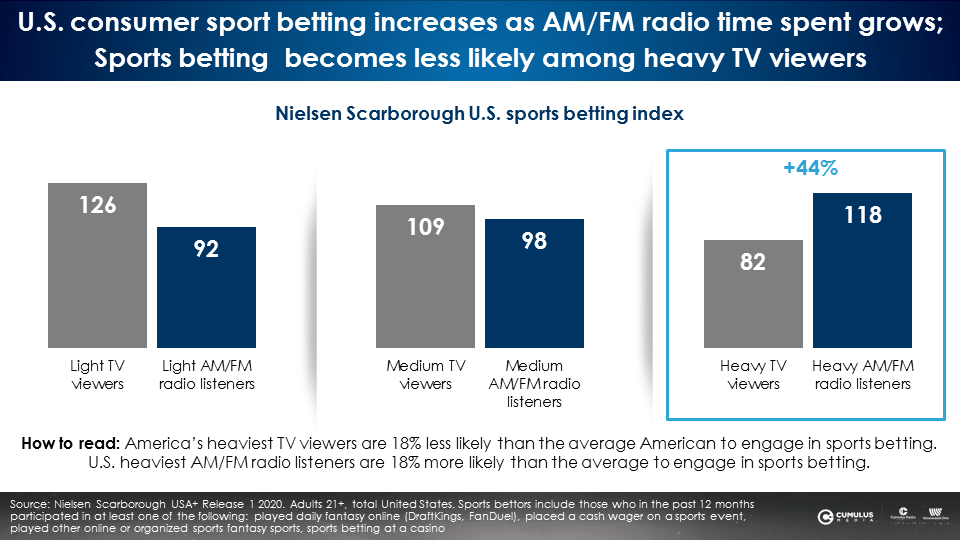

Nielsen Scarborough: Across the U.S., the greater the time spent with AM/FM radio, the greater the sports betting engagement

Conversely, the greater the time spent with TV, sports betting activity plunges. Older skewing TV viewers have far less interest and usage in online sports betting.

Heavy AM/FM radio listeners are +44% more likely to engage in sports betting compared to heavy TV viewers.

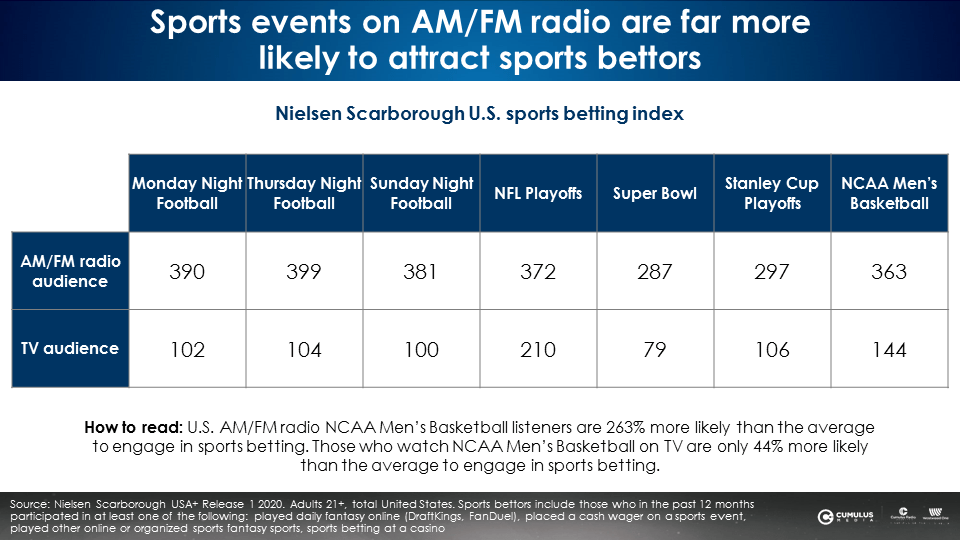

AM/FM radio sports listeners are significantly more engaged with sports betting versus TV sports viewers

Surprisingly, TV sports viewer interest in sports betting is only slightly greater than average. NFL prime time viewers show no greater interest in sports betting than the U.S. average. The only TV sports broadcast that does a decent job of attracting sports bettors are the NFL Playoffs and NCAA Men’s Basketball.

On the other hand, AM/FM radio sports listeners are 2.5 times more likely than the U.S. average to engage in sports betting. For example, American AM/FM radio listeners to NCAA Men’s Basketball are 263% more likely than the average to engage in sports betting. Those who watch NCAA Men’s Basketball on TV are only 44% more likely than the average to bet on sports outcomes. Sports play-by-play AM/FM radio broadcasts are the better platforms to attract sports bettors.

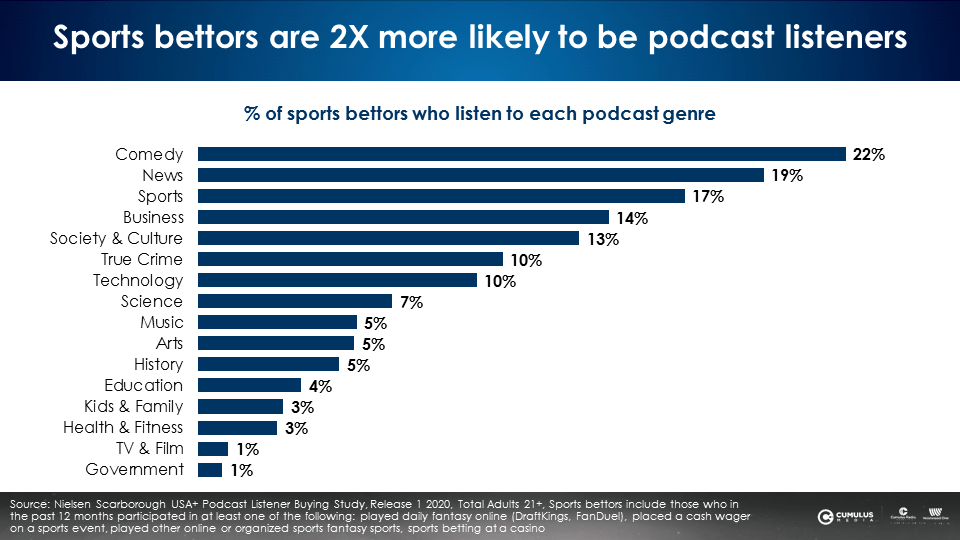

Nielsen Scarborough: Sports bettors are twice as likely to be podcast listeners

According to Nielsen Scarborough, sports bettors are twice as likely to be podcast listeners than the average. Across various podcast genres including Comedy (22%), News (19%), and Sports (17%), sports betting firms can find listeners who have engaged with online sports betting.

Key takeaways:

- 72% of Michigan residents are aware of sports betting legalization

- Sports betting interest is concentrated among men 21-54

- Unaided awareness: 55% of Michigan residents are unable to name an online sports betting brand

- Aided awareness: DraftKings and FanDuel lead, BetMGM places second, five firms tie for third

- Advertising recall: DraftKings and FanDuel lead, followed by BetMGM, BetRivers, and Barstool Sportsbook

- AM/FM radio is the ideal platform for online sports betting sites to build their brands and business

- Compared to heavy TV viewers, heavy AM/FM radio listeners are 52% more aware of sports betting brands

- Nielsen Scarborough: Across the U.S., the greater the time spent with AM/FM radio, the greater the sports betting engagement

- AM/FM radio sports listeners are significantly more engaged with sports betting versus TV sports viewers

- Sports bettors are twice as likely to be podcast listeners

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.